2022 December

-

DAX Can dip even lower with the RSI being the key

- December 16, 2022

- Posted by: Tradingshot Articles

- Category: Stock Indices

No Comments

The German stock index (DAX) has had a strongly bearish week as it got rejected just below the 14700 June 06 High, inside the greater Resistance Zone that is holding since March 29. As we mentioned last week, this is a much needed technical pull-back following the +24.50% rise since the October 03 Low.

-

XAUUSD Still bullish inside the 1 month Channel Up

- December 16, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) managed to break again today above the 4H MA50 (red trend-line), recovering yesterday’s early session drop and that keeps it on bullish track, at least for the short-term as the Channel Up that started a month ago (On the November 15 High) remains intact. In fact it seems to be replicating the

-

USDCAD Resistance test and then Sell.

- December 16, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The USDCAD couldn’t have confirmed our bearish view two months ago, when we called for a sell opportunity based on the RSI Bearish Divergence (Lower Highs against the price’s Higher Highs): As you see the divergence sell signal was spot on and the previous two times that this was spotted, helped us in a

-

DOGEUSDT This is confirming the new Bull Cycle

- December 15, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

We last looked into Dogecoin (DOGEUSDT) back in late October, analyzing the potential for break-out above the Channel Down that it has been trading in since May 2021 by using the Fibonacci extension levels. As you see, the aggressive Musk-led pump hit the 1.5 Fib extension of the Channel Down, while breaking above the

-

EURUSD Above its 1WMA50 after 18months! Confirmed longterm rally

- December 15, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair broke last week above the 1W MA50 (blue trend-line) and this week above the Lower Highs trend-line from the May 24 2021 market High. Last time the price was above the 1W MA50 was 18 months ago (on the week of June 21 2021!) and that alone constitutes a very strong

-

META reached our target. What’s next?

- December 15, 2022

- Posted by: Tradingshot Articles

- Category: Stocks

Over a month ago (November 10) we posted our outlook on the Meta Platforms Inc (META) following the cutting of 11k jobs (also feature on the Editor’s Pick): As you see our target has been hit as the price rose and reached the top of the Channel Down pattern that the stock has been

-

NASDAQ rejected on the 1 year Resistance! How bearish is that?

- December 14, 2022

- Posted by: Tradingshot Articles

- Category: Stock Indices

The Nasdaq index (NDX) rose yesterday aggressively after the lower than expected U.S. CPI but got rejected exactly on the 1 year Lower Highs trend-line (started on January 05), just below the 0.618 Fibonacci, as we showed on our analysis 2 weeks ago: As you see, this is the exact cluster level (Lower Highs

-

MASTERCARD About to break into long-term bullish territory

- December 12, 2022

- Posted by: Tradingshot Articles

- Category: Stocks

Mastercard Inc (MA) is rebounding again back towards the top of its +1 year Channel Down pattern after the December 02 rejection on the 262.000 Resistance, which happened to be also at the top (Lower Highs trend-line) of the Channel. If the price breaks above, that alone would be a major bullish break-out signal

-

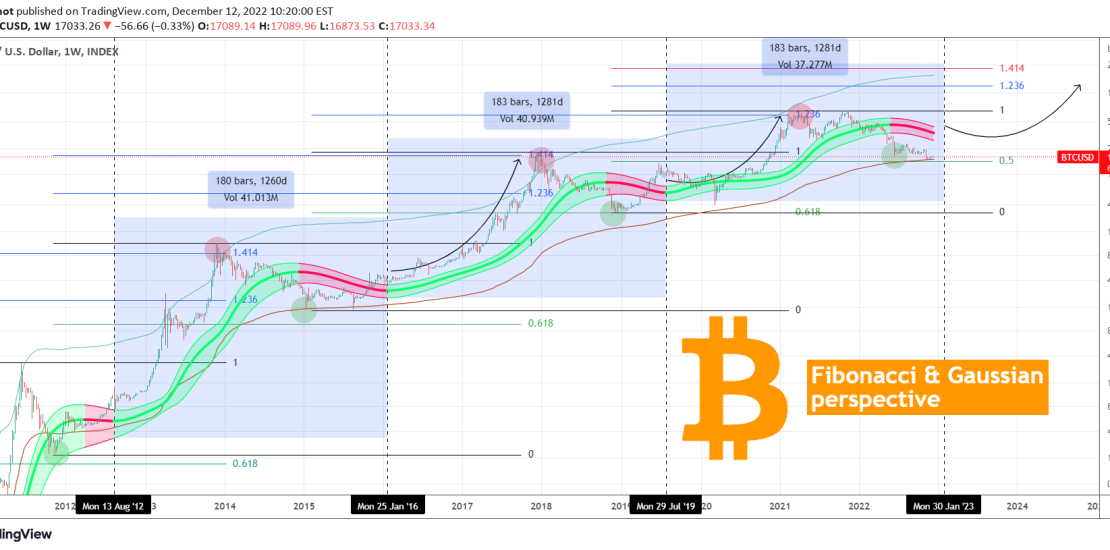

BITCOIN Historical Buy Signal is flashing

- December 12, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Bitcoin (BTCUSD) remains supported on the 1W MA350 (red trend-line) following the FTX crash. A rare indicator, the Gaussian Channel (GC), remains red but based on previous Cycles, by the time it turns green, Bitcoin already has the first mini rally of the new Bull Cycle. The previous two GC Cycles from the end

-

BITCOIN and S&P500 Has a 10 year Bull phase just started?

- December 11, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

A 1 year correction which is nothing but common throughout Bitcoin’s (BTCUSD) existence, has done its work well in spreading fear and doubt at the market during this inflationary stock crisis in 2022. In times like this what helps the most is to maintain a long-term perspective and look at how history reacted in