2021 October

-

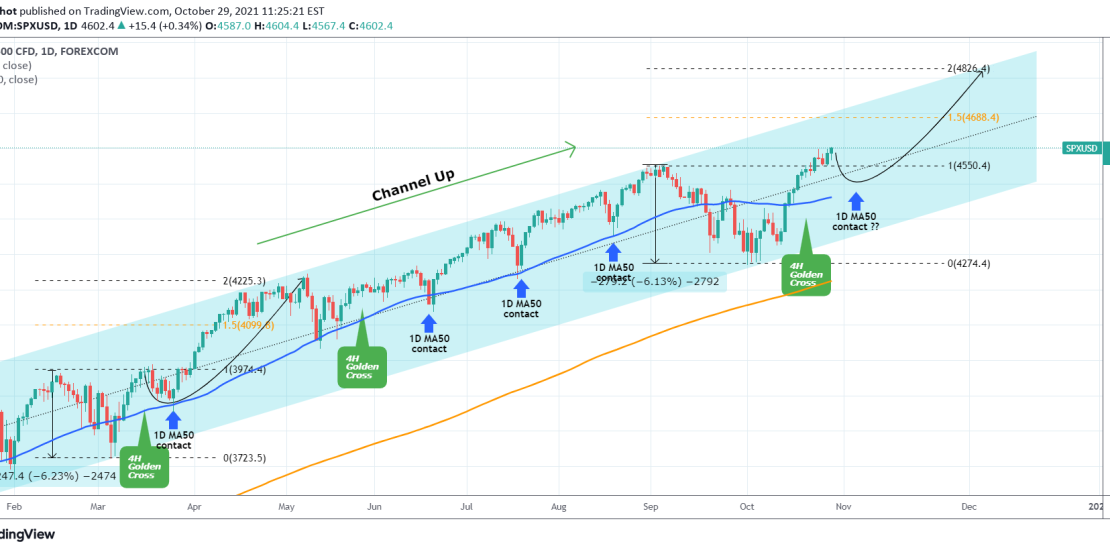

S&P500 One last 1D MA50 touch left before $4800?

- October 29, 2021

- Posted by: Tradingshot Articles

- Category: Stock Indices

No Comments

S&P has made new All Time Highs (ATH) since my analysis at the start of the month, where the diverging 1D RSI gave a strong buy signal at the bottom of the multi-month Channel Up: As you see the signal worked out well and the index has now the 1.5 Fibonacci extension as its

-

WTI OIL Reversal confirmed if daily closes below the 4H MA100

- October 28, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

Even though my firms thesis has been very bullish on WTI Oil long-term throughout the whole year, that doesn’t stop me from spotting potential medium-term tops and technical corrections that only serve for sustaining the uptrend on the long-term. An example was my following idea on October 19: So far it appears that the

-

NASDAQ 4H Golden Cross aims at 16300 long-term

- October 25, 2021

- Posted by: Tradingshot Articles

- Category: Stock Indices

My most recent Nasdaq post was a buy signal on the 1D MA50: Currently we have a buy continuation signal for the long-term towards the 1.5 Fibonacci extension (16300) with a potential short-term pull-back to add more longs on the 0.5 Fib retracement or the 1D MA100 (red trend-line). This is based on the May

-

DAX Bullish continuation towards 16000.

- October 25, 2021

- Posted by: Tradingshot Articles

- Category: Stock Indices

My last DAX analysis was on a bus signal after the price broke above the 4H MA50: The short-term target of the 4H MA200 eventually got reached and now I shift my focus for the medium-term back to the 1D time-frame. As you see the price has been trading around the 1D MA50 (blue

-

US10Y Signs of a bearish reversal.

- October 25, 2021

- Posted by: Tradingshot Articles

- Category: Other

The US10Y has reached (and so far got rejected on) the 1.707 Resistance (1), which last time rejected the price on May 13. With the 1D RSI on a Bearish Divergence (is on Lower Highs while the actual price is on Higher Highs), similarities can be made with the February 25 – March 30

-

XAUUSD Close to a Golden Cross. Next Targets: 1810, 1820

- October 19, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

Pattern: Bullish Megaphone on 4H. Signal: Buy as the price rebounded after breaking just below the 4H MA50 (blue trend-line), in similar way as the August – September Bullish Megaphone. We are now on the second red arrow leg. Target: 1810 and 1820 in extension (symmetrical levels from Aug-Sep). Tradingview link: https://www.tradingview.com/chart/XAUUSD/H8W2ZvG9-XAUUSD-Close-to-a-Golden-Cross-Next-Targets-1810-1820

-

WTI OIL is about to top soon. Reversal imminent.

- October 19, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

On my most recent WTI Oil idea I laid out the reason why I expected it to tun parabolic towards $82.50: That target has now been reached and on the 1D time-frame, WTI is approaching a very strong Support cluster both on price and RSI terms. As you see the price is close to

-

NASDAQ Testing the 1D MA50

- October 15, 2021

- Posted by: Tradingshot Articles

- Category: Stock Indices

It’s been some times since my last update on Nasdaq. As you see on my previous idea below, the break below the 1D MA100 (green trend-line) turned out to be accurate as the index made a Higher Low at the bottom of the long-term Channel Up and rebounded: The first bearish barrier broke when

-

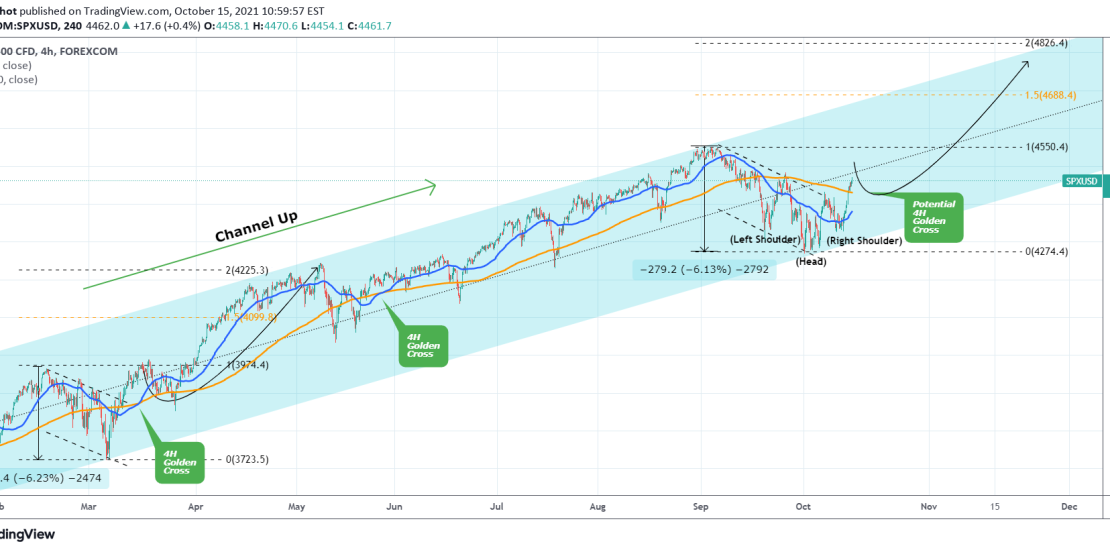

S&P500 Emerging Golden Cross on 4H.

- October 15, 2021

- Posted by: Tradingshot Articles

- Category: Stock Indices

My most recent analysis on S&P500 was 15 days ago, when I talked about why the Bearish Ichimoku was in fact a bullish signal: As it turned out, the signal was accurate and SPX made a bottom on the Higher Lows trend-line of the Channel Up and rebounded. In fact it even broke above

-

XAUUSD 4H MA50 holding, emerging Golden Cross inside a ChannelUp

- October 15, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

This is a follow up to my most recent Gold analysis: The Inverse Head and Shoulders pattern worked perfectly and the price easily broke above the 4H MA200 (orange trend-line). As it got rejected on the psychological 1800 level, the potential of a Channel Up emerges, similar to that of August that tested the

- 1

- 2