2020 March

-

USOIL Buy Signal

- March 31, 2020

- Posted by: Tradingshot Articles

- Category: Commodities

No CommentsPattern: Fibonacci retracement Signal: Bullish as the price made a bullish cross on the MACD and the whole pattern is similar to the previous sequence that topped on the 0.618 Fibonacci. Target: 22.80 (just below the 0.618 Fibonacci retracement). Tradingview link: https://www.tradingview.com/chart/USOIL/tukiDrS0-USOIL-Buy-Signal

-

BITCOIN is exactly where it should be.

- March 28, 2020

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

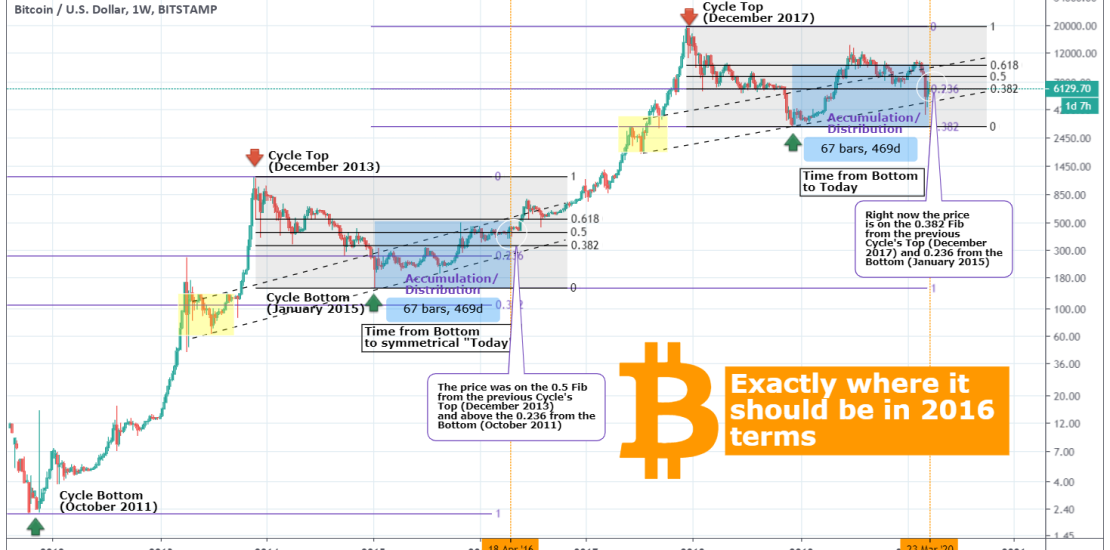

We are currently more than 450 days since the bottom of the previous Bear Cycle in December 2018. Despite the 13800 peak last June (2019), Bitcoin’s continuous and most recently more aggressive correction has got the crypto world worried that we are diverging from the long term bullish trend. But should we be that worried?

-

BITCOIN The 50%/60% Higher High Rule. Get ready for $20000!

- March 25, 2020

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

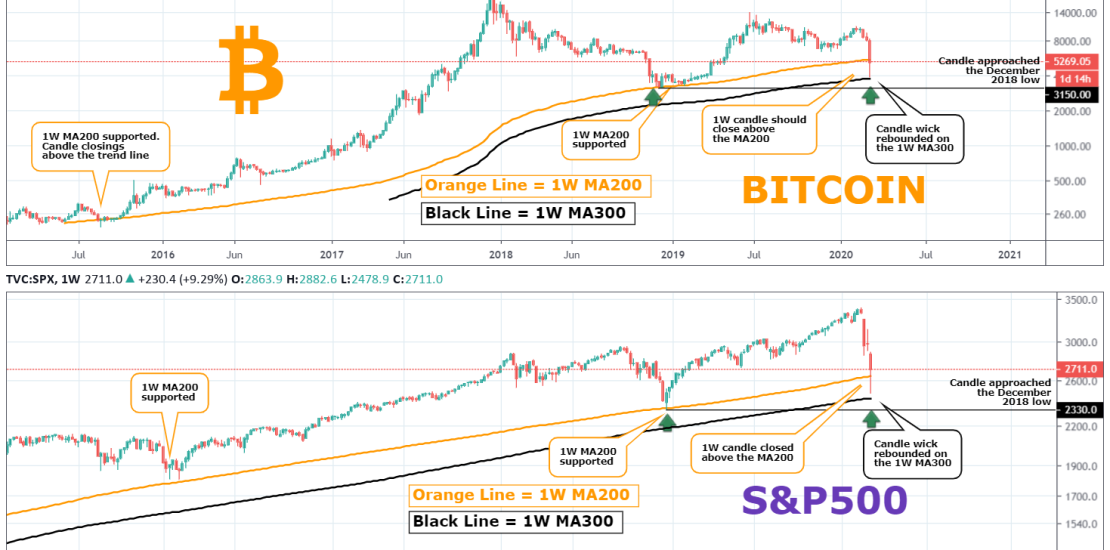

Ignore the recent sell-off caused by the “Coronavirus liquidation effect” across all non-liquid asset classes. Bitcoin found support on the 1W MA300 (black line) and rebounded. Most likely we will be viewing this in the future as “non-technical noise” as Bitcoin continues to make Bull Cycle after Bull Cycle and new All Time Highs.

-

XRPUSD Two good case scenarios: $0.24 and $0.30.

- March 23, 2020

- Posted by: Tradingshot Articles

- Category: Uncategorized

Going way back in mid 2018 the pattern is a Channel Down. For most of the pattern’s lifetime the price has been trading above the median with a level just below (blue line) working as the Support. That is except for two occasions where a Lower Low was made: August 2018 and recently March

-

BITCOIN Back into the Buy Zone. The importance of 1D MA1000/1400

- March 20, 2020

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Not even 1 week passed since my article on the 1W MA300 and why that bounce (and the candle’s wick) could be key for Bitcoin’s future. The Buy Zone which on the 1W chart consisted of the MA200 and MA300, on the 1D chart is made of the MA1000 (red trend line) and the

-

EURUSD Action plan

- March 19, 2020

- Posted by: Tradingshot Articles

- Category: Uncategorized

Pattern: Channel Down on monthly since June 2018. Signal: (a) Bullish as long as 1.06500 holds, (b) Bearish if it breaks (potential pattern breakdown symmetrical to the break upwards earlier this month). Target: (a) 1.08500 (potential contact with the 1D MA50 (b) 1.04100 (the -2.40% decline similar to the +2.40% outside of the pattern occurred

-

GBPUSD This feels like the Brexit sell-off

- March 18, 2020

- Posted by: Tradingshot Articles

- Category: Uncategorized

The current sell-off is similar to the Brexit shock on GBPUSD on June 24, 2016. Once the price got detached from the 1D MA50 it declined nearly -15% from the top. The reaction at the bottom was a pull back to the 0.236 Fibonacci level. The new (lower) High was confirmed by the MACD roll-over.

-

LTCBTC Maybe ahead of a big sell-off

- March 16, 2020

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Nothing fancy here just a simple comparison of the recent price action with June 2016, when LTCBTC also nose dived after a failed Golden Cross on the 1D chart. The result then was a nearly -70% drop. If the pattern is repeated then the price can decline as low as 0.0025. Tradingview link: https://www.tradingview.com/chart/LTCBTC/gjeqg3TL-LTCBTC-Maybe-ahead-of-a-big-sell-off

-

EURUSD Break out Signal

- March 16, 2020

- Posted by: Tradingshot Articles

- Category: Forex

Pattern: Rectangle on 4H within the 0.382 and 0.618 Fibonacci levels. Signal: (a) Bullish if the 4H MA50 (blue) breaks, (b) Bearish if the 4H MA200 (orange) breaks. Target: (a) 1.14000 (the 0.786 Fibonacci retracement level, (b) 1.08000 (just above the the 1D Support). Tradingview link: https://www.tradingview.com/chart/EURUSD/ZD8glsca-EURUSD-Break-out-Signal

-

BITCOIN The day it became fully correlated with S&P500

- March 14, 2020

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

With this title you might be wondering what Bitcoin has to do with the Standard & Poor’s 500 (S&P500) stock index. You think that Bitcoin and stocks are not correlated? Think again as there is a correlation and indeed a very scary one. Basically I should rephrase the title to “The WEEK it became fully

- 1

- 2