- December 12, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

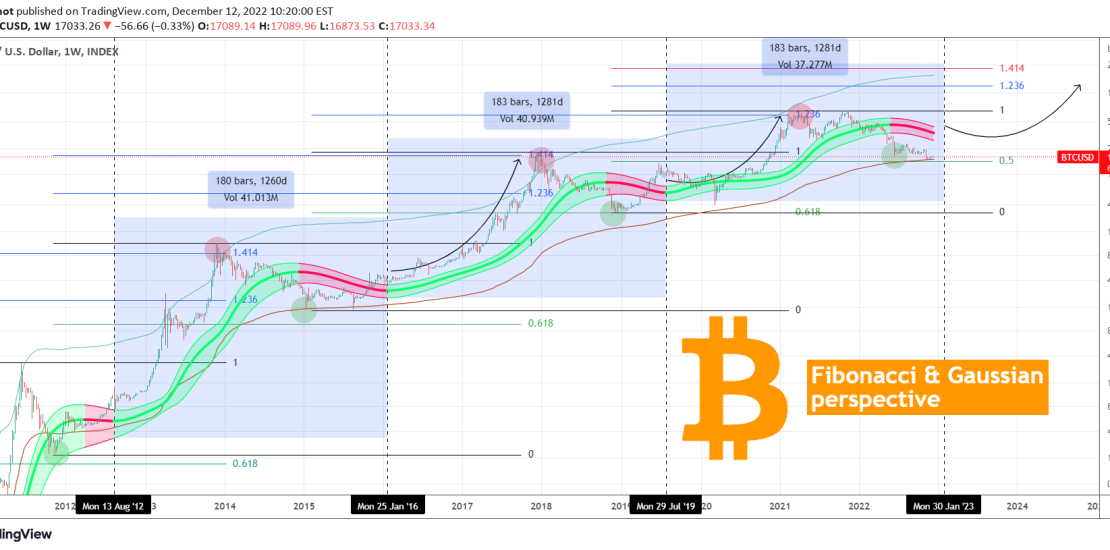

Bitcoin (BTCUSD) remains supported on the 1W MA350 (red trend-line) following the FTX crash. A rare indicator, the Gaussian Channel (GC), remains red but based on previous Cycles, by the time it turns green, Bitcoin already has the first mini rally of the new Bull Cycle.

The previous two GC Cycles from the end of the previous red period to the end of the next red period extended for 1260 and 1280 days respectively. If the 1280 day max is repeated during this Cycle also then the GC should flash green by January 30 2023. That means that historically there isn’t much time left to start the 1st rally of the new Bull Cycle.

Also by using the Fibonacci extension and retracement levels we see that the first two Cycles topped a little over the 1.414 Fib extension, while the bottoms of the first three Cycles have been above the 0.618 Fib retracement level. As diminishing returns are in effect on each Cycle, which in theory should narrow Bitcoin’s channel long-term, the last Cycle topped lower on the 1.236 Fib (which is where the last High before the Top was formed in the previous two Cycles). If the channel does narrow down, then we bottom should also be higher and the next candidate would be the 0.5 Fib, which is slightly below the recent November low.

With the Gaussian Channel pattern pointing to the 1st rally soon, the MA350 holding and the 0.5 Fib potentially the new Cyclical Support, we have perhaps the strongest buy signal of this Cycle flashing right now.

Do you think that’s the best time to buy? Feel free to let me know in the comments section below!

Tradingview link:

https://www.tradingview.com/chart/BTCUSD/rFTJJhjk-BITCOIN-Historical-Buy-Signal-is-flashing