-

NATURAL GAS Astounding multi-year Cycles showing sell’s not over

- January 22, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

No Comments

This is not the first time we look into Natural Gas (NG1!) and its long-term patterns. We have coined its Multi-year Cycles Theory in the past and it is time to extend on it a little on the 1W time-frame. Typically investors ask us for 1D analysis such as the following we published 2 months

-

WTI OIL Limited upside, significant downside

- January 19, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

It is time to update our WTI Oil (USOIL) thesis, which was bullish last week as the Resistance within the Channel Up broke: This time we see one last rise as a possibility since the price is rebounding on the 4H MA50 (blue trend-line) but limited to the 83.40 Resistance. An exception can be made

-

WTI OIL 4H Death Cross. Trade the break-outs.

- January 10, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

WTI Oil (USOIL) formed yesterday a Death Cross on the 4H time-frame, the first such (bearish) formation in almost 2 months (since November 17 2022). The price got rejected exactly on both the 4H MA50 (blue trend-line) and 4H MA200 (orange trend-line) following last week’s rejection (January 03) on the 1D MA50 (yellow trend-line). We

-

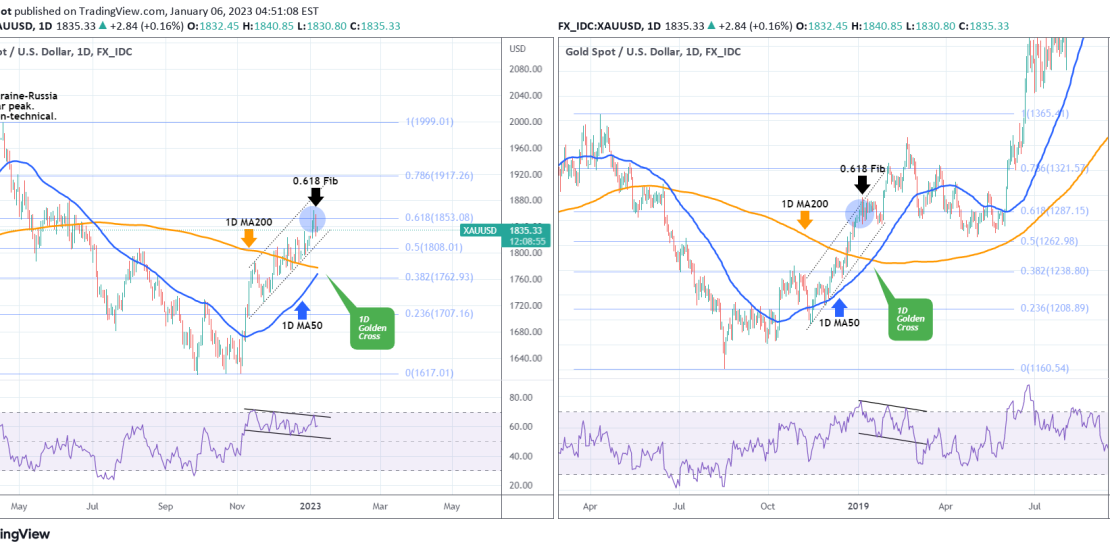

XAUUSD 1D RSI Bearish Divergence before the Golden Cross.

- January 6, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) is about to form a Golden Cross on the 1D time-frame (around next week), which is the bullish pattern when the 1D MA50 (blue trend-line) crosses above the 1D MA200 (orange trend-line). The price has been trading within a Channel Up pattern, while at the same time the 1D RSI has been within

-

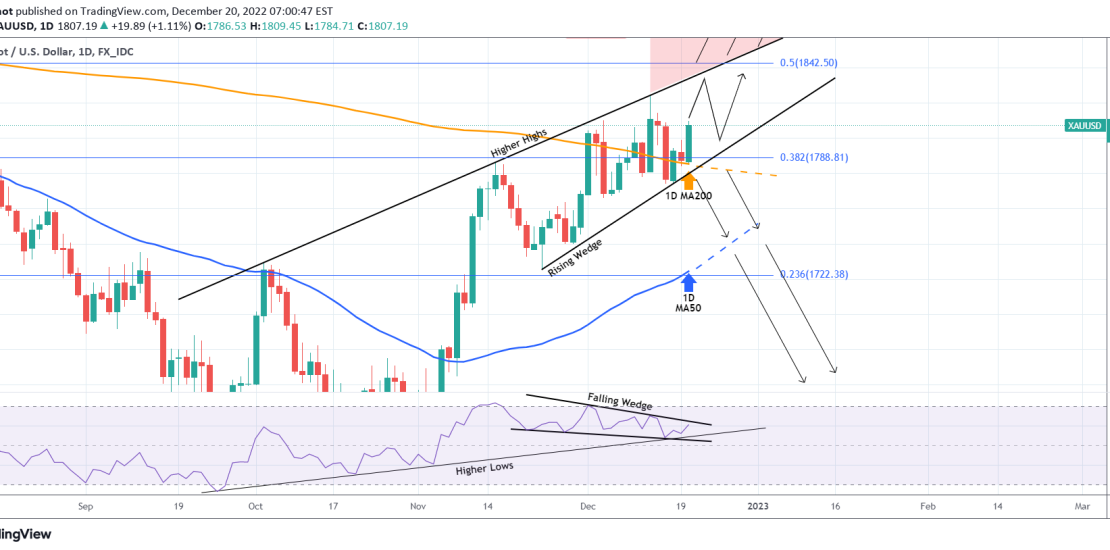

XAUUSD Be careful with this RSI Bearish Divergence

- December 20, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) is rising today supported by the 1D MA200 (orange trend-line). The pattern is so far a Rising Wedge since the November 15 High and the next Higher High limit is currently at 1835. At the same time, the 1D RSI has been within a Falling Wedge, indicating a Bearish Divergence. Though this

-

XAUUSD Still bullish inside the 1 month Channel Up

- December 16, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) managed to break again today above the 4H MA50 (red trend-line), recovering yesterday’s early session drop and that keeps it on bullish track, at least for the short-term as the Channel Up that started a month ago (On the November 15 High) remains intact. In fact it seems to be replicating the

-

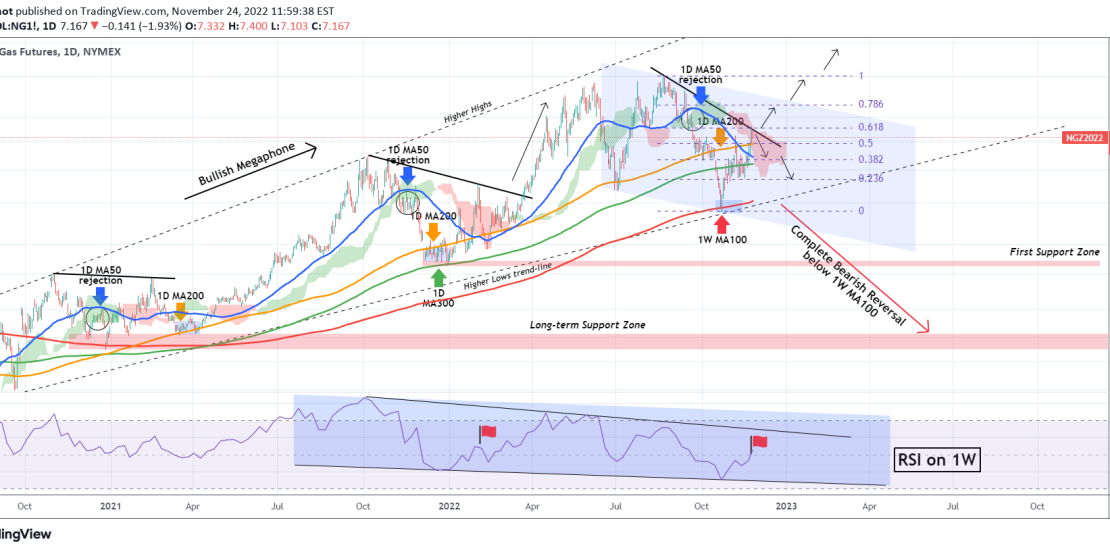

NATURAL GAS Critical test for bullish or bearish December

- November 24, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Natural Gas (NG1!) hit yesterday the Lower Highs trend-line of the August 22 top and today we see the first signs of a rejection. Until this breaks decisively, we can expect NG to pull-back to the 0.382 and 0.236 Fibonacci levels. Based on the 1W RSI though, which is on a Falling Wedge since

-

XAUUSD Short-term weakness. Buy lower or if this level breaks.

- November 21, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) broke below its 4H MA50 (red trend-line) on Friday for the first time since November 04, which was when the strong rally started on the Triple Bottom. Having failed to reach the 1D MA200 (orange trend-line), which is the long-term Resistance and difference maker between a long-term bullish and long-term bearish trend,

-

XAUUSD Approaching the 1W MA100. Bullish above, bearish below.

- November 18, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) is approaching the most critical level of its long-term trend. That is the 1W MA100 (green trend-line), which is currently at 1802.69 and tends to be the deciding factor between Gold’s Bull and Bear Cycles. This sample on the 1W time-frame starts from late 2009 and it shows that when Gold is

-

XAUUSD Close to a major bullish break-out!

- November 7, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) closed on Friday above the 1D MA50 (blue trend-line) for the first time since August 12 that was practically the time that the stock market made its previous High. At the same time, Gold broke and closed above both the former Channel Down and Triangle patterns that we discussed where bullish break-out