- January 6, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

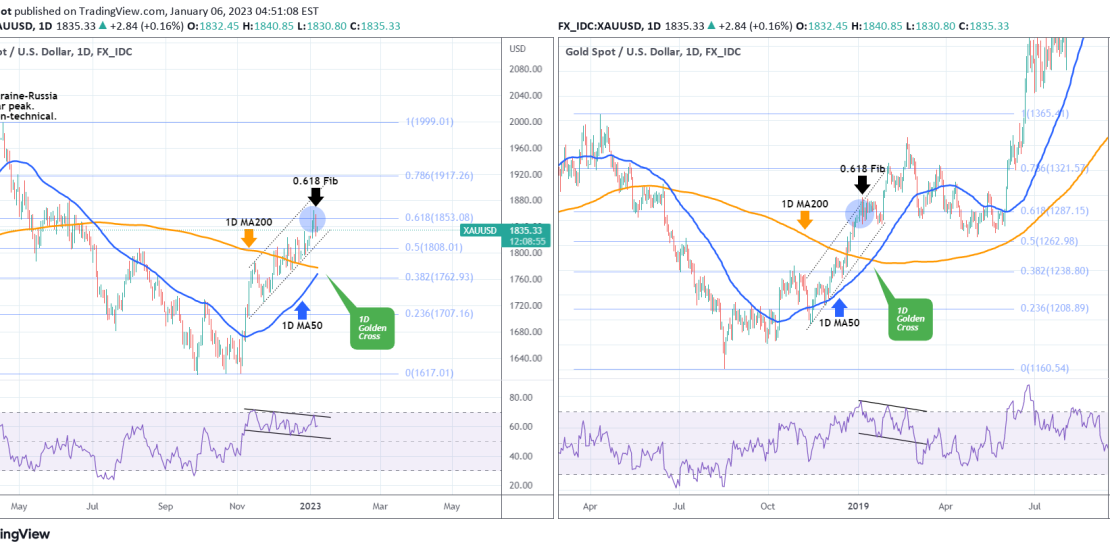

Gold (XAUUSD) is about to form a Golden Cross on the 1D time-frame (around next week), which is the bullish pattern when the 1D MA50 (blue trend-line) crosses above the 1D MA200 (orange trend-line). The price has been trading within a Channel Up pattern, while at the same time the 1D RSI has been within a Channel Down. This is a technical Bearish Divergence.

A similar price action was last spotted around the January 15 2019 Golden Cross. Gold was again recovering within a Channel Up on an RSI Bearish Divergence, with the price having breached the 0.618 Fibonacci retracement level just before the Golden Cross. After a short 3-week pull-back, Gold resumed the uptrend even above the 0.786 Fib, and a little before completing the full reversal. Then it made a 2-month correction below the 1D MA50 and towards the 1D MA200.

This time however, the price hasn’t made contact with the 1D MA50 at all in 2 months (since November 07 2022). If the USD and the US10Y search for their own 1D MA50, it is possible to see the price test 1D MA50 before rising further. In any case, keep dry powder for that, but the long-term trend remains bullish, which is something we projected would happen on our November 07 2022 analysis, after spotting the Triple Bottom on the RSI Higher Lows: