-

NWCUSDT is closer than ever to $2.00!

- April 9, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

No Comments

A combination of fractal behavior and excellent fundamental news, can finally catapult my NewsCrypto gem to $2.00. Let’s break this down: ** Technical Analysis ** As per my previous analyses, the current bullish leg on NWC is repeating methodically the July-August 2020 bullish sequence. A simple fractal comparison shows that we are currently on

-

EURUSD Strongest 4H RSI since December

- April 8, 2021

- Posted by: Tradingshot Articles

- Category: Forex

EURUSD has been trading within a Channel Down since the January 06, 2021 Top. However since the March 31 low, it has posted an impressive rise, which despite still being contained within the Channel Down, it has printed the highest RSI value since December 04 as the title suggests. This could be due to

-

WTI OIL Emerging 4H MA50/100 Golden Cross. Rally ahead?

- April 8, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

Simple fractal comparison on WTI as the price is consolidating since the March 23 low and is approaching the Higher Lows trend-line that started on December 01. As you see the current price action is quite similar to the late October – early November one. After the 4H MA50 crossed below the 4H MA100, a

-

DXY Will the 1W MA50 weigh more than the oversold 4H RSI?

- April 7, 2021

- Posted by: Tradingshot Articles

- Category: Forex

The U.S. Dollar Index is on critical cross cross-roads. Last week it got rejected on the Higher Highs trend-line (4H time-frame, left chart) and naturally pulled back to the Higher Lows trend-line, which is so far holding. With the 4H RSI oversold, the short-term sentiment is bullish. However last week’s rejection didn’t only happen

-

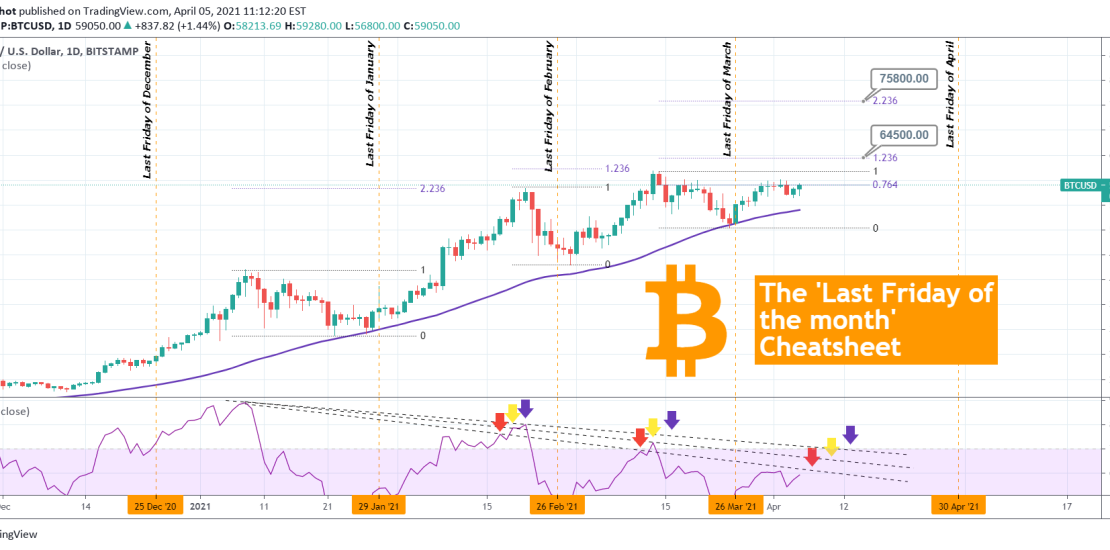

BITCOIN The ‘Last Friday of the month’ effect.

- April 5, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

We all know that BTC options expire on the last Friday of every month. See on this chart how this has been consistent with Bitcoin’s every major rise since December, being around the bottom of every of those mini-phases. The first Top was on the 2.236 Fibonacci extension from the bottom. The second was

-

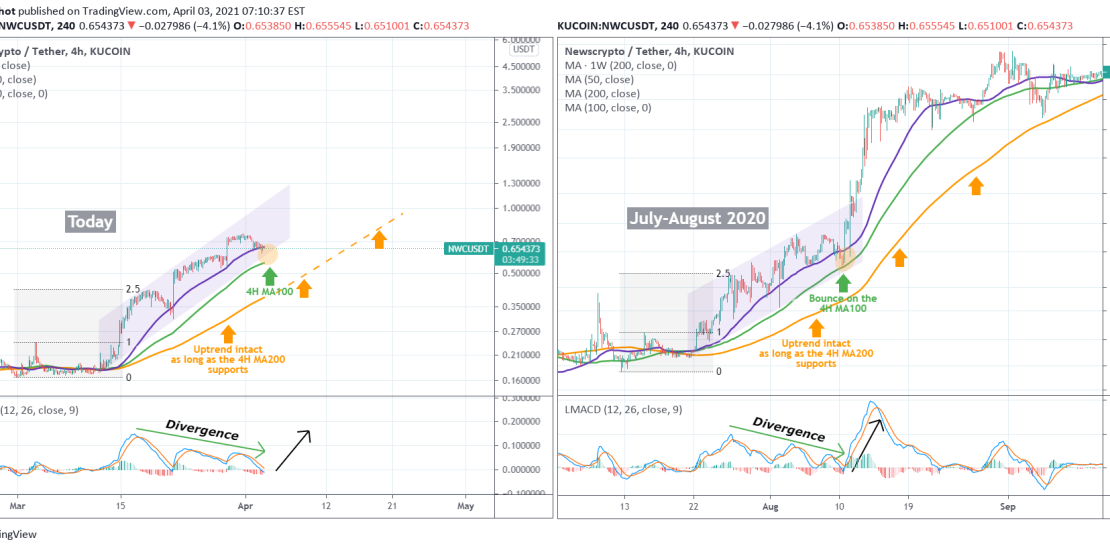

NWCUSDT getting ready for the pump of the month to $1.00!

- April 3, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Frankly, based on the fractal analysis you see on the charts, $1.00 may be a conservative target for the NewsCrypto Coin. But it is a monumental one based on market psychology that is why I’ve benchmarked this on the short-term. But we also had great fundamental news two days ago, so let’s break down

-

GOLD The peculiar 4H MA50/100 Cross divergence

- March 31, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

Today Gold is on a strong rebound as it held the 1675.50 Support made from the March 08 Low. But the reason for this short post is to bring forward the counter signal that the MA50/ 100 Cross give on the 4H time-frame. As you see on the chart since January 14 the MA50

-

DXY entered a new 3 year cycle. Will it be bearish or bullish?

- March 30, 2021

- Posted by: Tradingshot Articles

- Category: Forex

This month’s very bullish candle for the U.S. Dollar Index (DXY) is a transition one as it marks the end of the previous 3 year Cycle and the start of a new one. The previous Cycle was basically a neutral one, and it remains to be seen whether the current will be Bearish or

-

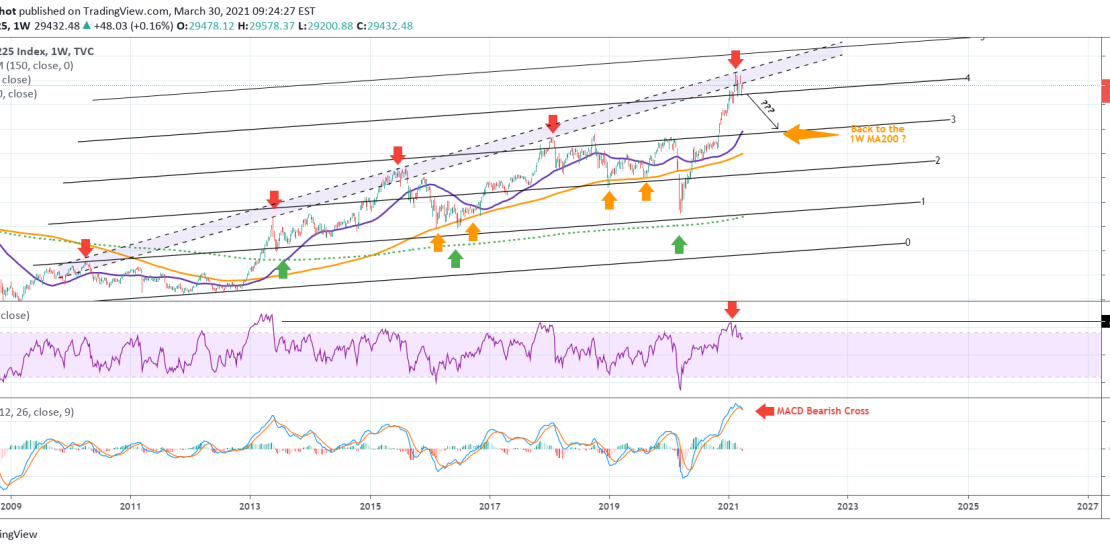

NIKKEI a bearish long-term signal

- March 30, 2021

- Posted by: Tradingshot Articles

- Category: Stock Indices

Not the most of encouraging formations for Nikkei as not only is the price struggling to break the 12-year Higher Highs trend-line (light blue zone) and has been consolidating on the 1W time-frame, but the 1W RSI is on its Resistance level too while the MACD printed a Bearish Cross. Similar occurrences in the

-

GOLD aims at $1850. Similarities with December 2020.

- March 26, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

This is a fractal comparison on XAUUSD between the current sequence and that of December 2020. At the moment Gold is trading on top of the 4H MA100 (green trend-line) using it as a Support and around the 4H MA50 (blue trend-line) using it as a Pivot. It still hasn’t broken above neither the