-

BITCOIN Short-term update

- February 1, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

No Comments

This is a quick update on BTC’s short-term price action following the holding of the 1D MA50 showed on my last post. I am taking you to the 4H time-frame on this study, as perhaps the most important development over the weekend was the fact that the 4H MA50 (blue trend-line on the chart)

-

BITCOIN Is the 1D MA50 here to save the day?

- January 27, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Update on today’s price action. Bitcoin made contact with its MA50 on the 1D time-frame (blue trend-line) for the first time since October 08, 2020 (roughly 110 days). The RSI is also testing its Support Zone which is holding since mid March 2020. Can this be enough to contain this correction from January’s High?

-

BITCOIN Watch out for that 4H Death Cross

- January 26, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Bitcoin remains under pressure since the January 08 High, with its main pattern being a Channel Down. On the 4H chart, the RSI and LMACD indicators have formed sequences similar to the mid November – mid December 2020 consolidation phase. As you see on the chart those are bottoming patterns formed within a short-term

-

BITCOIN It’s the underlying trend-line… again!

- January 21, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Do you remember this trend-line I posted back in June, 2020? Well it is time we have a new look at it as it is closed to being tested again. ** The underlying trend-line ** As you see this is the dominant trend-line since the March 2020 bottom that was caused by the massive

-

BITCOIN Is this fractal the way to go?

- January 14, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

I have already mentioned the probability of Bitcoin reprinting the November fractal, but since the price convincingly broke above the 4H MA50 today and the pattern is playing out so far exactly, I thought it would be a good time for a short update. So Fractal A and Fractal B are clear on your

-

ETHEREUM Fib channel shows $1900 in March

- January 5, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

First of all congratulations to ETHUSD traders, both targets ($690 and $990) based on my previous post got hit (see idea below), earlier than I expected: A lot of talk is being made lately regarding Ethereum’s recent rise. Where is this price jump attributed to? Well it was the next step on its Fibonacci

-

BITCOIN Trust the 4H MA50/MA200 pattern

- January 3, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency, Uncategorized

First of all congratulations hodlers. Another benchmark, the very important $30000, has been breached! There is every reason to be excited yet again, but rest assured, there are also several signs and patterns to consider for this 1st month of 2021. Today Bitcoin made yet another high, almost hitting $35k, but since we see a

-

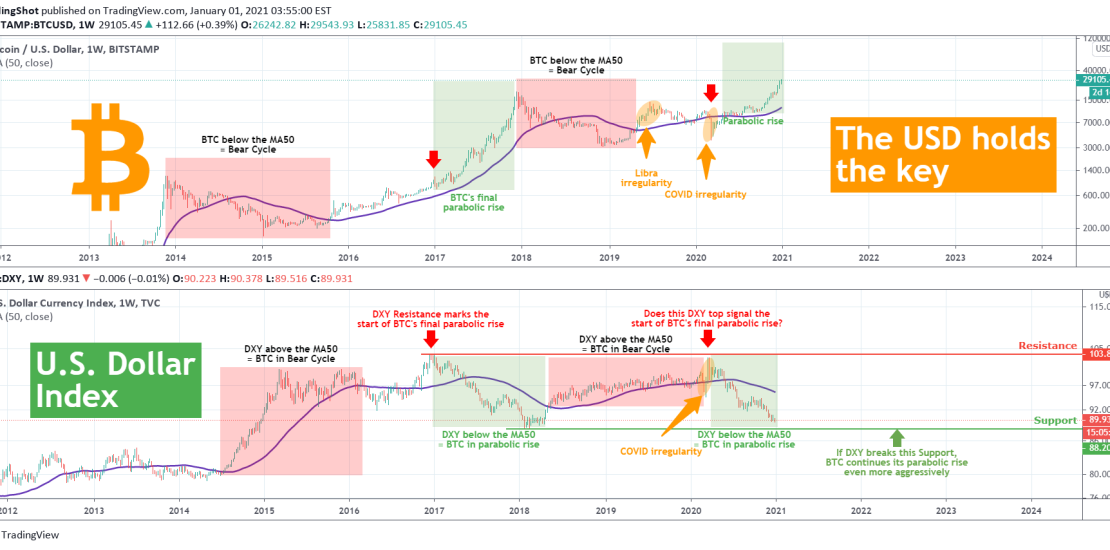

BITCOIN Happy New Year! The USD may be the key for 2021!

- January 1, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

First of all allow me to wish everyone a Happy New Year! This community is and has been more than great this past year and even though we are all here for trading/ investing, let me wish everyone above all good health and prosperity. Now back to trading and Bitcoin in particular. This study

-

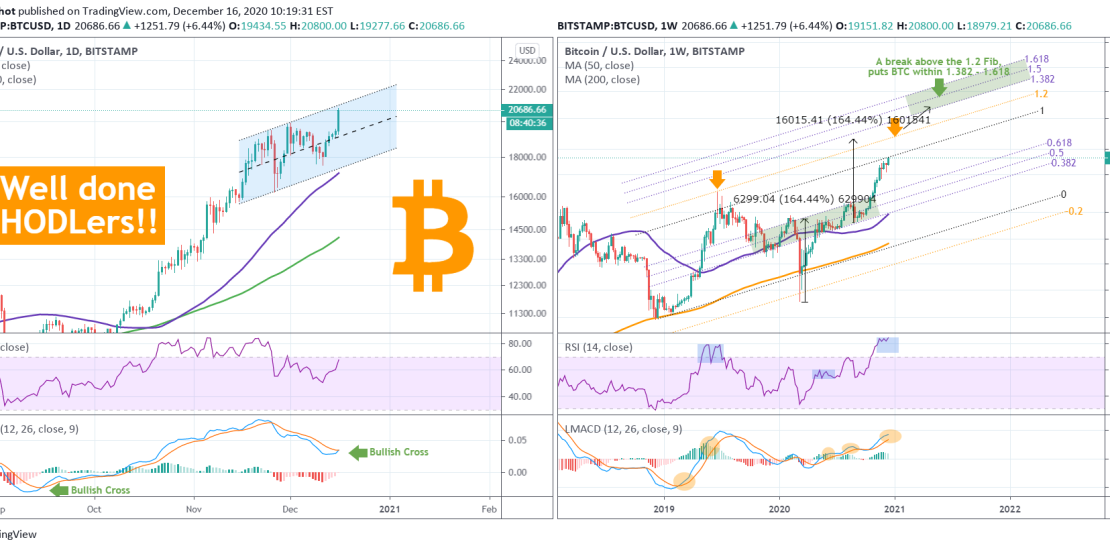

BITCOIN above $20000 for the 1st time! This is for all HODLers!!

- December 16, 2020

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

This is a festive post. Bitcoin finally broke the $20000 barrier, so let’s take some lines at least to celebrate. This one is for all the hodlers. For all those who had to endure 3 years of stress, anxiety, discomfort and pain but didn’t lose hope and held. Those who had to sit and

-

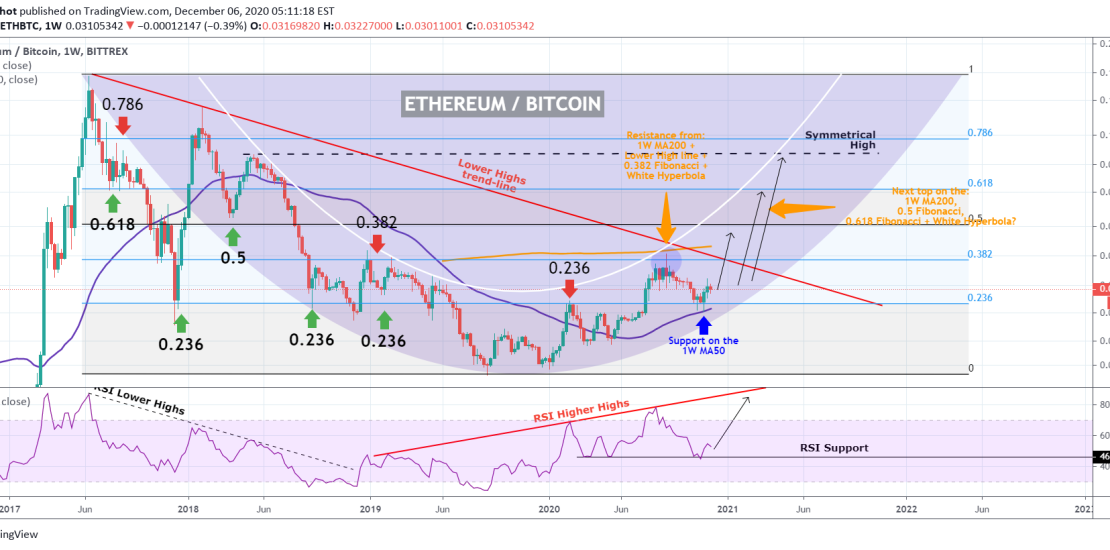

ETHBTC Time to get aggressive on Ethereum?

- December 6, 2020

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Back in August I published a warning on ETHBTC, warning traders that it was time to ease on Ethereum as seen below: My reasons were more than obvious and had to do with the price nearing not just the 1W MA200 but also the Lower Highs trend-line, the 0.382 Fibonacci retracement level and the