-

SOLUSD Broke above its Triangle. Bullish bias ahead.

- July 16, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

No Comments

Solana (SOLUSD) broke yesterday above the Lower Highs (top) trend-line of the Triangle pattern that it has been trading in for the past 1 month. The pull-back that followed has been quicly contained today above the 4H MA50 (blue trend-line), which has established itself as Support, with the 4H MA200 (orange trend-line) being right

-

XRPUSD Failed twice on the 1D MA50. Action plan.

- July 11, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

XRPUSD made its last Low on June 18 and since then attempted a rebound. So far this has been rejected twice on the 1D MA50 (blue trend-line), below which XRP has been trading since April 15. Even in the event of a break-out, there is still the March 28 Lower Highs trend-line to consider,

-

BTC/GOLD ratio Bitcoin will start to heavily outperform Gold

- July 9, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

We looked into this correlation 3 weeks ago with the following analysis but on the reverse ratio of GOLD/BTC: As you see that was right when the ratio tested the 7 year Lower Highs trend-line and the rejection so far is confirming our bias, which are sell Gold and buy Bitcoin for the next

-

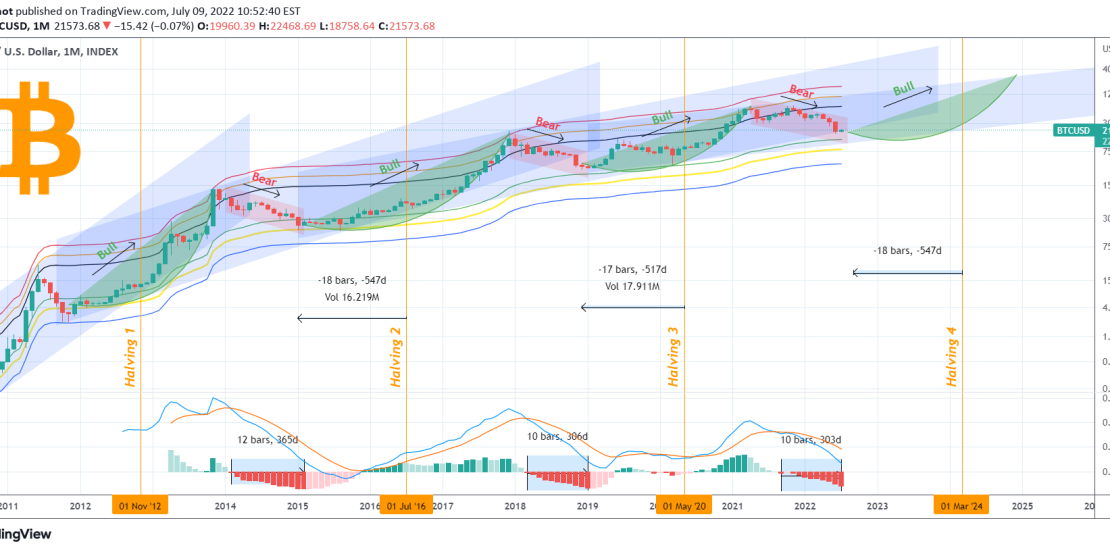

BITCOIN Bear Market ending this summer. Charting the next Bull.

- July 9, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

This is an analysis of Bitcoin (BTCUSD) on the 1M (monthly) time-frame where its long-term (historic) Cycles are best viewed. This is a combination of some previous studies of mine with adding the element of Cycle Channels instead of the Parabolic Growth Curve. ** The LMACD ** As you see those also effectively depict

-

KAVAUSD Approaching the 1D MA50. Attention.

- June 28, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Kava (KAVAUSD) has been trading within a Bearish Megaphone since the August 30 2021 High. The recent short-term rally in the form of a Channel Up is close to a 1D MA50 (blue trend-line) test. A candle closing above it should be a bullish break-out call towards the 1D MA200 (orange trend-line). The pattern

-

TONUSDT Lower Highs break-out but Resistance come to play

- June 28, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Toncoin (TONUSDT) made a convincing bullish break-out yesterday above the Lower Highs trend-line that has been keeping the price action below since the April 21 dump. Today it is attempting a 1D candle closing above the 1D MA50 (blue trend-line). After the break-out that turned the trend bullish at least on the short-term, the

-

STORJUSD Amazing rise but needs to break this Resistance

- June 24, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

STORJUSD had a very strong rise yesterday, pivoting off the previous 0.62 – 0.64 Resistance level. Despite this heavily bullish short-term trend, the Lower Highs trend-line from its All Time High is now coming to play again and in fact rejected so far the price on its High yesterday. This is the second Lower

-

BITCOIN The Resistance that every Cycle broke to start the rally

- June 24, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Following the ‘back to basics’ analysis on Bitcoin (BTCUSD) and the reminder that the Parabolic Growth Channel is still dictating its long-term cyclical trend, I thought it would be useful to extend it a bit with new parameters. ** The Parabolic Rally and Bear Cycle Resistance elements ** As you see, I’ve incorporated new

-

SHIBUSDT Falling Wedge forming a Bottom

- June 20, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

*** *** For this particular analysis on SHIBA we are using the SHIBUSDT symbol on the Phemex exchange. *** *** The idea is on the 1D time-frame where Shiba has been trading within a Falling Wedge pattern since the December 24 2021 High. The price has been trading near the pattern’s Lower Lows trend-line

-

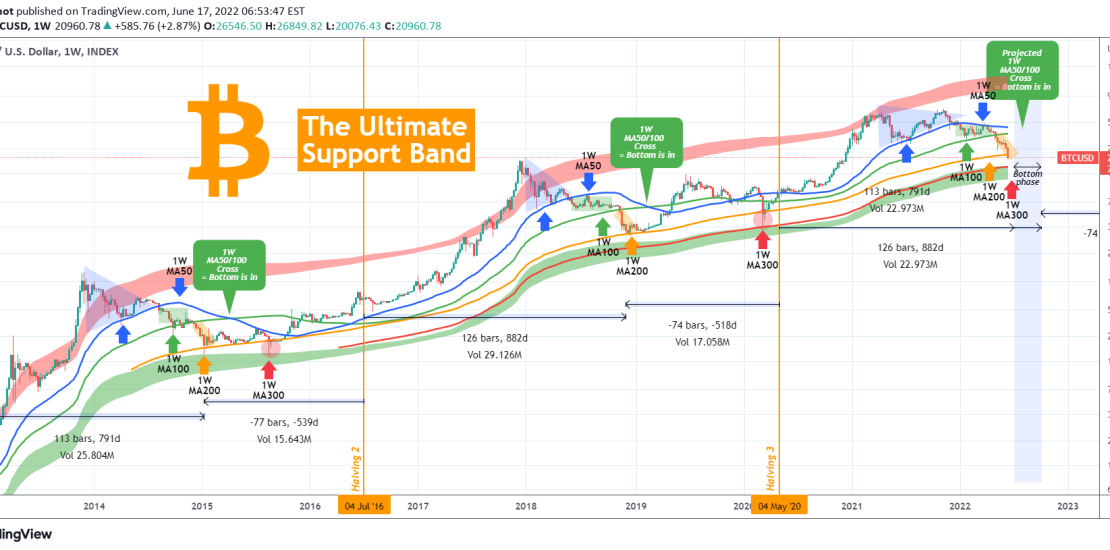

BITCOIN The Ultimate Support Band. 1W MA300 coming into play?

- June 17, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Bitcoin (BTCUSD) is now below its 1W MA200 (orange trend-line) for the first time since the March 2020 COVID crash. As I’ve mentioned numerous times, that has been the trend-line that marked the bottoms on both previous BTC Bear Cycles (all candles closed above). On this analysis, I am extending my previous publications on