2023 March

-

S&P500 Buy without fear. Bull not over until 2030.

- March 30, 2023

- Posted by: Tradingshot Articles

- Category: Stock Indices

No Comments

This is not the first time we look into the S&P500 (SPX) from a multi-decade perspective. Every time we look into the Cycles since the Great Depression we bring an additional element to the table. This time we break down parts of those Cycles even more and look into the RSI as well. This analysis

-

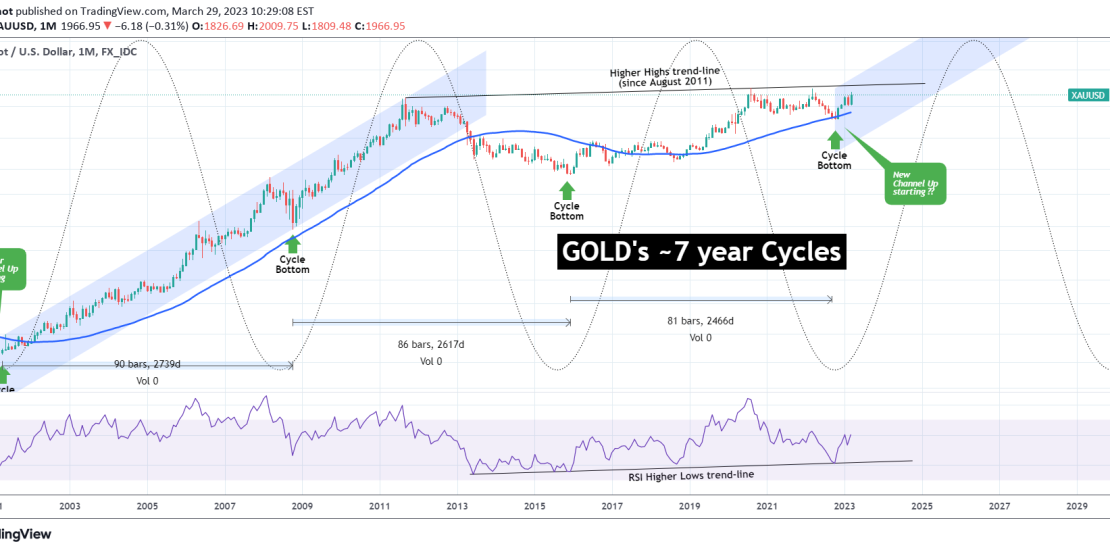

GOLD May be starting a new 7 year Bull Cycle.

- March 29, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) has been on a 6 month rally since the September 28 2022 market Low. This chart on the 1M time-frame shows that Gold is trading on approximately 7 year Cycles since the April 2001 market bottom and that based on this model, the September low may be the bottom of the previous Cycle

-

WTI OIL Channel Up aiming at the 1D MA50.

- March 27, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

WTI Oil (USOIL) transitioned from the Inverse Head and Shoulders (IH&S) pattern we described last week to a Channel Up: Our target remains 74.50 on the medium-term which makes both a Higher High on the Channel Up while filling a 2.0 Fibonacci extension, which is the technical target for the IH&S. Tradingview link: https://www.tradingview.com/chart/USOIL/Fdx7w1Ns-WTI-OIL-Channel-Up-aiming-at-the-1D-MA50

-

EURUSD Supported on the 4H MA50. Buy signal.

- March 24, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair is executing our long-term well as explained on this idea earlier this month: After correcting the very aggressive rise on the day of the Fed Rate Decision, the price now found Support on the 4H MA50 (blue trend-line). With the price past a 4H Golden Cross and the 4H RSI supported on

-

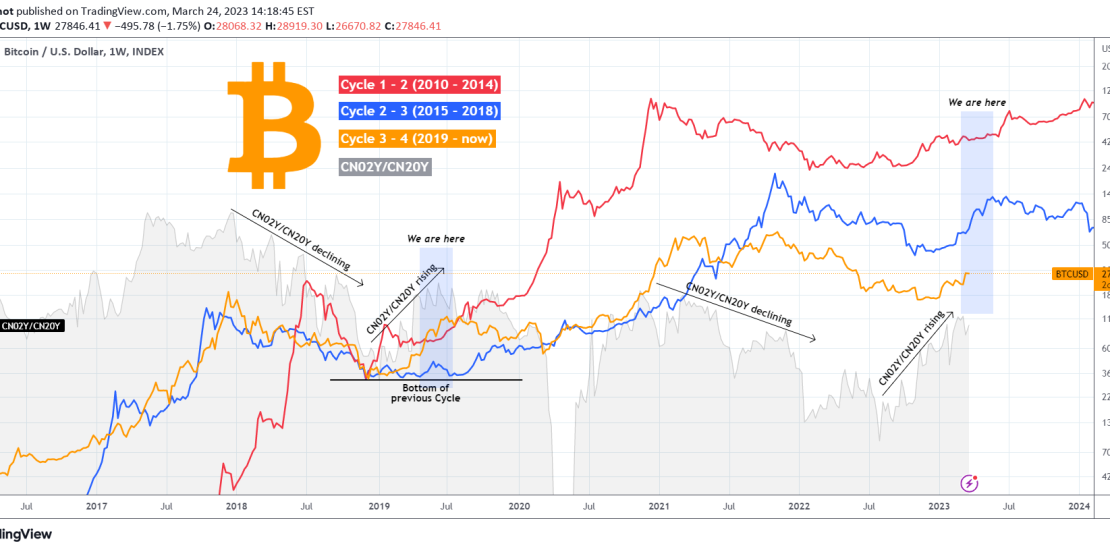

BITCOIN Cycle comparison and how China bonds initiate new Bull!

- March 24, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

This is not the first time we incorporate the Chinese bond yields element (CN02Y/CN20Y) to Bitcoin (BTCUSD) analysis, but it is the first time we do so in such an illustrative way by displaying all Cycles from a common starting point. We have made a case in the past how strong of a correlation the

-

S&P500 is pricing the new Low of the bullish leg.

- March 23, 2023

- Posted by: Tradingshot Articles

- Category: Stock Indices

The S&P500 (SPX) hit today the 4H MA50 (blue trend-line) again and the Higher Lows since the March 13 bottom. That was a bottom on the 5-month Channel Up and the best buy opportunity on a 1 month time-frame. With the 4H RSI sequence similar to the Higher Lows of the previous bullish leg in

-

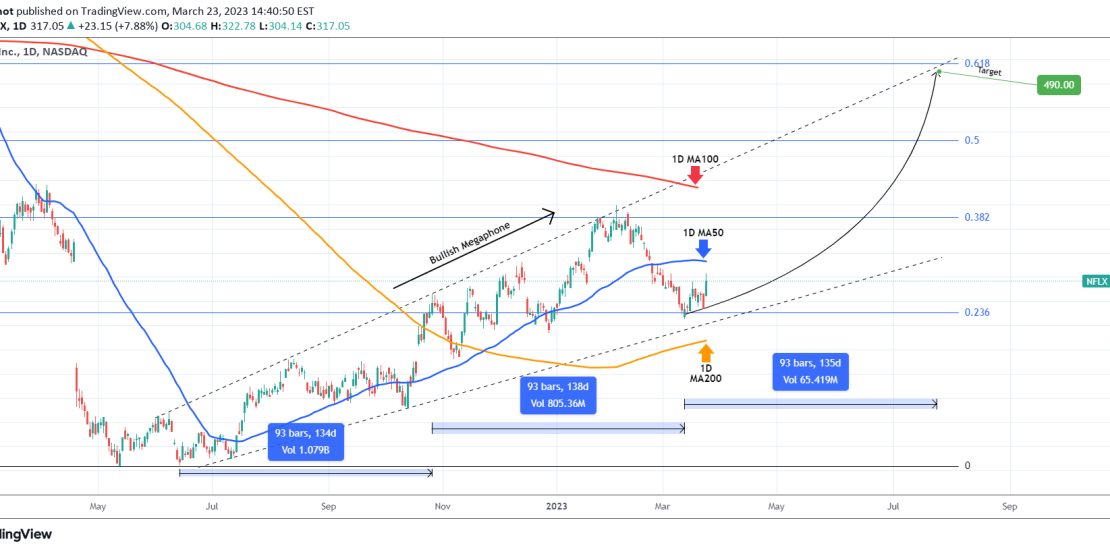

NETFLIX This price jump will be huge and can reach $490.

- March 23, 2023

- Posted by: Tradingshot Articles

- Category: Stocks

Netflix (NFLX) has gone a long way since we called the exact bottom back on our April analysis: Since then, the stock has formed a well structured Bullish Megaphone pattern, which is currently rising after almost touching its bottom. The 1D MA50 is the short-term Resistance and the 1W MA100 (red trend-line) the long-term. A

-

BITCOIN $50000 is a realistic target by November!

- March 22, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Bitcoin (BTCUSD) satisfied those that kept comparing the 2022/23 Cycle to the 2014/15 one as after the a clear rejection on the 1W MA50 (blue trend-line), it rebounded on the Cyclical Lower Highs trend-line and since last week it closed above it as well as the 0.382 Fibonacci retracement level. This symmetry is remarkable and

-

RNDRUSD Buy the break-out or the next pull-back

- March 22, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Render Token (RNDRUSD) it currently testing the 1D MA50 (blue trend-line). If the 1D candle closes above it, then buy the break-out. If not, a rejection as in mid December is more likely, so buy the pull-back on this Pitchfork Support. Target in both cases 3.0000. Tradingview link: https://www.tradingview.com/chart/RNDRUSD/NdhTu1PX-RNDRUSD-Buy-the-break-out-or-the-next-pull-back

-

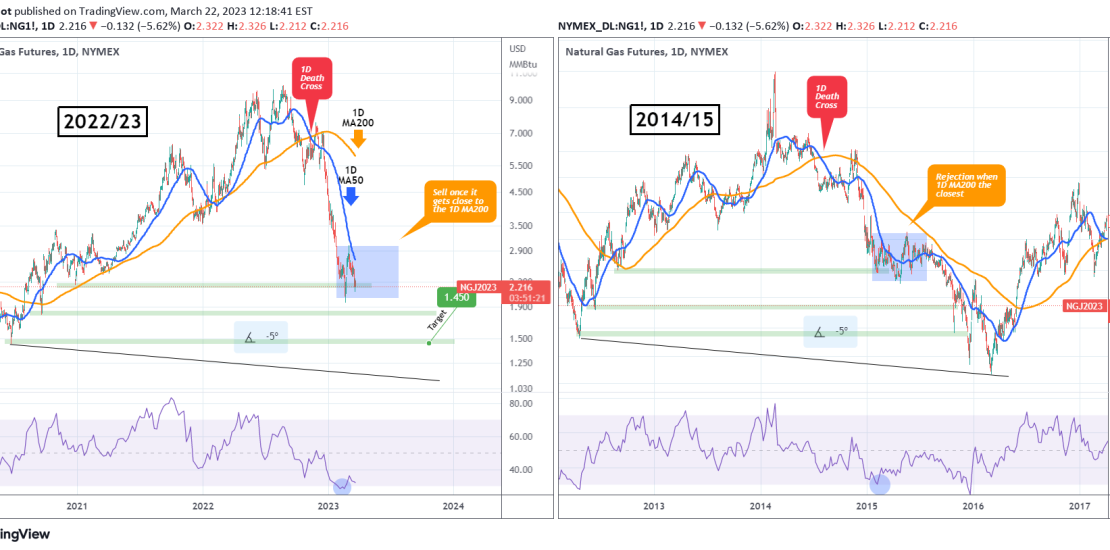

NATURAL GAS Confirmed our long-term view, now turning sideways.

- March 22, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

Those who follow us for long, know that we tend to utilize long-term patterns, especially cyclical pattern that give a high probability of return as they filter out the day-to-day noise from the news. Natural Gas (NG1!) is no exception and our multi-year Cycles analysis last January proves that: As the price continued to free-fall,