-

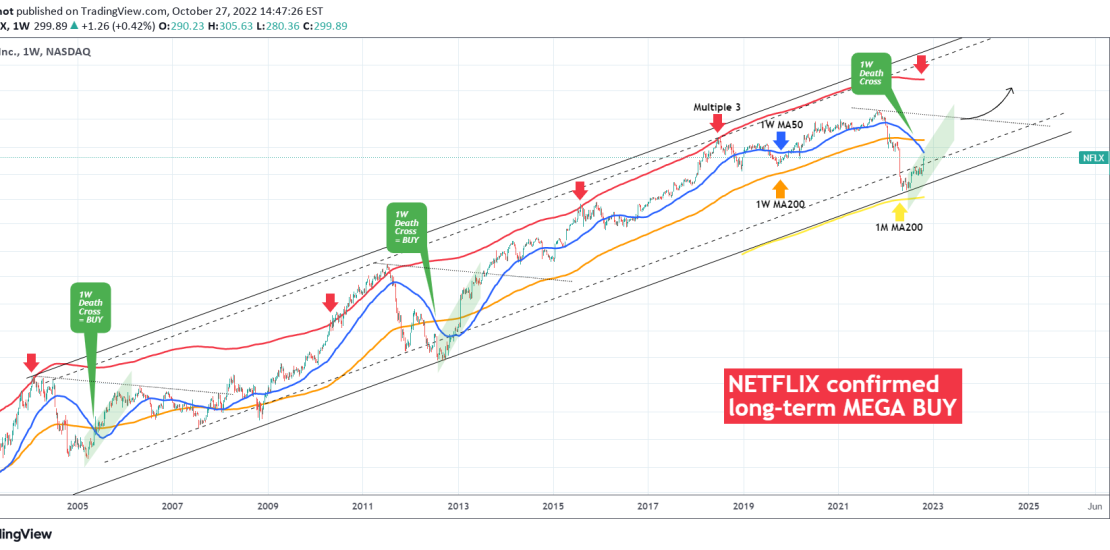

NETFLIX gives a confirmed MEGA BUY signal

- October 27, 2022

- Posted by: Tradingshot Articles

- Category: Stocks

No Comments

We’ve been bullish on Netflix (NFLX) since early Summer after the price held the 1M MA200 (yellow trend-line), which as we noted on our April 21 analysis, is the historical Support: Even though the drop didn’t complete the expected -80% drop, it did come close enough (-76.50%) and as you see the rebound since

-

CADCHF Previous Target hit. Sell now, unless breakout happens.

- October 27, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The CADCHF pair gave us a perfect buy 1 month ago after we spotted the RSI Bullish Divergence and the price rebounded strongly on the 1 year Support Zone: Our 1D MA50 (blue trend-line) target was successfully hit and now we see the price struggling to close above it. This continues to print the

-

USDZAR Short-term Sell signal and long-term level to watch.

- October 27, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The USDZAR pair continues to confirm our break-out trade strategy as by breaking above the previous Resistance Zone we discussed on September 06, while holding the 1D MA50 (blue trend-line) as Support, it activated our buy signal and hit the -1.0 Fibonacci target and the 2.0 Fib extension (green dotted line) of the long-term

-

S&P500 Huge confirmation of our bull pattern repeat.

- October 24, 2022

- Posted by: Tradingshot Articles

- Category: Stock Indices

Right on the October 13 2022 low, when the CPI number came out higher than expected and the market was in extreme fear mode, we posted the following idea on the S&P500 index (SPX), explaining how fundamentally the report was still lower than the previous month and more importantly how technically the index was

-

TONUSDT Massive break above the 1D MA50. Potential +100% rise!

- October 21, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

*** *** For this particular analysis on The Open Network we are using the TONUSDT symbol on the OKX exchange. *** *** The idea is on the 1D time-frame where TON is currently testing the 1D MA50 (blue trend-line) for the second day in a row. This test is carried out while the 1D RSI is on a strong rise,

-

ORACLE Broke above the 1D MA50, first time in more than a month

- October 21, 2022

- Posted by: Tradingshot Articles

- Category: Stocks

The Oracle Corporation (ORCL) broke today above its 1D MA50 (blue trend-line) for the first time since September 14. Within the long-term Channel Down pattern that the price has been trading in since January 12, this is the fastest break-out after a Lower Low bounce. Basically it resembles the fast rebound after the February

-

DELL Excellent buy opportunity on the break-out

- October 21, 2022

- Posted by: Tradingshot Articles

- Category: Stocks

Dell Technologies (DELL) is testing the top (Lower Highs trend-line) of the short-term Channel Down that started after the September 12 High. The 1D MA50 (blue trend-line) is right above it, all within the wider pattern of the long-term Channel Down since the March 29 rejection on the 1D MA50. However, while the price

-

USDHKD Drop imminent on a 5-year RSI signal

- October 21, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The USDHKD pair naturally has a tight trade but at times gets volatility shocks. A signal that since 2017 has triggered such shocks to the downside has been flashing on the 1D RSI. As you see during that period, every time the 1D RSI formed Lower Highs while the candle action was either rising

-

USDCNY Next week will probably top and turn sideways

- October 21, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The USDCNY pair has been on a very strong rise since it got detached from the 1D MA50 (blue trend-line) on August 11. The bullish channel resembles that of mid April – mid May, which topped on its 6.0 Fibonacci extension from its previous Support. The RSI is printing a similar sequence that was

-

NETFLIX +15% near the 1D MA200 for the first time since January!

- October 19, 2022

- Posted by: Tradingshot Articles

- Category: Stocks

Netflix (NFLX) had its highest daily opening in over one year, rising so far +15.21% form a 240.86 close yesterday to a 277.50 intra day peak. This is of course a fundamental move due to the big earnings surprise yesterday (3.1 EPS against a 2.18 forecast). Technically, this brings the price just below the