- October 27, 2022

- Posted by: Tradingshot Articles

- Category: Stocks

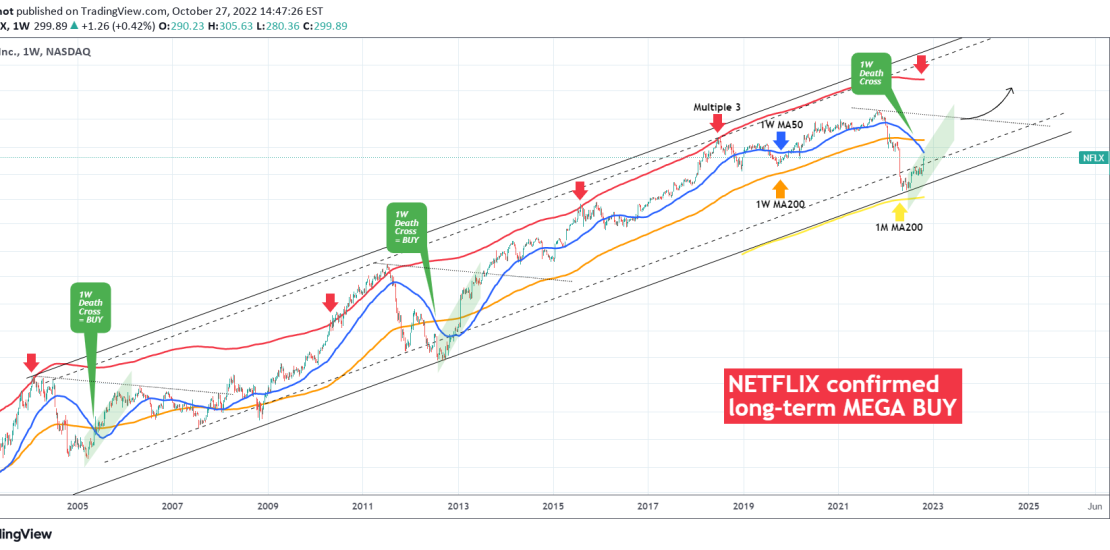

We’ve been bullish on Netflix (NFLX) since early Summer after the price held the 1M MA200 (yellow trend-line), which as we noted on our April 21 analysis, is the historical Support:

Even though the drop didn’t complete the expected -80% drop, it did come close enough (-76.50%) and as you see the rebound since the mid May bottom has been massive already (+87%). The price is now close to hitting the 1W MA50 (blue trend-line) for the first time since the first week of January.

The current analysis is on the 1W time-frame and illustrates NFLX’s long-term price action since it’s first trading day. Though the scale is logarithmic, we can fit the price action within a Channel Up. The recent May bottom was exactly on the Channel’s bottom (Higher Lows trend-line) just like the previous Higher Low in late July 2012.

The catalyst that is making us claim that Netflix formed a bottom and is giving a confirmed long-term buy signal is the fact that the price continues to rise even after the formation of the Death Cross (bearish signal technically), which is when the 1W MA50 crosses below the 1W MA200 (orange trend-line). In all (2) previous occurrences (July 2012, April 2005), the stock price had already formed its bottom and was at the start of a very aggressive rally towards its previous All Time High. The current Death Cross was formed in August (2022) and the +87% already shows how this is similar to past bottoms.

There is a Lower Highs trend-line involved (dotted line) which during the past two rallies, was the initial target. In the 00s the price took a while before making a new All Time High while in the early 2010s it took just a few months after touching the (dotted) Lower Highs trend-line. As a long-term target, an investor could use the Multiple 3 (red trend-line), from the Fib MAs indicator.

Tradingview link:

https://www.tradingview.com/chart/NFLX/tK3ApFxG-NETFLIX-gives-a-confirmed-MEGA-BUY-signal