-

BITCOIN Yuan and China bond yields point to a mega rally!

- January 26, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

No Comments

This is not the first time we emphasized the strong correlation of Bitcoin (BTCUSD) with Yuan (USDCNY) and the Chinese Bond Yields (CN02Y and CN20Y). We made an analysis right in the aftermath of the FTX crash, indicating why those indicators have all aligned, paving the way for BTC’s new Bull Cycle. As you see

-

GBPNZD Best long-term signal you’ll get

- January 26, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The GBPNZD pair hit the bottom of the Triangle pattern it has been trading in since early 2019. This has been done staight after a 1D Death Cross (when the blue 1D MA50 crosses below the orange 1D MA200). This is quite similar to the October 2018 – August 2019 fractal. A new Golden Cross

-

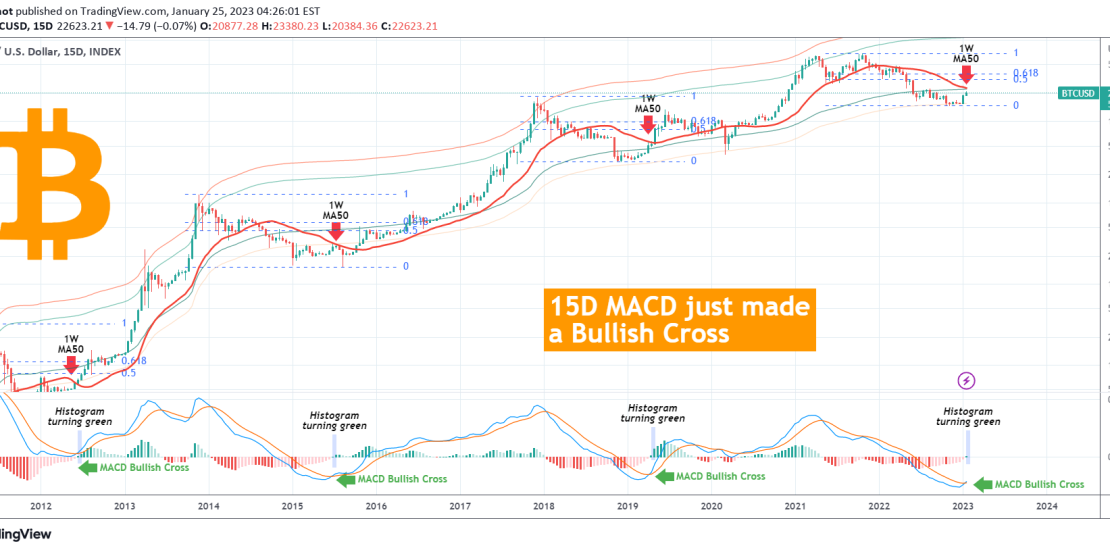

BITCOIN This is the Bullish Cross that will take it to $33k

- January 25, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Bitcoin (BTCUSD) just made a hugely important and unique Bullish Cross on its LMACD. Those who follow us regularly over the years, know that we like looking into assets (and Bitcoin in particular) from different time-frames that provide a more spherical overview of the market and the direction. This time we analyze the 15D chart

-

BITCOIN Transition from a Wedge to an Inverse H&S showing 33.5k?

- January 24, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Bitcoin (BTCUSD) is up +40% since the start of the year and did so by breaking above its former Falling Wedge pattern that was holding since the June 18 2022 Low. On this 1D time-frame, we see that there is a high probability of the Wedge break-out to transition BTC into the next pattern that

-

DXY Testing the 4H MA50. Short-term Resistance.

- January 23, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The U.S. Dollar Index (DXY) it currently testing its 4H MA50 (blue trend-line), which has caused two rejections last week and has been closing all 4H candles below it since January 06. As long as it continues to do so, we expect a short-term bearish trend between that and the medium-term Channel Down that has

-

META The worst is history! 6 straight green weeks.

- January 22, 2023

- Posted by: Tradingshot Articles

- Category: Stocks

Our update on The Meta Platforms (META) on the 1W time-frame. What stands out is that the stock has completed six (6) straight weekly candles, for the first time since March 2017! This is one of the strongest bullish sequences in its history and while at it, it has established 2 weeks above the 1D

-

NATURAL GAS Astounding multi-year Cycles showing sell’s not over

- January 22, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

This is not the first time we look into Natural Gas (NG1!) and its long-term patterns. We have coined its Multi-year Cycles Theory in the past and it is time to extend on it a little on the 1W time-frame. Typically investors ask us for 1D analysis such as the following we published 2 months

-

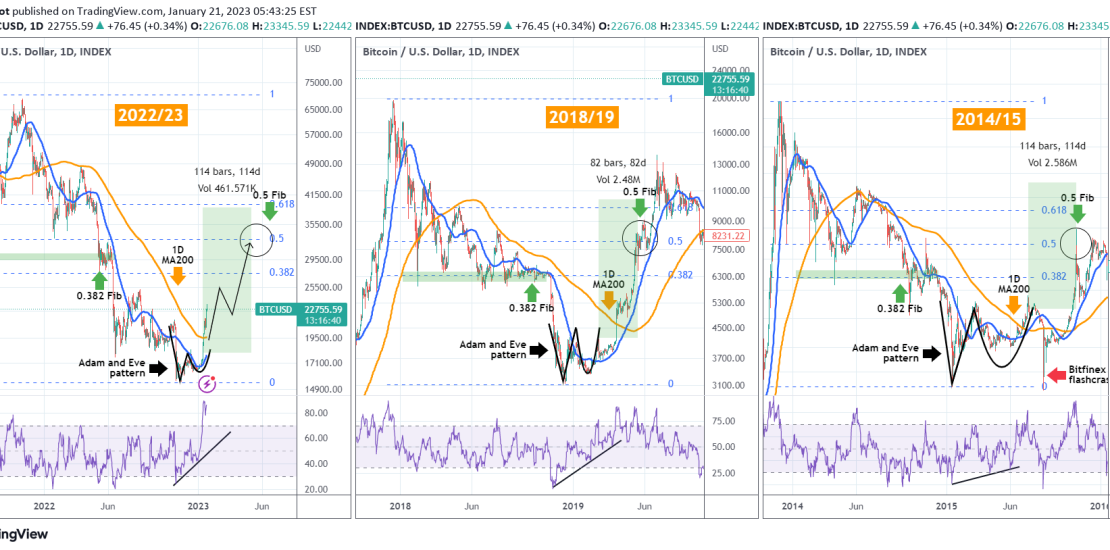

BITCOIN 33k seems inevitable next. This pattern always delivers.

- January 21, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

We talked yesterday about how beautifully Bitcoin’s (BTCUSD) Adam and Even (A&E) pattern delivered a textbook short-term target at 21650: We looked into such past occurrences more and discovered even more interesting clues for the immediate future. As this analysis shows, every Bear Cycle bottom has been formed on an A&E pattern (even the first

-

DOW JONES The High volatility zone continues to pay off

- January 19, 2023

- Posted by: Tradingshot Articles

- Category: Stock Indices

The Dow Jones Industrial Average (DJI) followed our previous call (almost) 3 weeks ago to perfection as after trading within the Triangle, it broke to the upside and hit the 34300 target: The strong rejection of this week simply validates the argument that we’ve made since November, that the blue zone will be a High

-

WTI OIL Limited upside, significant downside

- January 19, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

It is time to update our WTI Oil (USOIL) thesis, which was bullish last week as the Resistance within the Channel Up broke: This time we see one last rise as a possibility since the price is rebounding on the 4H MA50 (blue trend-line) but limited to the 83.40 Resistance. An exception can be made