2022

-

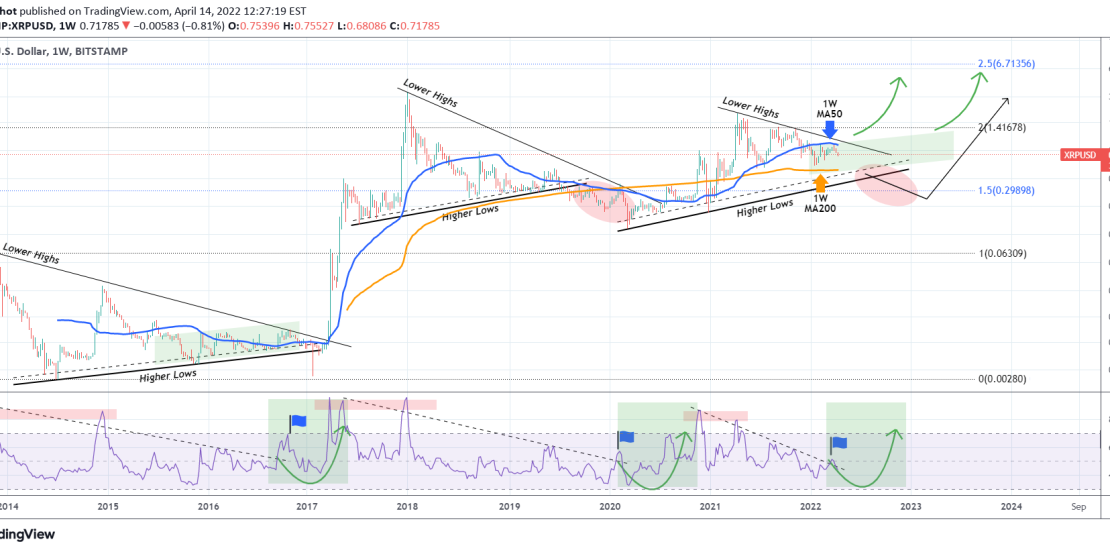

XRPUSD Critical crossroads! Which scenario will prevail?

- April 14, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

No Comments

XRPUSD got rejected on the 1W MA50 (blue trend-line) for the second time in two months. Basically, it has been trading below the 1W MA50 for the whole year. At the same time it has been trading under the bearish pressure of the Lower Highs trend-line since the April 2021 High. This is not

-

EURJPY Bull Flag done. Targeting $139.00.

- April 14, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURJPY pair has broken above its Bull Flag this week. That was a pattern coming off the incredible 10% rise since the March 07 bottom that broke above its Bearish Megaphone pattern. The 1D MACD topped and made a Bearish Cross. The last time we saw the very same set of conditions was

-

NZDUSD Strong sell signal

- April 13, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The NZDUSD pair has been trading within a long-term Channel Down since the start of 2021. Our last call on this pair was a buy signal and our 0.7000 target has been hit: The price broke below the Lower Lows trend-line, creating a small divergence and we have to re-adjust our projected Fibs. As

-

NASDAQ going according to last week’s plan. Eyes on 1D MA50/100.

- April 7, 2022

- Posted by: Tradingshot Articles

- Category: Stock Indices

Nasdaq (NDX)has is following exactly last week’s suggested trading plan so far, as it pulled-back from the 1D MA200 (orange trend-line) and today reached the 1D MA50 (blue trend-line): This pull-back took place primarily because the index failed to break above the Lower Highs trend-line of the December 28 High and got rejected two

-

EURUSD The 1D MA50 rejection can deliver sub 1.0700 prices.

- April 6, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair got rejected last Thursday on the 1D MA50 (blue trend-line) and as a result it trading today towards the March 07 Low. A new Lower Low within the long-term Channel Up seems imminent as a break below the 1.0810 Low should put the 1.0640 low of the March 2020 COVID melt-down

-

GBPUSD aiming at a new Low within the Bearish Megaphone.

- April 6, 2022

- Posted by: Tradingshot Articles

- Category: Forex

GBPUSD failed to break above the 1D MA50 (blue trend-line) and the 0.5 Fibonacci retracement level last week and as a result the market lost confidence and resumed the long-term bearish trend. That has been within a Bearish Megaphone pattern since July 2021. The selling fractal since February 17 resembles the sequence of late

-

USDJPY Testing a 20 year Resistance. Major Bull Cycle if broken!

- April 6, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The USDJPY pair has been on the strongest multi-week rise in March-April since the November-December 2016 rally. By doing so, it reached the 125.00 level for the first time since August 2015, which was exactly when the China economic growth slowdown worries hit the market. In fact, the 124.200 – 126.000 band is a

-

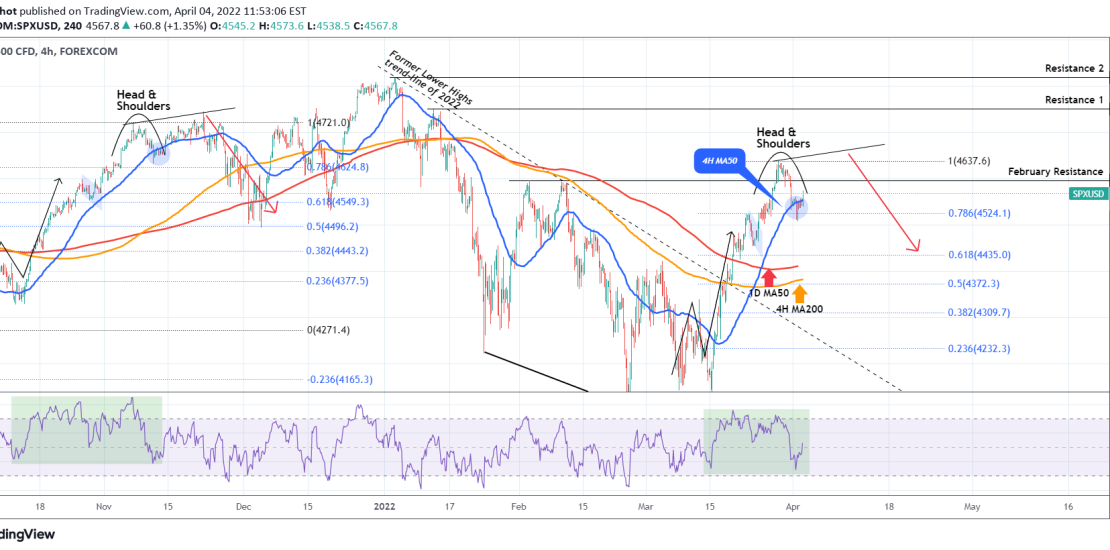

S&P500 can rise temporarily but 4400 likely mid-term.

- April 4, 2022

- Posted by: Tradingshot Articles

- Category: Stock Indices

S&P500 print a Head & Shoulders pattern last week and naturally dropped below the 4H MA50 (blue trend-line) for the first time in two weeks (since March 15). The pull-back is now neutralized and we see today a bullish reaction. This rise can be temporary and even though a test of the recent High

-

EURUSD within a Channel Up short-term

- March 23, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair has been trading within a short-term Channel Up on the 4H time-frame. The RSI moving sideways within roughly 65.00 – 40.00 is setting up the pace, where we can sell on the Resistance the Higher Highs and buy on its Support the Higher Lows of the price. Basically right now the

-

XAUUSD long-term bullish and bearish levels.

- March 23, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) has exhausted the late February – early March rally and since the March 08 peak, has corrected back near the 1D MA50 (blue trend-line). That is the 1st Support and should be enough to hold the price for at least another 3 weeks. Basically that rally and subsequently the blow-off top, resembles