2022 March

-

EURUSD within a Channel Up short-term

- March 23, 2022

- Posted by: Tradingshot Articles

- Category: Forex

No Comments

The EURUSD pair has been trading within a short-term Channel Up on the 4H time-frame. The RSI moving sideways within roughly 65.00 – 40.00 is setting up the pace, where we can sell on the Resistance the Higher Highs and buy on its Support the Higher Lows of the price. Basically right now the

-

XAUUSD long-term bullish and bearish levels.

- March 23, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) has exhausted the late February – early March rally and since the March 08 peak, has corrected back near the 1D MA50 (blue trend-line). That is the 1st Support and should be enough to hold the price for at least another 3 weeks. Basically that rally and subsequently the blow-off top, resembles

-

USDCHF Rejected at the top of its Channel Up.

- March 18, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The USDCHF pair has been trading within a Channel Up since June 16 2021. This week it hit and so far got rejected on the Higher Highs (top) trend-line of the Channel. Technically we should see the pull-back extending as low as the Higher Lows zone. A reasonable target is just above the zone

-

CARDANO can’t get out of this death spiral

- March 15, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

ADAUSD (Cardano) has been trading inside a Channel Down ever since its September 02 2021 All Time High (ATH). That is a significant amount of time it has been on a bearish trend and the pure structure of this Channel Down, doesn’t seem to allow much room for hope, at least not yet. Right

-

USDJPY targeting 120.000 based on this recurring pattern.

- March 11, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The USDJPY pair is on a strong bullish break-out this week, having recorded an absolute 5 day green 1D candle streak. The 1D MA50 (blue trend-line) is supporting while the 1D RSI is about to break the Lower Highs trend-line started on October 20 2021. Last time the 1D RSI broke above a similar

-

EURUSD Make or break on a multi-year basis?

- March 10, 2022

- Posted by: Tradingshot Articles

- Category: Forex

EURUSD has been among the major losers of the Ukraine – Russia war and this has accelerated the bearish trend towards a Higher Lows trend-line that has been holding since late 2016. This chart illustrates the pair on the 1W time-frame but with the CCI indicator below on the 1M (monthly) time-frame. This analysis

-

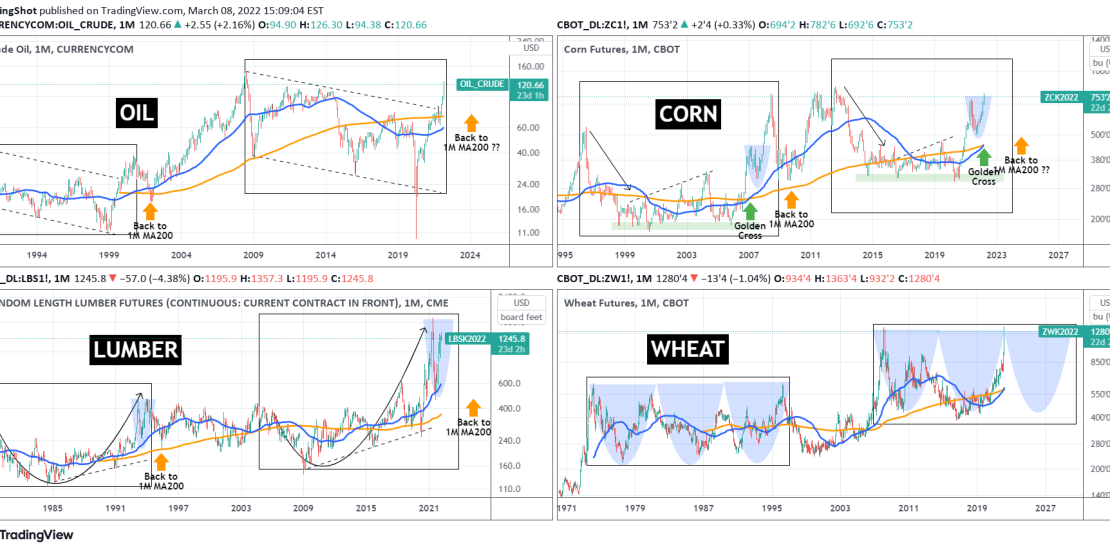

COMMODITIES running wild everywhere. Decade-long cycles in play.

- March 8, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

The talk of the street, since the war broke out between Russia and Ukraine, has been how aggressively commodities have been rising. Of course this rise hasn’t started this month or the previous but is the outcome of inflation running high on historic levels since the March 2020 COVID crash, when global central banks

-

EURUSD close to its medium-term bottom ahead of ECB & FED Rates

- March 8, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair has been trading within a Channel Down since 2021. Yesterday the price came to the closest to the bottom (Lower Lows trend-line) of the Channel Down it has been since the March 31 2021 Lower Low and the 1D RSI the lowest since February 18 2020! Those are indications that the

-

XAUUSD Targets in case of further war escalation or deescalation

- March 8, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Gold has seen a rapid rise in recent weeks as investors seek safe haven shelter during the start of the Ukraine – Russia war. The result has been an aggressive detachment of the price from its 1D MA50 (blue trend-line), where Gold has been trading around using it as a pivot since August 2021.

-

WTI OIL in need of a pull-back to the 1D MA50.

- March 8, 2022

- Posted by: Tradingshot Articles

- Category: Forex

One of the biggest (if not the biggest) winner of the current war between Russian and Ukraine, is Oil. Energy crises are almost a certainty in times of geopolitical conflicts involving major producers. Even though it is tough predicting technically WTI prices while war is ongoing, charting past fractals could give an idea to