- March 8, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

The talk of the street, since the war broke out between Russia and Ukraine, has been how aggressively commodities have been rising. Of course this rise hasn’t started this month or the previous but is the outcome of inflation running high on historic levels since the March 2020 COVID crash, when global central banks (more importantly the Fed and the ECB) engaged in enormous economic rescue packages through liquidity by money printing at a historic pace.

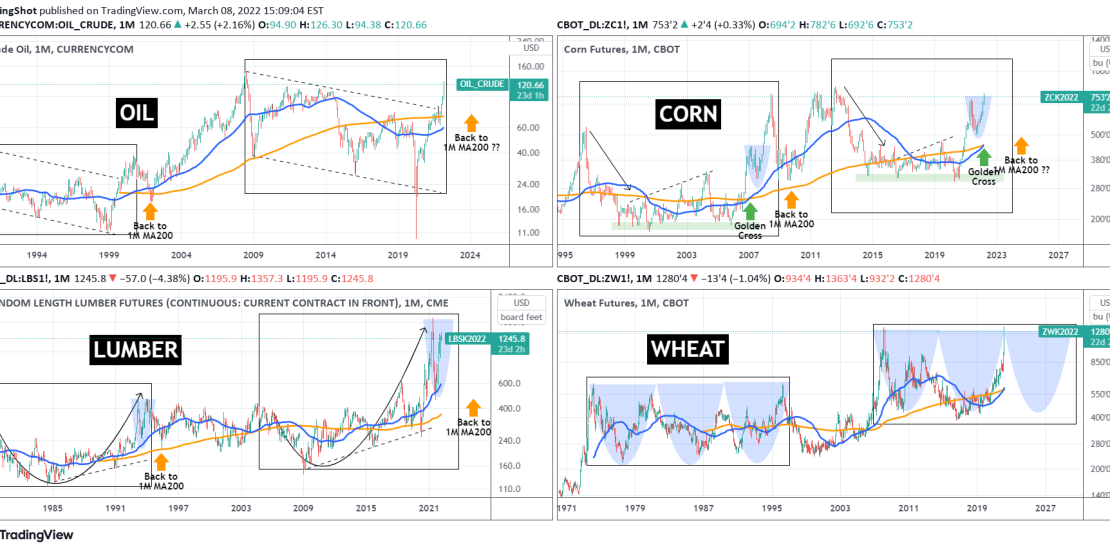

I have excluded Gold (XAUUSD), which is the obvious counter to inflation and safe haven during times of geopolitical unrest and instead have included WTI Oil, Corn, Lumber and Wheat as representative commodities. I will not go into detail for each one separately, as the charts are pretty much self-explanatory. The goal here is to illustrate their long-term Cycles and how similar today’s rise is to those of the previous cycle.

As you see, what is happening today is no different to what happened in the previous Cycle. All commodities seem to be approaching their respective symmetrical tops when compared to their previous Cycle. That is more evident on WTI Oil, Corn and Lumber. When their previous Cycles peaked, the price always went back to the 1M (monthly) MA200 (orange trend-line).

If you are a long-term investor, such charts help at giving a very clear perspective as to what action should be taken in portfolio making.

Tradingview link: