2021 August

-

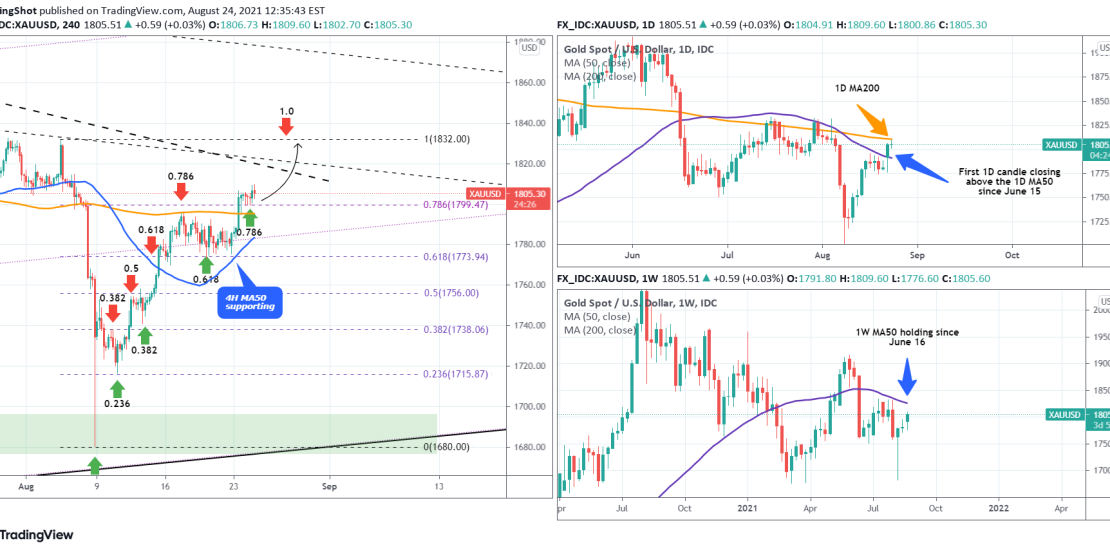

XAUUSD Golden Cross formed on 4H

- August 31, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

No Comments

Pattern: Channel Up on 4H. Signal: Buy as the price rebounded near the 4H MA50 (blue trend-line) and even though there is still room within the Channel for one last low, the 4H Golden Cross that was formed may bring higher prices without it. Target: 1829 (just below the 1.236 Fibonacci retracement level and

-

WTI OIL had the biggest weekly rise since May 31 2020!

- August 31, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

WTI Crude Oil posted last week the strongest 1W candle (+10.30%) since May 31 2020 (+11.44%). What can this possibly mean for future prices? Alone nothing. But as you see, last week’s bounce came after a 1W RSI touch on the 43.50 Support which has been holding since May 2020 as well. That makes

-

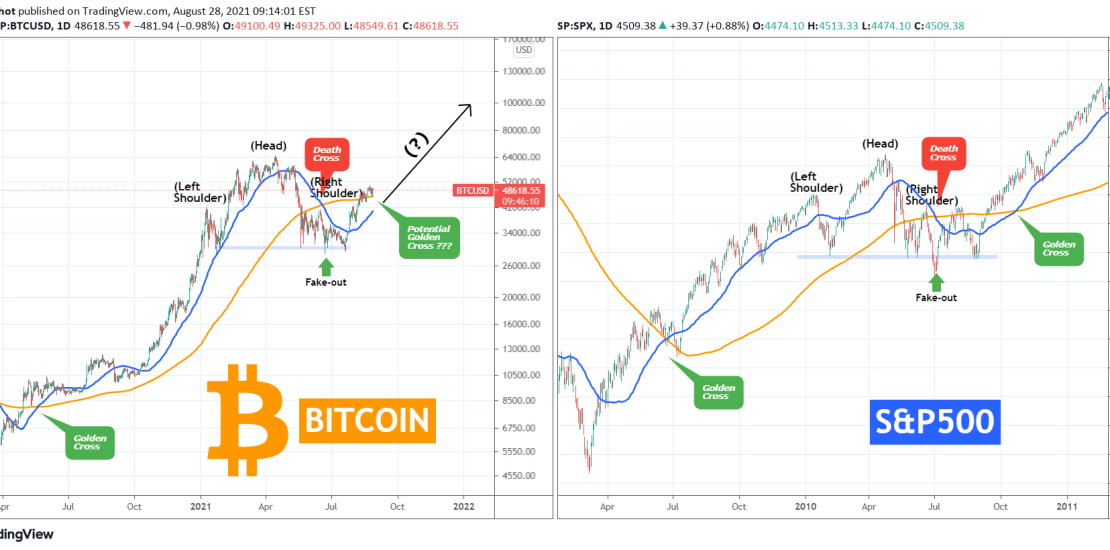

BITCOIN fun fractal.. or something more?

- August 28, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Those who follow me since my start here on TradingView or even way back on Reddit know that I am a big fun fractal comparison. I have been using this approach extensively especially on long-term technical analysis and more often than not, proves to be quite efficient. The fractal comparison I am bringing to you

-

WTI OIL aiming at the 1D MA50

- August 24, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

Pattern: Triangle on 1D. Signal: Buy as the price (a) made a strong rebound on the Higher Lows trend-line, (b) near the 1D MA200 (orange trend-line) and (c) broke above the Pivot Zone. Target: The 1D MA50 (blue trend-line). Tradingview link: https://www.tradingview.com/chart/USOIL/X7DQLRmq-WTI-OIL-aiming-at-the-1D-MA50

-

XAUUSD They symmetrical harmony of Fibonacci levels

- August 24, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

In my most recent Gold idea I introduced the importance of the Fibonacci retracement levels as targets following the August 08 flash crash of the Nonfarm Payrolls: As you see since then, the Fibs have acted very well as Resistance levels which on the following pull-backs acted as Supports. As the 0.786 Fib is

-

GBPJPY Major Resistance from 2007!

- August 12, 2021

- Posted by: Tradingshot Articles

- Category: Forex

GBPJPY is ahead of a “Make or break” situation as it is facing the Lower Highs trend-line that started all the way back from the 2007 subprime mortgage crisis. As long as it holds, the pair will most likely reverse back towards the lower Support levels. However if the 2007 line breaks, then it

-

FTSE 2017 fractal points to a 7500 top

- August 12, 2021

- Posted by: Tradingshot Articles

- Category: Stock Indices

This is a fractal analysis on FTSE from 2017. Not much description is needed here, the chart is quite straightforward. The 2020-2021 (Fractal B) price action so far is similar to the 2016-2017 (Fractal A) sequence. They both started after the market bottomed out on a 1W Death Cross and have been rising with

-

EURUSD hit the 4H Lower Lows trend-line

- August 11, 2021

- Posted by: Tradingshot Articles

- Category: Forex

Pattern: Bearish Fibonacci Channel on 4H. Signal: Buy as the price hit the Lower Lows trend-line of the Channel which within July has always initiated a rebound towards at least the 4H MA50 (blue trend-line). Target: 1.1800 short-term (right below the Channel’s 1.0 Fib and the horizontal 0.382 Fib retracement) and 1.18500 medium-term (right

-

XAUUSD Bullish divergence and Inverse H&S lead to break-out

- August 11, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

This is a short-term update to my recent long-term idea: As you see on the left chart, Gold broke above the Channel Down and the early signal to this break-out was the 4H RSI which was you see was on a Bullish Divergence as while the price was in a Channel Down, the RSI

-

XAGUSD Multi-decade Cup & Handle?

- August 9, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

Silver pulled back on Friday and today along with most major commodities due to the USD showing strength on the incredible Nonfarm Payrolls numbers. All this short-term price action though can be viewed as nothing but noise on one pattern that has been developing since 1980 and may be close to completion. I am

- 1

- 2