- August 24, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

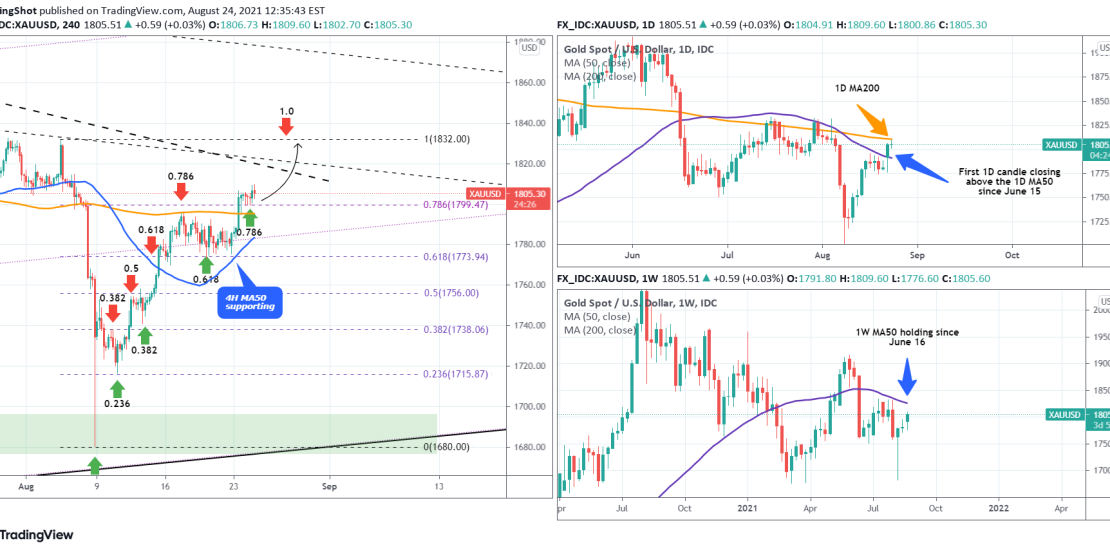

In my most recent Gold idea I introduced the importance of the Fibonacci retracement levels as targets following the August 08 flash crash of the Nonfarm Payrolls:

As you see since then, the Fibs have acted very well as Resistance levels which on the following pull-backs acted as Supports. As the 0.786 Fib is currently holding, the only gap left to be filled is the 1.0 Fib at 1832.

It is however the most difficult Fib target to fill as there are two very important barriers: first the 1D MA200 (orange trend-line on the right top chart) at 1,810.30 and the 1W MA50 (blue trend-line on the right bottom chart) at 1,825.93, which is holding since June 16.

A positive sign though is the fact that yesterday XAUUSD posted the first 1D candle closing above the 1D MA50 since June 15.

Long-term view:

Tradingview link: