-

BITCOIN, NASDAQ, DXY all on Huge Pivot Zones! Tick tack..

- April 10, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

No Comments

With the high degree of correlation among financial assets, it is not a coincidence that Bitcoin (BTCUUSD), Nasdaq (NDX) and the U.S. Dollar Index (DXY) all are on Huge Pivot Zone, the behavior of which is more likely going to determine the trend for the next several months. Bitcoin’s Pivot Zone has been in effect

-

BITCOIN Is 300k the true potential of this Cycle?

- April 8, 2023

- Posted by: TradingShot

- Category: Cryptocurrency

Bitcoin (BTCUSD) isn’t backing down, withstanding to perfection so far any noise in the stock market, a development that establishes that its new Bull Cycle is well underway. Having broken above the 1W MA50 (blue trend-line) and what will most likely be the 4th straight weekly closing above it, we can see that it is

-

GBPUSD Making a bullish break-out

- April 6, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The GBPUSD pair eventually rebounded and hit the Double Top Resistance, which was our Target as presented on our February 28 analysis: At the moment the price is above that level (1.2450) and as long as it closes above it, we will be targeting 1.2650 on the May 27 2022 High Resistance. A closing below

-

USDJPY Reached our target. Critical move ahead.

- April 6, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The USDJPY pair hit the sell target we set on our February 28 analysis as it got rejected on the 138.210 Resistance and dropped back to the (dashed) Higher Lows trend-line: As long as this trend-line holds, it is more likely to see one more rebound first to the 1D MA50 (blue trend-line) for short-term

-

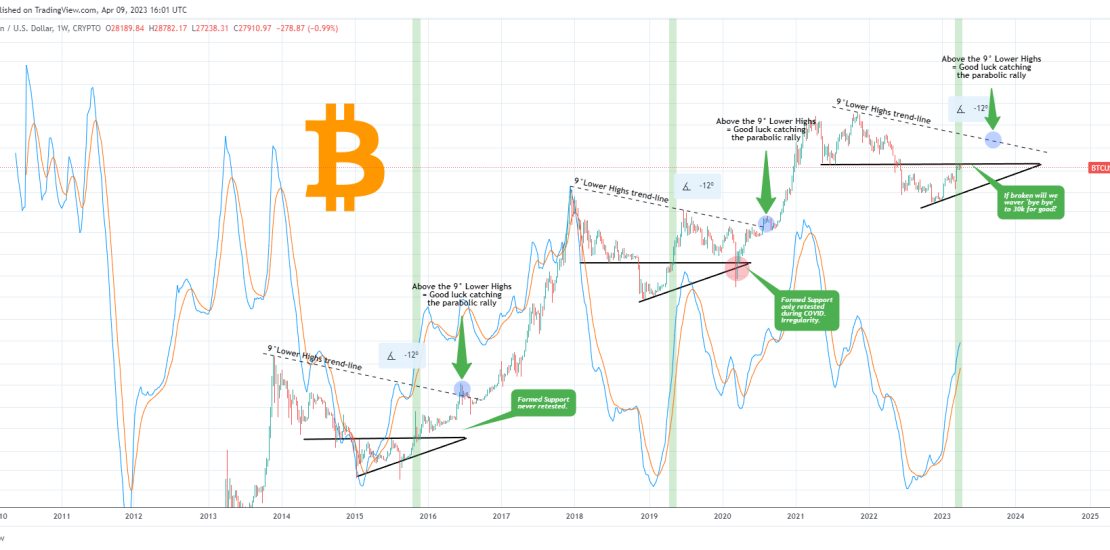

BITCOIN About to wave goodbye to 30k for good if broken?

- April 5, 2023

- Posted by: Tradingshot Analysis

- Category: Cryptocurrency

Bitcoin (BTCUSD) is ahead of a critical breakthrough on the 1W time-frame. The former Support of the first half of the Bear Cycle is around 30k and is currently being tested. History has shown that when this level gets tested as a Resistance and breaks during the start of a new Bull Cycle, it never

-

EURUSD Bullish but hit the top of the Channel Up

- April 4, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair has recovered after the drop below the 4H MA50 (blue trend-line) and is almost at the top of its short-term Channel Up. With the 4H RSI reaching its Lower Highs trend-line, we expect pull-back to the bottom of the Channel Up and the 4H MA50 before a rebound that will test Resistance

-

WTI OIL Near a long-term Resistance

- April 4, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

WTI Oil (USOIL) hit our medium-term target last week but following OPEC’s cuts, it opened with a big gap up on Monday: In order to more effectively understand the market dynamics after this move, it is best to view Oil on the 1W time-frame where we see all key characteristics of this move. First the

-

S&P500 Buy without fear. Bull not over until 2030.

- March 30, 2023

- Posted by: Tradingshot Articles

- Category: Stock Indices

This is not the first time we look into the S&P500 (SPX) from a multi-decade perspective. Every time we look into the Cycles since the Great Depression we bring an additional element to the table. This time we break down parts of those Cycles even more and look into the RSI as well. This analysis

-

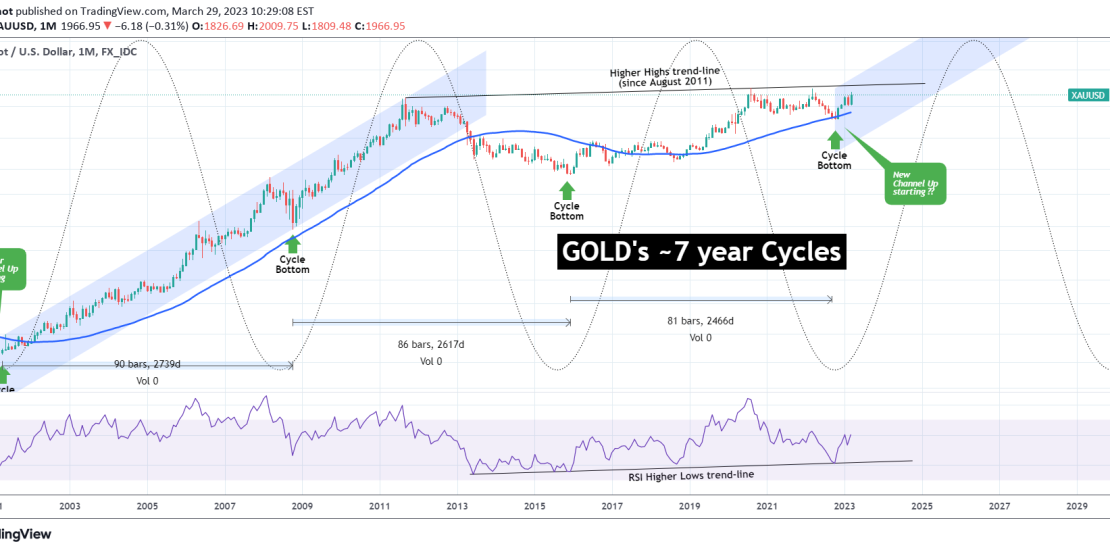

GOLD May be starting a new 7 year Bull Cycle.

- March 29, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) has been on a 6 month rally since the September 28 2022 market Low. This chart on the 1M time-frame shows that Gold is trading on approximately 7 year Cycles since the April 2001 market bottom and that based on this model, the September low may be the bottom of the previous Cycle

-

WTI OIL Channel Up aiming at the 1D MA50.

- March 27, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

WTI Oil (USOIL) transitioned from the Inverse Head and Shoulders (IH&S) pattern we described last week to a Channel Up: Our target remains 74.50 on the medium-term which makes both a Higher High on the Channel Up while filling a 2.0 Fibonacci extension, which is the technical target for the IH&S. Tradingview link: https://www.tradingview.com/chart/USOIL/Fdx7w1Ns-WTI-OIL-Channel-Up-aiming-at-the-1D-MA50