2022

-

ALGOUSD on a strong bullish streak but not a Buy Opportunity yet

- May 3, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

No Comments

Algorand (ALGOUSD) has completed a strong 3 day bullish streak coming close to the 1D MA50 (blue trend-line) again for the first time since the first week of April. Despite this green short-ter display, it is not a buy opportunity yet, as on the medium-term it remains within a Channel Down (dashed lines) and

-

EURUSD hit multiple Support levels!

- April 29, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair has been trading within a multi-month Channel Down since late May 2021. This week the price broke and will most likely close below its Lower Lows trend-line for the first time. In doing so it hit the first Support level, which is the 1.5 Fibonacci extension. At the same time, the

-

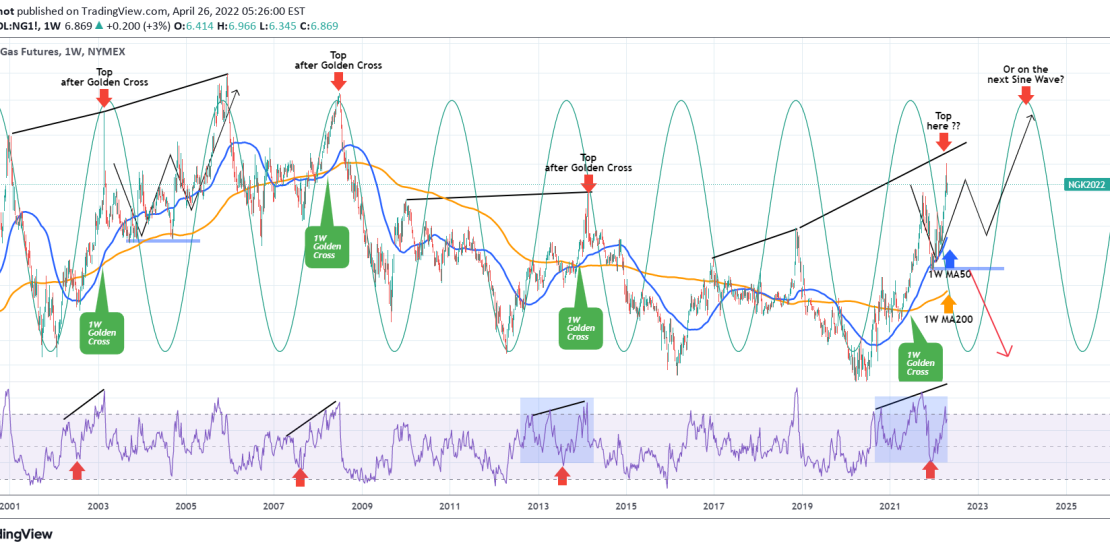

NATURAL GAS Multi-year Cycles.

- April 26, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Natural Gas (NG1!) has been one of the most profitable trading assets of the year offering great returns. On a long-term scale though (1W time-frame on this chart) it has starting to form a peak pattern, which we have seen previously in the past 20 years. I’ve plotted the Sine Waves on the chart

-

GBPCHF Rejection on the 1D MA200. 1-month downtrend ahead.

- April 22, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The GBPCHF pair got rejected yesterday on the 1D MA200 (orange trend-line) and today is on the strongest recent red 1D candle that is about to test the 1D MA50 (blue trend-line) as a Support. Basically, the Bearish Megaphone pattern I presented more than two months ago is still intact, hitting all targets: As

-

NETFLIX When bubbles pop. The bottom isn’t in yet.

- April 21, 2022

- Posted by: Tradingshot Articles

- Category: Stocks

Netfilx (NFLX) is having a historic weekly selling pressure after the negative quarterly report, which showed a loss of 200k subscribers, putting a stop to a growth for the first time in 10 years. This chart on the 1W time-frame shows how the NFLX bubble popped in mid January 2022. The Jan 18 1W

-

CADJPY Buy on this pull-back

- April 20, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The CADJPY pair has made a parabolic rise since the March 08 low, which even exceeded our expectations based on our most recent trading idea: Even though the dominant pattern remains bullish on a Fibonacci Channel, the strength has changed and is now more aggressive. The price action is on the 1D time-frame to

-

AUDCAD formed a bearish reversal pattern.

- April 19, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The AUDCAD pair just hit the 1D MA50 (blue trend-line) after a rejection on the 0.95200 level. This resembles the February 25 2021 rejection of a similar 1-6 fractal in late 2020/ early 2021. We do expect a test of the 0.89125 low by Q3, however are prepared to take the loss and turn

-

EURCAD get ready for cyclical uptrend

- April 18, 2022

- Posted by: Tradingshot Articles

- Category: Forex

EURCAD has been trading within a stable and consistent pattern on the long-term. Since 2013 it is trading within a hyperbolic channel posting aggressive 1 year rallies followed by steadier +1.5 years corrections in the form of Channel Down sequences. At the moment the price is trading at the lowest level it has been

-

CHFJPY Correction ahead.

- April 15, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The CHFJPY pair has been on a strong rally that smashed through our target on the last analysis: Right now the price formed a new Channel Up, remaining within a Fibonacci Channel where it broke above the 1.5 Fib extension and almost reached as high as the 2.0. However with the RSI hitting its

-

AUDJPY Sell signal on overbought 1D RSI

- April 14, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The AUDJPY pair has given a clear medium-term bearish signal. The 1D RSI got rejected late last month within its multi-year Resistance Zone with the price initially reacting with a pull-back but has since recovered and turned neutral. Every time that the price hit the 1D RSI Resistance Zone since 2020, it pulled-back to