2022 January

-

NASDAQ Channel Down emerged. Trade the rejection or break-out.

- January 31, 2022

- Posted by: Tradingshot Articles

- Category: Stock Indices

No Comments

Nasdaq has suffered the most during January’s correction. The Lower Lows created a new Channel Down which we have to consider, despite having the 1D RSI make a rebound from oversold levels and a bottom formation similar to early October, mid-May and early March 2021. The 1D MA200 (orange trend-line) is the first natural

-

EURJPY Buy opportunity on Higher Lows

- January 28, 2022

- Posted by: Tradingshot Articles

- Category: Forex

EURJPY has been trading within a long-term Channel Down since the June 01 2021 market top. Since January 05 2022 it has seen a strong downfall within this wide pattern but this week could have found Support on this internal Higher Lows trend-line (dashed) as it turned sideways. The 1D MA50 (blue trend-line) is

-

XAUUSD Channel Up + 1 extra Support towards 1875

- January 27, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Gold is being sold aggressively following Powell’s comments on the expected inflation yesterday, despite being considered a counter-inflation asset. Technically that sell-off can be attributed to the chart I posted 1 week ago on the selling pressure that the top of the long-term Triangle applies: On the shorter term and the 1D time-frame, Gold

-

S&P500 ended the U.S elections rally. Years of volatility ahead?

- January 25, 2022

- Posted by: Tradingshot Articles

- Category: Stock Indices

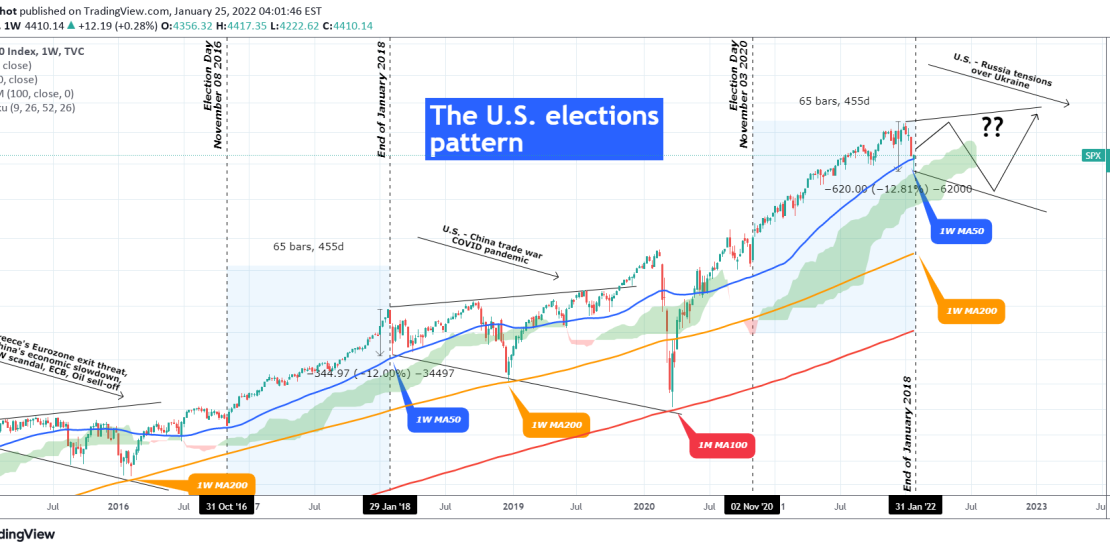

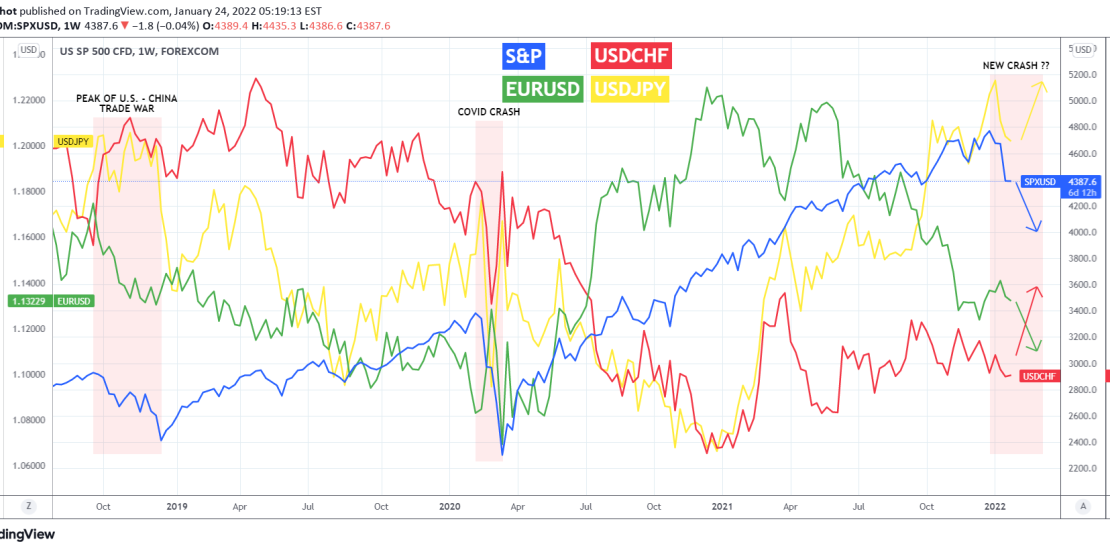

This is the S&P500 index on the 1W time-frame (on the log scale). The recent sell-off (-12% so far) is leaving many wondering what is happening and rightly so as it broke below the very strong bullish pattern (Higher Highs/ Higher Lows) since the November 2020 U.S. elections. As I looked more closely into it

-

S&P500 ended the U.S elections rally. Years of volatility ahead?

- January 25, 2022

- Posted by: Tradingshot Articles

- Category: Stock Indices

This is the S&P500 index on the 1W time-frame (on the log scale). The recent sell-off (-12% so far) is leaving many wondering what is happening and rightly so as it broke below the very strong bullish pattern (Higher Highs/ Higher Lows) since the November 2020 U.S. elections. As I looked more closely into

-

NZDUSD approaching a buy zone

- January 24, 2022

- Posted by: Tradingshot Articles

- Category: Forex

NZDUSD has been trading within a Channel Down since the start 2021. The RSI on the 1D time-frame has successfully provided very accurate buy signals within a zone that is currently very close to. The price itself is approaching the bottom (Lower Lows trend-line) of this long-term Channel Down and it resembles (also on

-

EURGBP All conditions filled for a rise

- January 24, 2022

- Posted by: Tradingshot Articles

- Category: Forex

EURGBP has been trading within a Channel Down since April 2021. Last Thursday, the price touched the bottom (Lower Lows trend-line) of that Channel and Friday posted a strong green 1D candle. This also formed a Bullish Cross on the 1D MACD. Every time the price reverses near the Lower Lows trend-line of the

-

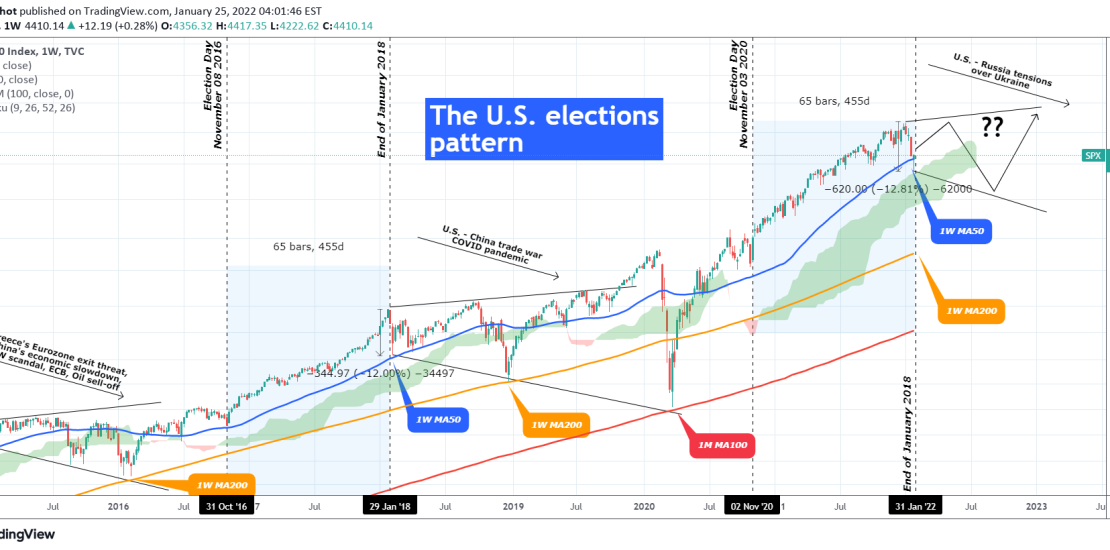

U.S. stocks crashing? If so which currencies to trade?

- January 24, 2022

- Posted by: Tradingshot Articles

- Category: Other, Stock Indices

Last week was a very painful one for the U.S. (as well as global) stock markets, seeing the biggest sell-off since the March 2020 crash that was caused by the COVID outbreak panic. So if we are at the start or halfway of a typical correction on the stock markets, which currencies should we

-

XAUUSD Major long-term break-out ahead.

- January 20, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Gold eventually followed the pattern presented on my last analysis (see chart below) and after completing the Bull Flag, it reversed and broke above the 1834 Resistance: The immediate target on the short-term is 1875 (Resistance at 1877.50). However, this latest development brings us ahead of a potential huge long-term break-out. Today’s chart is

-

GOLD forming a symmetrical November bullish break-out pattern.

- January 11, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

As you see Gold spot prices (XAUUSD) broke below their dominant Channel Up pattern of December but this didn’t turn out to be a bearish signal as the very same bullish (break-out) flag was formed in October’s Channel Up. The Bull Flag (black channel) eventually recovered the 4H MA50 (blue trend-line) and broke upwards,

- 1

- 2