- January 24, 2022

- Posted by: Tradingshot Articles

- Category: Other, Stock Indices

Last week was a very painful one for the U.S. (as well as global) stock markets, seeing the biggest sell-off since the March 2020 crash that was caused by the COVID outbreak panic. So if we are at the start or halfway of a typical correction on the stock markets, which currencies should we seek as a safe haven and which to avoid?

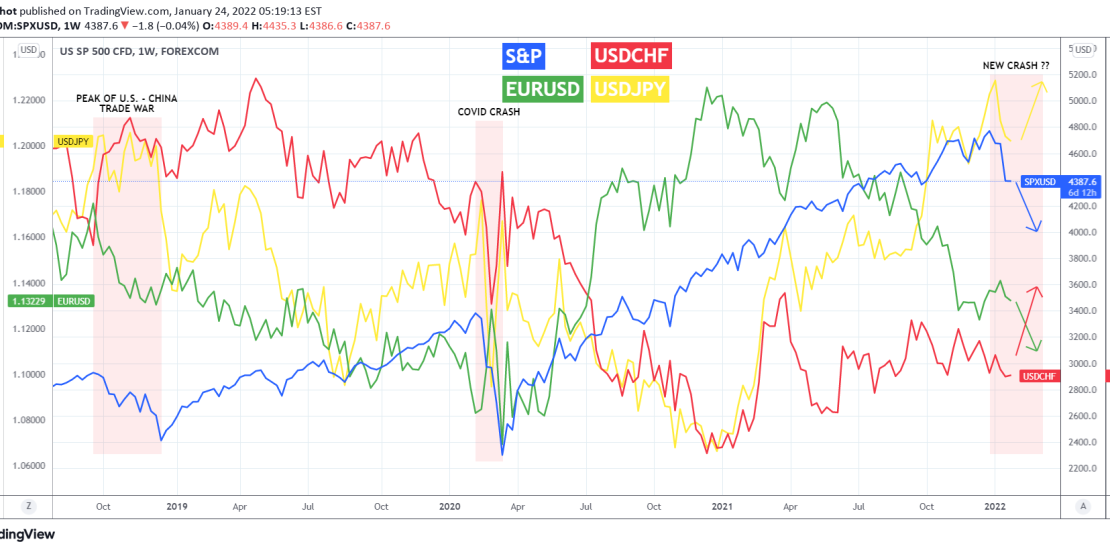

The current chart is on the 1W time-frame and it includes the price action of S&P500 (blue trend-line), EURUSD (green), USDCHF (red) and USDJPY (yellow) since September 2018, which was when the U.S. – China trade war reached its peak.

This analysis is simple yet it offers very useful and straightforward insight on how these markets behave when the S&P500 crashes:

* As you see during the U.S. – Chine trade war peak when the S&P started to drop significantly on the week of September 17 2018, the EURUSD started to fall as well. At the same time the USDCHF started rising aggressively while the USDJPY despite an initial fall, it recovered and stayed stable.

* During the COVID crash, when the S&P500 started to fall on the Feb 10 2020 1W candle, the EURUSD initially rose but on the final flush crash of the March 02 candle, it also crashed, even on a Lower Low. At the same time, both the USDCHF and USDJPY crashed at first but recovered aggressively on S&P’s March final flush.

Based on the above, assuming that S&P500 is closer to the middle of this correction and not the start, the USDCHF and the USDJPY should offer the best shelter until this correction is over. We could see an initial rise on EURUSD but if this is indeed a stock market correction, it should later follow stocks lower.

Tradingview link: