2020 November

-

WTI OIL Trading Plan

- November 22, 2020

- Posted by: Tradingshot Articles

- Category: Commodities

No Comments

Pattern: Channel Up on 4H. Signal: (A) Buy as long as the 4H MA50 is supporting, (B) Sell if it breaks. Target: (A) 43.40 (September 01 High), (B) 40.20 (just above the 4H MA200). ** Please support this idea with your likes and comments, it is the best way to keep it relevant and

-

S&P500 Trading Plan

- November 22, 2020

- Posted by: Tradingshot Articles

- Category: Stock Indices

Pattern: Triangle on 4H. Signal: (A) Buy as long as the Higher Lows trend-line holds, (B) Sell if it breaks. Target: (A) 3595 (just below the Lower Highs), (B) 3485 (just above the 4H MA200). ** Please support this idea with your likes and comments, it is the best way to keep it relevant

-

Is this the start of the parabolic run for LITECOIN?

- November 20, 2020

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

This is a simple comparison on LTCUSD of the current cycle with the previous. As seen on the chart, on March 2017, Litecoin broke above the accumulation sequence that was contained under a Lower Highs trend-line and that 1W candle was what kick-started its parabolic Bull Run. Right now the situation is exactly the

-

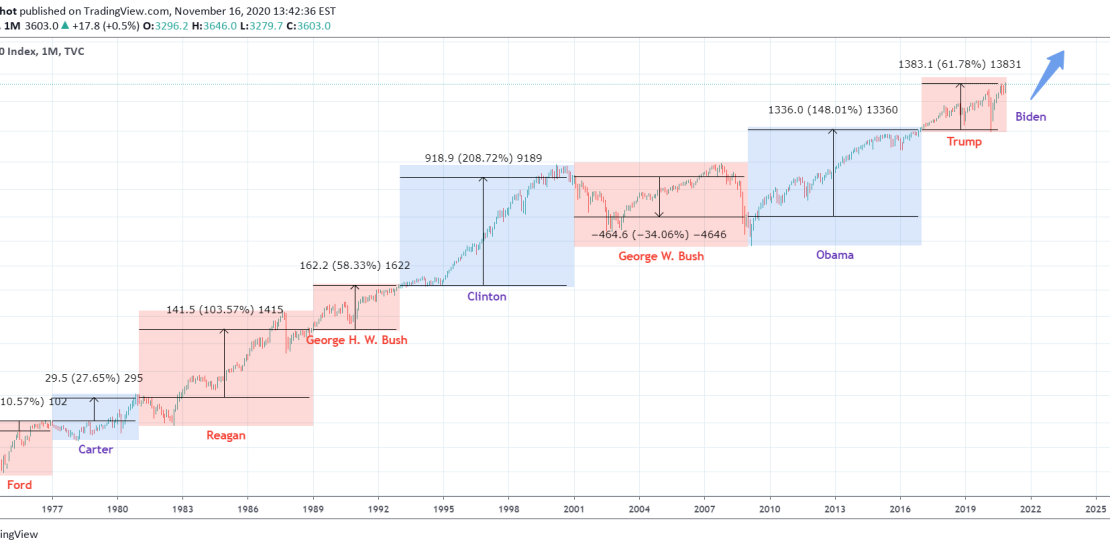

Can the market rise more during Biden’s Presidency than Trump’s?

- November 16, 2020

- Posted by: Tradingshot Articles

- Category: Stock Indices

This is a simple chart showing the performance of the S&P500 under each President since the Ford administration is 1974. As you see contrary to popular belief, the stock market in modern times has done (much) better under a Democrat President. Bill Clinton has had the strongest performance with more than +200% in gains

-

S&P500 Buy Signal / Strong supporting line

- November 11, 2020

- Posted by: Tradingshot Articles

- Category: Stock Indices

Pattern: Higher Lows on the 4H chart. Signal: Buy as the index rebounded not only on the former Lower Highs trend-line (dashed line), but also on the newly formed Higher Lows trend-line. Target: 3660 (just below the 3675 Resistance). Recent S&P signals: ** Please support this idea with your likes and comments, it

-

BITCOIN The Hyperbola & Pitchfork break can end the year at 20k!

- November 10, 2020

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

This study focuses on two very important underlying dynamics that have been dictating Bitcoin’s price action for the past 1.5 year: The Pitchfork and the Hyperbola. This comes at a time when Bitcoin is consolidating after a 1 month rally that broke above the $13865 High of June 26, 2019. So it is natural

-

USDJPY Is is still SOER?

- November 9, 2020

- Posted by: Tradingshot Articles

- Category: Forex

Pattern: Channel Down on 1D. Signal: Sell as the rejection pattern on the 1D MA50 (blue trend-line) has been very consistent since July. Also the RSI is hitting the 4 month Resistance. Target: 102.300 (1.382 Fibonacci extension). Most recent USDJPY trade: ** Please support this idea with your likes and comments, it is the

-

WTI OIL high chances to break its bearish channel

- November 9, 2020

- Posted by: Tradingshot Articles

- Category: Commodities

Pattern: Channel Down on 4H. Signal: Buy if the Lower Highs trend-line of the Channel Down breaks (practically if the 0.786 Fib breaks), as this time the price broke the 4H MA200 (as opposed to September 18) while the MACD is on a Bullish Cross. Target: 43.00 (the 0.918 Fib, last Resistance before a

-

DAX Buy Signal

- November 9, 2020

- Posted by: Tradingshot Articles

- Category: Stock Indices

Pattern: Lower Highs bullish break-out. Signal: Buy as the RSI broke above its 3 month Lower Highs trend-line and the MACD is on a Bullish Cross much below the mean. Target: 13850 (within the ATH and 1.236 Fib extension line). Most recent DAX signal: ** Please support this idea with your likes and comments,

-

S&P500 Time to break above the Stimulus-Elections Triangle?

- November 5, 2020

- Posted by: Tradingshot Articles

- Category: Stock Indices

Since the September 03 Top (All Time High), S&P500 has entered a volatile pattern in the form of a Triangle. The major drivers of this weakness have fundamentally been the U.S. stimulus being delayed and then the elections. Today the Lower Highs trend-line of this Triangle is being tested. If broken, I expect the

- 1

- 2