-

NZDCAD 1D MA50 is the key. Sell below, buy above.

- August 26, 2022

- Posted by: Tradingshot Articles

- Category: Forex

No Comments

The NZDCAD pair has offered us an excellent pattern for a sell high/ buy low plan on our previous analysis more than two months ago: As you see, we were successful on the sell exactly on the 1D MA50 (blue trend-line) rejection and the buy on the Lower Lows trend-line of both the Megaphone

-

GBPNZD Excellent buy level for a rally to the end of the year

- August 26, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The GBPNZD pair has been following exactly our trading plan since our last update a month ago, getting rejected on the 1D MA200 (orange trend-line) and hitting the Higher Lows zone of the long-term Triangle pattern that it has been trading in since the April 02 2020 High: The initial rebound after the August

-

DXY critical test on the multi-year pivot. Huge sell ahead?

- August 26, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The U.S. Dollar Index (DXY) hit last month a Pivot trend-line (2) and so far is unable to break it. This pivot has started as a Support back in August 1992 and then turned into a Resistance since May 2004 and has been such up to this date. As you see, the very same

-

EURUSD heavy rejection on the 1D MA50 yet again

- August 15, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair got rejected again on its 1D MA50 (blue trend-line) and the 0.5 Fibonacci retracement level yet again. This is the 3rd time that this sequence is being repeated within the Channel Down pattern that started following the February 10 high. We’ve outlined this potential in our last EURUSD analysis last week:

-

AUDCAD Important 1D MA200 test. Low risk trades around it.

- August 12, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The AUDCAD pair has been on a strong rise since the July 13 Low on the 1 year Lower Lows zone. That was a buy signal that we posted exactly a month ago: The rebound has now reached the critical 1D MA200 (orange trend-line), which has been the Resistance in the past 3 months.

-

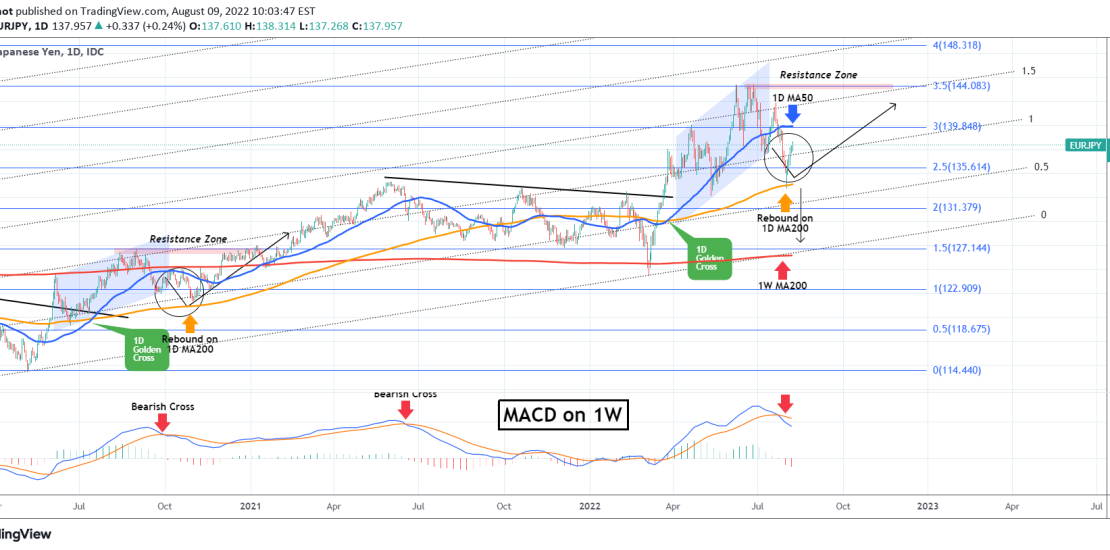

EURJPY keeps following our plan. Strong buy ahead.

- August 9, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURJPY pair has been trading exactly as the plan we first posted here a month ago: As you see, the break below the Channel Up, along with the 1W MACD Bearish Cross, kick-started a sell sequence that eventually found Support and rebounded exactly on the 1D MA200 (orange trend-line). This continues to be

-

EURUSD Quick buy opportunity. Sell then but tight SL.

- August 8, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair has been trading within a Channel Down pattern since the February 10 High (rejection). Every Lower High has been formed on the 0.5 Fibonacci retracement level and we have been targeting this since our last medium-term buy exactly 1 month ago: As you see, despite the initial rebound, the pair turned

-

EURUSD going for a 1.0367 High

- August 1, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair continues to trade sideways around the 4H MA50 (blue trend-line), keeping all this time the trend within the strict boarders of the long-term Channel Down pattern since the February 10 High. As this pattern shows, which I’ve been analyzing on all recent posts, every Lower High is always priced above the

-

GBPNZD targeting 2.010 after this pull-back is completed

- July 25, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The GBPNZD pair is trading below both the 1D MA50 (blue trend-line) and 1D MA200 (orange trend-line) for the past week. This is not an unfamiliar trading set-up as the same W pattern was last seen from October 2018 to October 2019. The last Lower High of the long-term Triangle pattern was on February

-

AUDCHF Emerging Death Cross can push it back to 0.6513.

- July 22, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The AUDCHF pair is seeing a short-term rebound following the July 01 Low and is approaching the 1D MA200 (orange trend-line) and 1D MA50 (blue trend-line). It has been trading below the latter since June 16 and the former since June 17. The emerging Death Cross formation (when the MA50 crosses below the MA200)