-

GBPNZD Confirmed long-term buy

- September 28, 2022

- Posted by: Tradingshot Articles

- Category: Forex

No Comments

The GBPNZD pair has been following exactly our trading plan since our last update a month ago, getting rejected on the 1D MA200 (orange trend-line) and hitting the Higher Lows zone of the long-term Triangle pattern that it has been trading in since the April 02 2020 High: Following the initial rebound after the

-

GBPCHF Best long-term buy signal since COVID

- September 27, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The GBPCHF pair almost hit early this week the Lower Lows trend-line of the multi-year Bearish Megaphone pattern that it has been trading in since June 05 2017. At the same time, the RSI on the 1M time-frame printed its lowest value since the October 31 2016 candle. This combination is a strong buy

-

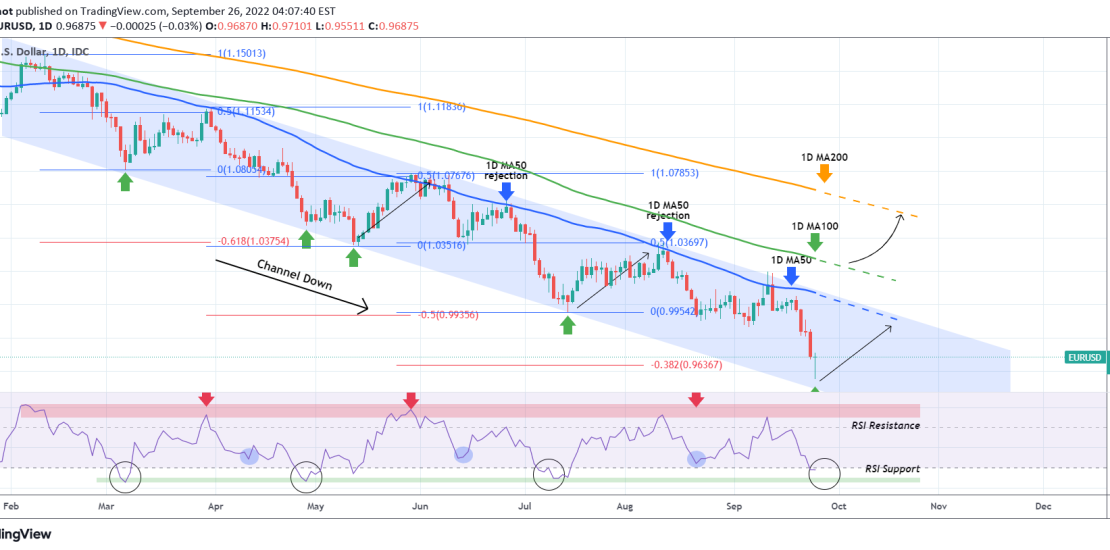

EURUSD Expected rebound on the bottom of the Channel Down

- September 26, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair has been trading within a Channel Down pattern since the February 10 High. Time and time again we have pointed out the recurring buy/ sell levels within this pattern due to its strong symmetry both on the price action and the RSI on the 1D time-frame, which provided the following accurate

-

GBPAUD Buy opportunity and reversal levels

- September 23, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The GBPAUD pair has been trading within a Channel Down pattern since March 15. At the moment the price is on the bottom (Lower Lows trend-line) of the pattern, below both the 1D MA50 (blue trend-line) and the 1D MA200 (orange trend-line) with the 1D RSI on the 30.000 oversold level. That should be

-

AUDNZD Testing Resistance. How to trade a breakout or rejection.

- September 23, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The AUDNZD pair has been on a strong structured uptrend since September 16 2021 market low, within a long-term Channel Up. Recently, the pattern turned into a Bullish Megaphone according to the 1W RSI and MACD indicators, much like the one that started on January 2021. The price is currently testing the top (Higher

-

NZDJPY Rebound on the 1D MA200 or break to pre-March levels?

- September 22, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The NZDJPY pair has had a massive rejection today on the 1D MA50 (blue trend-line) as the forex market is attempting to digest yesterday’s Fed Rate Hike by 0.75 bp for the 3rd straight meeting. The sell-off almost hit and is so far holding the 1D MA200 (orange trend-line), which has been holding since

-

EURUSD How will it react to the Fed’s 3rd straight 0.75% Hike?

- September 22, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair is rebounding on the current 4H candle, following the rejection after the Fed raised the Interest Rate again by 0.75% for the 3rd straight meeting. So far this rebound seems to be technical as the 4H RSI hit the oversold level (green circles) that it has another 4 times in the

-

CADJPY Sell-opportunity on a long-term rising trend.

- September 20, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The CADJPY pair has been on a (very) long-term rising trend as depicted by the Fibonacci Channel on this chart, since the March 2020 market low. At the moment we see a short-term pull-back after the price made a new Higher High since the April 21 one. Based both on the RSI and MACD

-

AUDCAD Still bearish unless this level breaks

- September 20, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The AUDCAD pair is following our trading plan to the point since our last analysis (August 12), which was a sell signal following the 1D MA200 (orange trend-line) rejection: As you see nothing has changed, the price got emphatically rejected on the 1D MA200 and entered a Channel Down that has already hit our

-

EURUSD Still neutral. Best to trade the break-outs.

- September 19, 2022

- Posted by: Tradingshot Articles

- Category: Forex

Following our previous EURUSD analysis, the pair is exactly as we left it, neutral within the 0.98650 Support (of the September 06 Low) and the top (Lower Highs trend-line) of the 8-month Channel Down. The September 12 break above the 1D MA50 (blue trend-line), proved to be a fake-out as the price failed to