2022 April

-

EURUSD hit multiple Support levels!

- April 29, 2022

- Posted by: Tradingshot Articles

- Category: Forex

No Comments

The EURUSD pair has been trading within a multi-month Channel Down since late May 2021. This week the price broke and will most likely close below its Lower Lows trend-line for the first time. In doing so it hit the first Support level, which is the 1.5 Fibonacci extension. At the same time, the

-

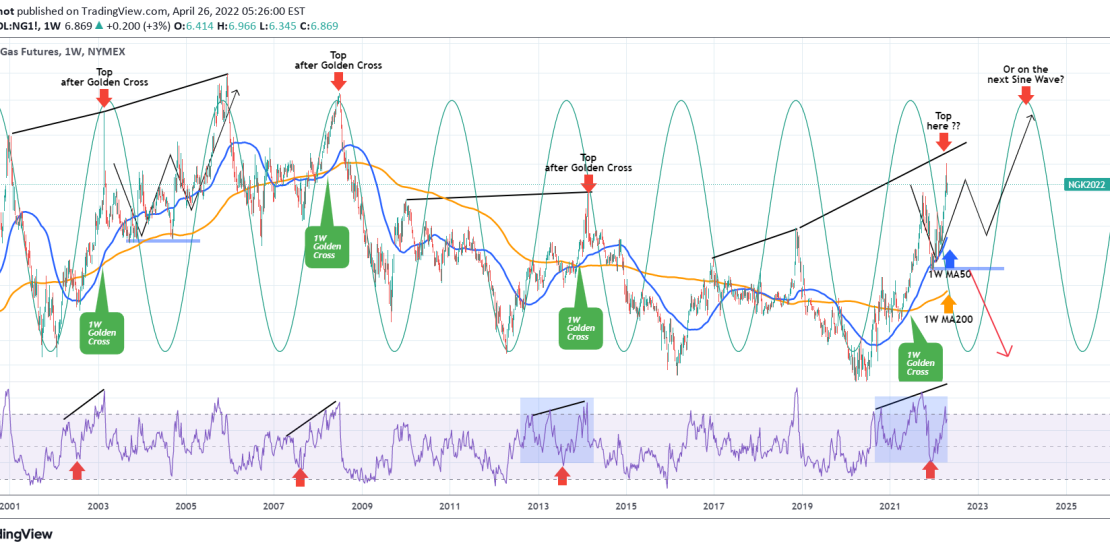

NATURAL GAS Multi-year Cycles.

- April 26, 2022

- Posted by: Tradingshot Articles

- Category: Commodities

Natural Gas (NG1!) has been one of the most profitable trading assets of the year offering great returns. On a long-term scale though (1W time-frame on this chart) it has starting to form a peak pattern, which we have seen previously in the past 20 years. I’ve plotted the Sine Waves on the chart

-

GBPCHF Rejection on the 1D MA200. 1-month downtrend ahead.

- April 22, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The GBPCHF pair got rejected yesterday on the 1D MA200 (orange trend-line) and today is on the strongest recent red 1D candle that is about to test the 1D MA50 (blue trend-line) as a Support. Basically, the Bearish Megaphone pattern I presented more than two months ago is still intact, hitting all targets: As

-

NETFLIX When bubbles pop. The bottom isn’t in yet.

- April 21, 2022

- Posted by: Tradingshot Articles

- Category: Stocks

Netfilx (NFLX) is having a historic weekly selling pressure after the negative quarterly report, which showed a loss of 200k subscribers, putting a stop to a growth for the first time in 10 years. This chart on the 1W time-frame shows how the NFLX bubble popped in mid January 2022. The Jan 18 1W

-

CADJPY Buy on this pull-back

- April 20, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The CADJPY pair has made a parabolic rise since the March 08 low, which even exceeded our expectations based on our most recent trading idea: Even though the dominant pattern remains bullish on a Fibonacci Channel, the strength has changed and is now more aggressive. The price action is on the 1D time-frame to

-

AUDCAD formed a bearish reversal pattern.

- April 19, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The AUDCAD pair just hit the 1D MA50 (blue trend-line) after a rejection on the 0.95200 level. This resembles the February 25 2021 rejection of a similar 1-6 fractal in late 2020/ early 2021. We do expect a test of the 0.89125 low by Q3, however are prepared to take the loss and turn

-

EURCAD get ready for cyclical uptrend

- April 18, 2022

- Posted by: Tradingshot Articles

- Category: Forex

EURCAD has been trading within a stable and consistent pattern on the long-term. Since 2013 it is trading within a hyperbolic channel posting aggressive 1 year rallies followed by steadier +1.5 years corrections in the form of Channel Down sequences. At the moment the price is trading at the lowest level it has been

-

CHFJPY Correction ahead.

- April 15, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The CHFJPY pair has been on a strong rally that smashed through our target on the last analysis: Right now the price formed a new Channel Up, remaining within a Fibonacci Channel where it broke above the 1.5 Fib extension and almost reached as high as the 2.0. However with the RSI hitting its

-

AUDJPY Sell signal on overbought 1D RSI

- April 14, 2022

- Posted by: Tradingshot Articles

- Category: Forex

The AUDJPY pair has given a clear medium-term bearish signal. The 1D RSI got rejected late last month within its multi-year Resistance Zone with the price initially reacting with a pull-back but has since recovered and turned neutral. Every time that the price hit the 1D RSI Resistance Zone since 2020, it pulled-back to

-

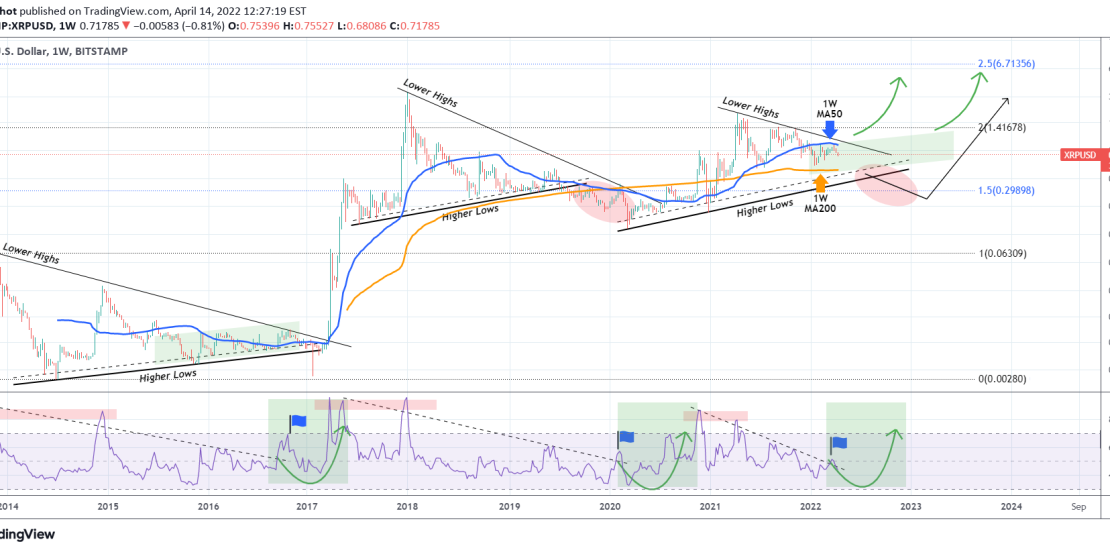

XRPUSD Critical crossroads! Which scenario will prevail?

- April 14, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

XRPUSD got rejected on the 1W MA50 (blue trend-line) for the second time in two months. Basically, it has been trading below the 1W MA50 for the whole year. At the same time it has been trading under the bearish pressure of the Lower Highs trend-line since the April 2021 High. This is not

- 1

- 2