2023 February

-

XAUUSD closed above the 4H MA50, first time since Feb 02!

- February 28, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

No Comments

Gold (XAUUSD) is having the first major bullish break-out since it started its aggressive collapse on the February 02 top, as it closed a 4H candle today above the 4H MA50 (blue trend-line) for the first time since the top! By doing so it also broke above the Falling Wedge pattern of the past two

-

GBPUSD Aiming at the Rectangle’s top. Buy signal.

- February 28, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The GBPUSD pair eventually broke below the Channel Up, since our previous idea at the start of the month, hit the 1D MA200 (orange trend-line) and rebounded: This has created a ranged trading action inside a +2 month Rectangle. The price is now trapped within the 1D MA50 (blue trend-line0 and 1D MA200 and if

-

USDJPY Approaching the 1D MA200, last test December 20.

- February 28, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The USDJPY pair is about to make contact with the 1D MA200 (orange trend-line) for the first time since December 20 2022. This is just below the 138.210 Resistance (December 15 High). With the 1D RSI overbought (70.00), we deem this level as the best sell opportunity on the medium-term, targeting first the 1D MA50

-

BITCOIN Breakthrough Fibonacci Grid mapping the new Cycle!

- February 28, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

This is a unique analysis of Bitcoin displayed on a grid pattern made of the Fibonacci retracement levels (black trend-lines) applied from the top of the previous Bull Cycle to the bottom of the Bear Cycle and the Fibonacci extension levels (blue trend-lines) applied on the Lower Lows and Lower Highs of the Bear Cycle.

-

BITCOIN The Fear & Greed Index prompts to an immediate rally!

- February 27, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

On this chart, Bitcoin (BTCUSD) is shown on the 1W time-frame using the Fear & Greed Indicator (F&GI). A month ago it broke above 50, which is the neutral level between Fear and Greed. Since then it has stabilized sideways around 55 as the market is split with some being greedy for further rise while

-

XAGUSD Our great masterplan continues to work to perfection.

- February 27, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

Since early last year, we have been following a certain buy low/ sell high approach on Silver (XAGUSD) after we identified that it has been trading inside a 2-year Channel Down: We most recently turned bearish again on precisely the right time on our previous January 31 sell call: Right now however, with the price

-

US10Y Rejection cluster. Targeting the 1D MA200 again.

- February 27, 2023

- Posted by: Tradingshot Articles

- Category: Other

The U.S. Government Bonds 10YR Yield (US10Y) has been trading within a Channel Down pattern ever since the October 21 2022 High and even though there might be a Diverging Channel Up (dashed lines) emerging, the current levels and the fact that it has failed to break higher in the last five 1D candles, make

-

EURUSD Very close to a macro bottom. Start buying from here.

- February 26, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The EURUSD pair has been on a strong monthly pull-back for the whole month of February. Technically the pull-back has been caused by an exact rejection on the 1W MA100 (green trend-line). The correction has already broken below the 0.236 Fibonacci retracement level. Since 2009 and the U.S. Housing Crisis, similar corrections at or below

-

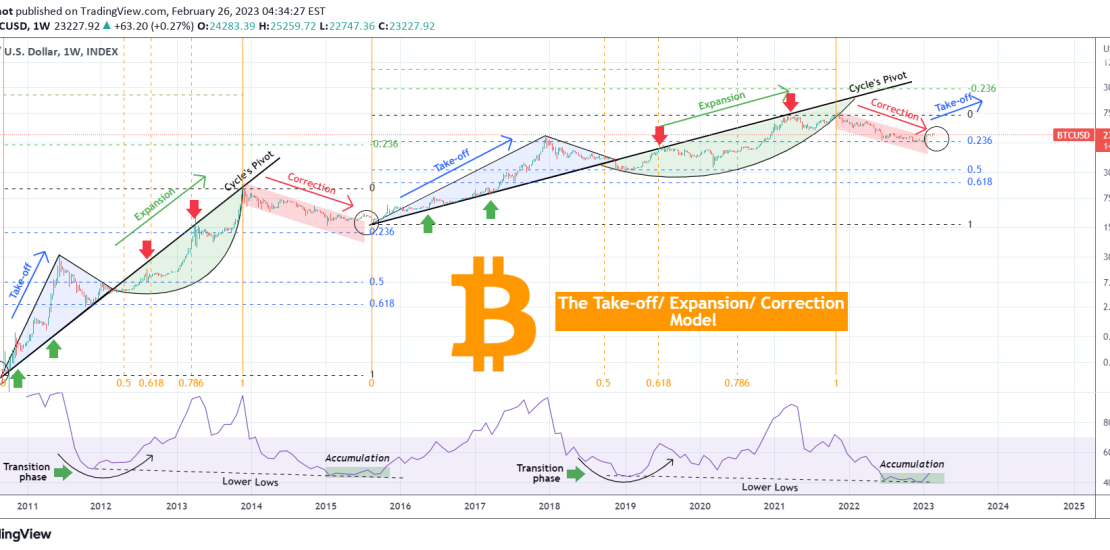

BITCOIN Three Ph-Model started a new mega Cycle. $280k possible?

- February 26, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

This is a very radical approach to Bitcoin’s (BTCUSD) Cycle Theory as it expands on the notion that BTC has so far had only two (mega) Cycles instead of the traditional view of four (smaller ones), which is an idea we have analyzed quite a few times in the past. Radical but as the analysis

-

DAX One last push lower for a bottom.

- February 24, 2023

- Posted by: Tradingshot Articles

- Category: Stock Indices

DAX has had the strongest 1D bearish candle today since December 15 2022. That was the candle that accelerated the correction from the Higher High Zone (red zone) of the long-term Channel Up to the Buy Zone (green zone). With the Channel Up pattern starting on the October 03 2022 market bottom and remaining valid