2021 November

-

S&P500 is approaching its medium-term buy level

- November 30, 2021

- Posted by: Tradingshot Articles

- Category: Stock Indices

No Comments

It is time to update our perspective on the S&P500, which we last analyzed a week ago when we called the exact market top on November 22: As you see the index got rejected that day and corrected instantly, which based on our analysis is a much needed technical correction in accordance with the

-

WTI OIL Ideal long-term buy opportunity

- November 30, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

WTI Oil is down more than -20% since the October High. The fundamentals over the new Omicron COVID variant have undoubtedly accelerated this but technically this is a much needed correction following the big rally of August – October. My last update on WTI was the following, where I pointed out the upcoming rejection

-

MANAUSDT Bear Flag on 1D. Attention needed.

- November 29, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

MANA has seen extreme gains on a 1 month horizon. However buyers should be careful at this stage as on the 1D time-frame, the price is printing a Bear Flag, the likes of which has been a strong red signal in the past. As you see on the chart, every time this pattern along

-

WTI OIL Rejection on the 1D MA50

- November 25, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

Pattern: Megaphone on the 1D time-frame. Signal: Sell as the price has been rejected on the 1D MA50 (blue trend-line) and buy before it touches the 1D MA200 (orange trend-line) or when the RSI hits the Support Zone. Target: 85.40 (the October 23 High). Tradingview link: https://www.tradingview.com/chart/USOIL/Ruv1Y4G2-WTI-OIL-Rejection-on-the-1D-MA50

-

COPPER Buy signal

- November 24, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

Pattern: Channel Up on 1D. Signal: Buy as the price is rebounding on the Higher Lows (bottom) trend-line of the Channel Up while the MACD just formed a Bullish Cross. Target: 4.980 (the 1.236 Fibonacci extension). Tradingview link: https://www.tradingview.com/chart/HG1!/9bWfnHKZ-COPPER-Buy-signal

-

PLATINUM targeting $1090

- November 24, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

Pattern: Giant Head and Shoulders on 1D. Signal: Buy as the price hit the 0.5 Fibonacci trend-line and is near the Support. The 1D CCI is also on its Core long-term Support. Target: 1090 (potential contact with the 1D MA200 (orange trend-line) and right on the 2.0 Fibonacci extension). Tradingview link: https://www.tradingview.com/chart/XPTUSD/fDBsJTAs-PLATINUM-targeting-1090

-

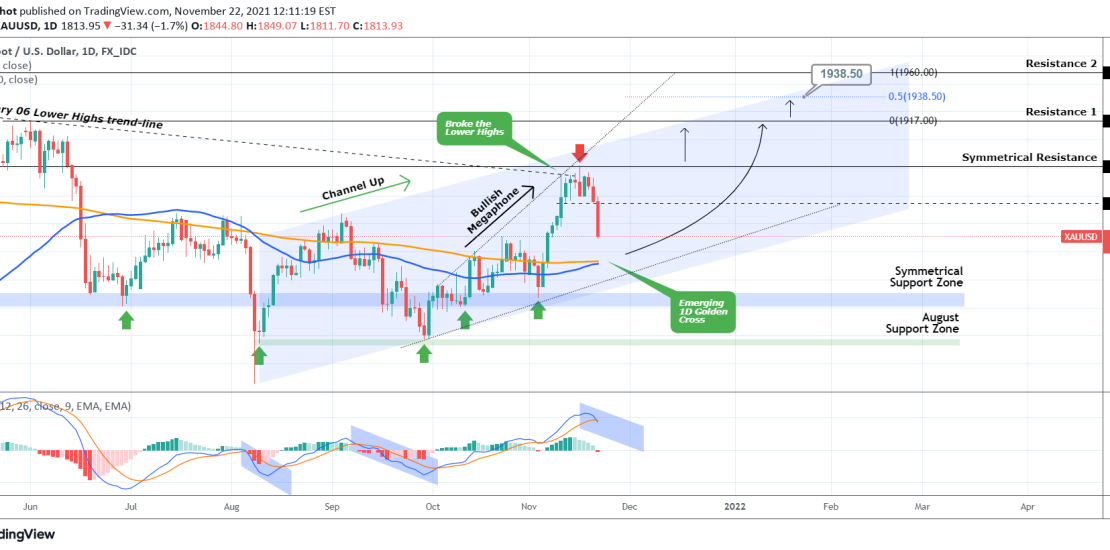

XAUUSD Correction towards the 1D MA50

- November 22, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

This is an update to the 30 day trading plan I published last week: Obviously as the condition of closing a 1D candle above the 1876 Symmetrical Resistance was not fulfilled, the bullish momentum failed and Gold got heavily rejected today. As mentioned on the trading plan, the natural Support is the 1D MA50

-

WTI OIL can go much lower based on this pattern

- November 19, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

It was exactly one month ago (October 19) when I reversed my bullish thesis on WTI Crude Oil, calling for a top and a reversal: As you see, the top got priced exactly on the March Higher Highs trend-line and the rejection successfully took place. Even early into November, the Lower Highs peak formation

-

XAUUSD broke major Resistances. Check this 30 day trading plan.

- November 18, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

It’s been a while since I updated my Gold thesis. My last post was a short-term bullish trade on 4H: That target has been achieved and now we have to switch back to 1D for a more effective evaluation of the current trend. Obviously that is bullish as not only has Gold (XAUUSD) been

-

WTI OIL Break-out or rejection

- November 9, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

Oil is approaching the most important trend-line on the medium-term, the 84.80 – 85.40 Resistance Zone. A break and session close above 85.40 should technically aim at the 2.0 Fibonacci extension of 92.50. On the other hand, a rejection at 84.80 should aim at the 1D MA50 (red trend-line) and the Lower Lows trend-line.

- 1

- 2