2021 April

-

GOLD Successful test of 1760 as Support. Bullish.

- April 29, 2021

- Posted by: Tradingshot Articles

- Category: Uncategorized

No Comments

-

FTSE100 Buy Signal

- April 27, 2021

- Posted by: Tradingshot Articles

- Category: Stock Indices

Pattern: Channel Up on 4H. Signal: Buy as the price is rising following a (near) Higher Low on the pattern. Target: 7120 (the 1.382 Fibonacci extension). Tradingview link: https://www.tradingview.com/chart/UK100GBP/Rtvk9s3s-FTSE100-Buy-Signal

-

WTI OIL Buy Signal

- April 26, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

Pattern: Channel Up on 4H. Signal: Buy as the price rebounded on the Higher Lows trend-line of the Channel and is supported by the 4H MA100 (green trend-line), which has been the Support on the November 2020 – February 2021 uptrend. Target: 66.00 (just below the 66.40 Resistance). Tradingview link: https://www.tradingview.com/chart/USOIL/wzDCbhFJ-WTI-OIL-Buy-Signal

-

EURUSD testing the most important Resistance

- April 26, 2021

- Posted by: Tradingshot Articles

- Category: Forex

EURUSD is currently testing the Lower Highs trend-line that started after the January 06 High. This is technically the most important Resistance on the long-term and the trend-line to beat if this bullish trend is to be extended. The 4H MA50 (blue trend-line) is supporting but perhaps the most interesting development is on the

-

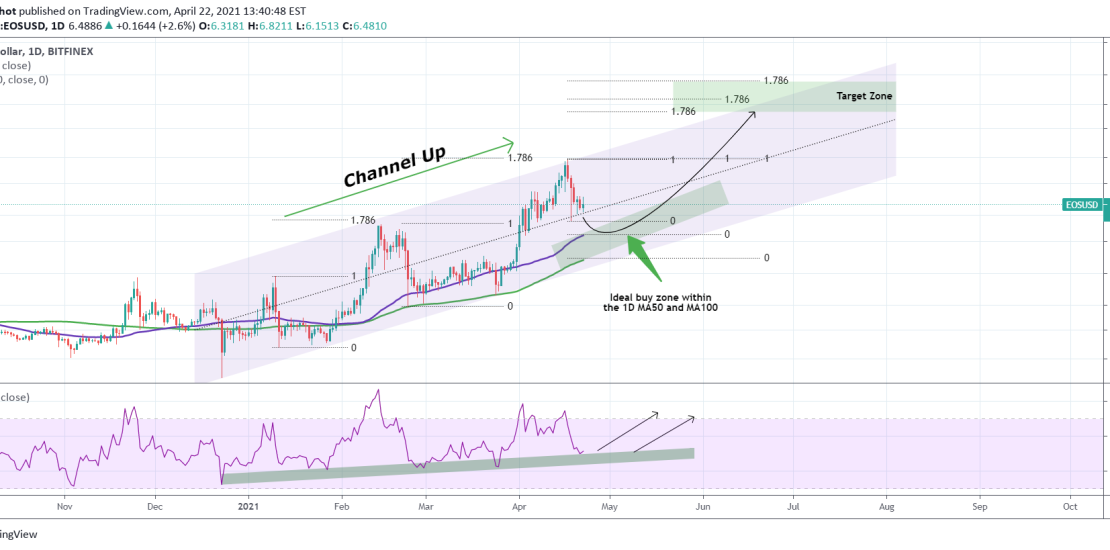

EOSUSD Buy Signal

- April 22, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Pattern: Channel Up on 1D. Signal: Buy once the price enters the 1D MA50 (blue trend-line) and 1D MA100 (green trend-line) Zone. The RSI is already waving a bull flag for those who seek more risk. Target: 12.350 – 15.250 (depending on where the low will be in order to calculate the 1.786 Fibonacci

-

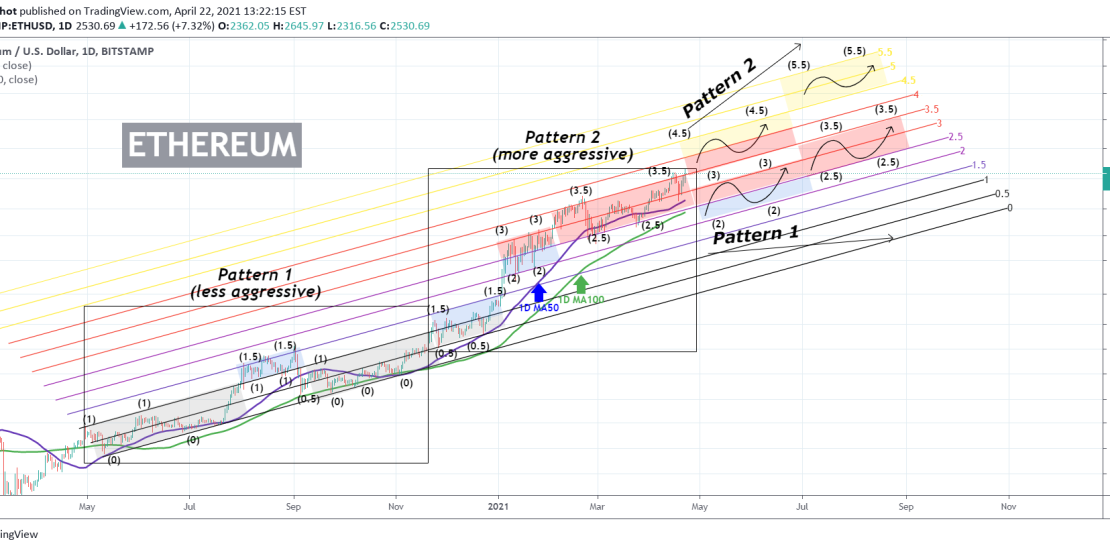

ETHUSD Projections for the next 4 months. Peak at 4k or 7k?

- April 22, 2021

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Back in January 05 (2021) I posted the following idea that (understandably to some extent) was received with some skepticism by the trading community: ** The Fibonacci Channel and the 1.0 Fib lower rule ** As you see the $1900 target was achieved even before my March deadline, but the most impressive thing is

-

DXY long-term trend bearish but possibility for one last spike

- April 21, 2021

- Posted by: Tradingshot Articles

- Category: Forex

Pattern: Channel Down on 4H. Signal: Two sell positions, one now and the other in the event of a 0.786 Fibonacci spike, similar to what took place after the previous two 4H Golden Crosses. Target: 90.350 (the bottom of the Higher Lows Zone). Most recent DXY signal: Tradingview link: https://www.tradingview.com/chart/DXY/Nz3IpltF-DXY-long-term-trend-bearish-but-possibility-for-one-last-spike

-

EURUSD on bullish continuation

- April 21, 2021

- Posted by: Tradingshot Articles

- Category: Forex

Pattern: Channel Up on 4H (blue). Signal: Buy as the breaking of the 1.382 Fibonacci extension (former Channel Down Fib Resistance), signals a buy continuation for the pattern and invalidation of the Channel Down (similar to November-December). Target: 1.21800 (top of the High Volume Resistance Zone of 2021). Most recent EURUSD signal: Tradingview link:

-

BONDS 10year yield formed the 1st 4H Death Cross since September

- April 21, 2021

- Posted by: Tradingshot Articles

- Category: Other

The US10Y has just formed a Death Cross (the MA50 (blue trend-line) crossing below the MA200 (orange trend-line)) on the 4H time-frame since September 24, 2020!. That is technically a bearish formation. It gets even more bearish if we count the fact that the price got rejected on the 4H MA50 after the bounce.

-

WTI OIL First 4H Golden Cross since November!

- April 21, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

WTI Crude Oil has just formed a Golden Cross on the 4H chart (MA50 (blue trend-line) crossing above the MA200 (orange trend-line)), the first since November 12, 2020. The price action since March 12 is quite similar to late October – early November. After the Death Cross on October 27, 2020, a bottom was