-

PALLADIUM Buy opportunity on the 1D MA50.

- May 17, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

No Comments

Last time we looked into Palladium (XPDUSD) is was almost a year ago: This time the price has formed a Channel Up pattern after breaking above the dashed Lower Highs trend-line form the October 04 2022 High. The price is exactly on the 1D MA50 (blue trend-line) now, near the bottom of the Channel Up,

-

XAUUSD hit the August 2020 Resistance! Can it close above it?

- May 4, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) hit the 2075 Resistance that was formed on the August 07 2020 market Top and was the level that made a new aggressive rejection on the March 08 2022 High, in the midst of the Russia – Ukraine war. So far it has reacted with a rejection in the early trading sessions. They

-

WTI OIL Very strong long-term Buy opportunity.

- May 4, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

WTI Oil (USOIL) hit the last remaining targets as pointed out on our April 24 idea: In fact, this completed our long-term 3 target approach as presented on our analysis three weeks ago: That has come after a Double Bottom buy almost 2 months ago (March 16), which falls into our usual long-term swing trading

-

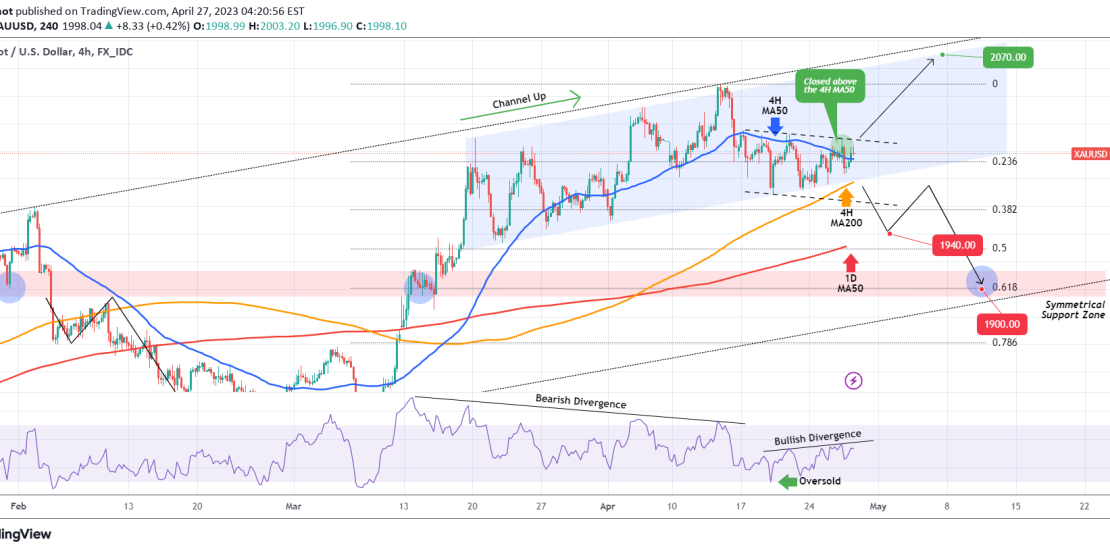

XAUUSD Made the expected bullish break-out. 2070 on sight.

- May 3, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

Our Gold (XAUUSD) outlook is intact since last week’s buy signal after the closing above the 4H MA50: Our target remains 2070 which is the top (Higher Highs trend-line) of the medium-term Channel Up pattern. Every pull-back to the 4H MA50 (blue trend-line) is a buy opportunity. Tradingview link: https://www.tradingview.com/chart/XAUUSD/xt5JcNNn-XAUUSD-Made-the-expected-bullish-break-out-2070-on-sight

-

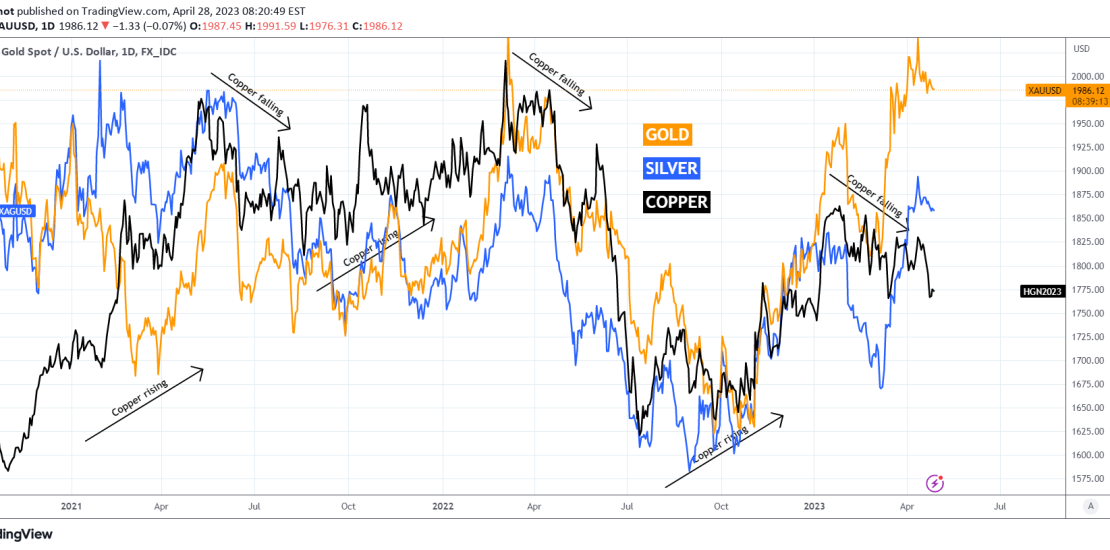

GOLD, SILVER, COPPER. Is the latter leading the way?

- April 28, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

On this 1D chart we see Gold (XAUUSD) against Silver (XAGUSD) and Copper (HG1!) displayed by the orange, blue and black trend-lines respectively. There is a lot of worrying lately with Gold’s pull-back since the mid-April High. Even though Gold and Silver have made Higher Highs, Copper has been declining since since its late January

-

WTI OIL Channel Down extended selling to 72.50.

- April 28, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

Perfect execution of our plan last Monday for WTI Oil (USOIL) as the price initially rebounded to the 4H MA50 (blue trend-line), got rejected and hit our 74.00 target: That is the top of the Pivot Zone that started back in mid-December. We are now expecting a (near) test of the 1D MA50 (red trend-line)

-

XAUUSD on a breaking point. Get ready for the big move.

- April 27, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

Gold (XAUUSD) closed above the 4H MA50 (blue trend-line) yesterday for the first time since April 14. This is the first major bullish signal in a while but it is not confirmed yet as the price remains and in fact got rejected on the (dashed) Channel Down. A 4H candle close above it will be

-

SILVER/GOLD ratio showing Gold will outperform

- April 26, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

The Silver/ Gold ratio on the 1W time-frame shows the price trading within a Triangle pattern, with the price almost reaching the top two weeks ago and currently getting rejected. On the long-term, the break-out of this pattern will determine the next trend so be prepared but as long as it holds, then Gold (XAUUSD)

-

WTI OIL Filling the downside gap but short-term rebound.

- April 24, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

The WTI Oil (USOIL) got, as we expected, heavily rejected on the 1D MA200 (orange trend-line), starting to fill the gap of March: Our next target is 74.00, just above the Pivot Zone, but on the short-term, with the 4H RSI rebounding after getting oversold (has given a 100% buy signal short-term in the past

-

WTI OIL Broke below the 4H MA50. Sell confirmed.

- April 18, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

WTI OIL (USOIL) broke yesterday below its 4H MA50 (blue trend-line) and today upon re-testing it as a Resistance, it is currently being rejected. This is a major sell signal as since December 2022 inside the Resistance Zone, every such break-out was a confirmed sell. All prior 5 cases hit the Support Zone shortly after.