-

XAUUSD Made the expected bullish break-out. 2070 on sight.

- May 3, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

No Comments

Our Gold (XAUUSD) outlook is intact since last week’s buy signal after the closing above the 4H MA50: Our target remains 2070 which is the top (Higher Highs trend-line) of the medium-term Channel Up pattern. Every pull-back to the 4H MA50 (blue trend-line) is a buy opportunity. Tradingview link: https://www.tradingview.com/chart/XAUUSD/xt5JcNNn-XAUUSD-Made-the-expected-bullish-break-out-2070-on-sight

-

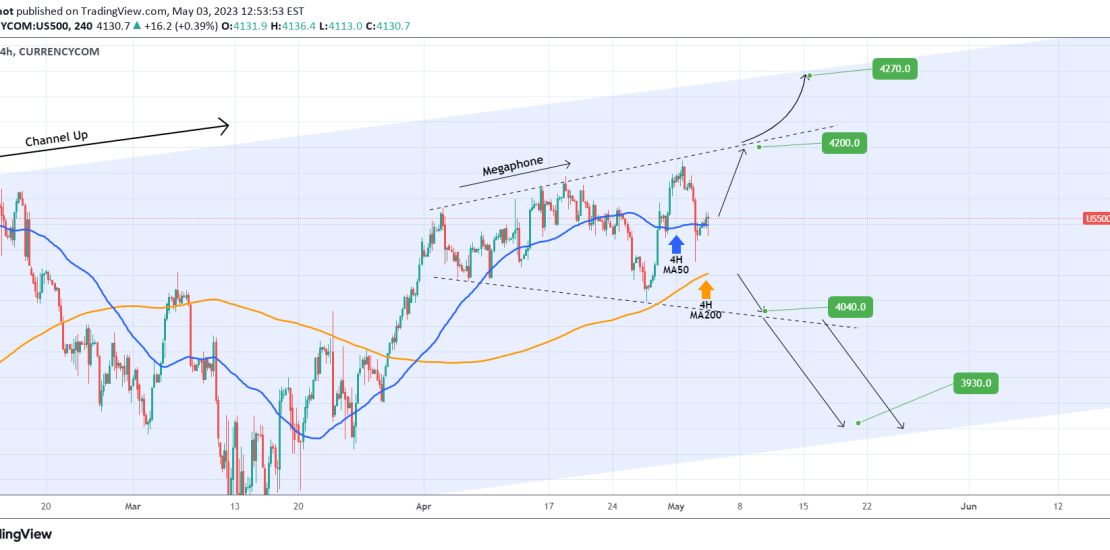

S&P500 Megaphone pattern on 4H.

- May 3, 2023

- Posted by: Tradingshot Articles

- Category: Stock Indices

The S&P500 (SPX) has had an excellent run following our buy call more than one month ago: Right now we see a Megaphone pattern in formation on the 4H time-frame and with the price above the 4H MA50 (blue trend-line) and with the 4H MA200 (orange trend-line) holding since March 29, we are targeting the

-

UBER is still bullish short-term

- May 3, 2023

- Posted by: Tradingshot Articles

- Category: Stocks

UBER had a massive price jump yesterday after the upbeat earnings and is approaching Resistance 1 (37.50), which rejected the February 08 High. That was the last Higher High of the Channel Up pattern that started after the June 30 bottom. We expect this trend to continue for a new Higher High at 39.00. If

-

CADJPY Rejected on the 1D MA200. Is this a trend change?

- May 3, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The CADJPY pair got a rejected yesterday near the 1D MA200 (orange trend-line), which hasn’t been touched since November 30 2022. Since the March 24 Low the price has been trading within a Channel Up but the long term pattern is a Megaphone and yesterday’s rejection took place on its top (Higher Highs trend-line). With

-

AUDCAD Testing the top of the Channel Down. Sell.

- May 2, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The AUDCAD pair hit today the 1D MA50 (blue trend-line) for the first time in more than two months (since February 22). By doing so, it has approached both the Channel’s top (Lower Highs trend-line) and Resistance 1 (0.912750) of the April 03 High. With the 1W RSI still far from its Support/ Buy Zone,

-

NASDAQ Bullish within a Double Channel Up

- May 2, 2023

- Posted by: Tradingshot Articles

- Category: Stock Indices

Nasdaq (NDX) has gone a long way since we called for a rebound on the 1D MA200 on March 17: Right now the uptrend has slowed down as the Channel Up that started in December has transitioned into a much less aggressive Channel Up, supported by the 1D MA50 (blue trend-line) that is targeting 13500

-

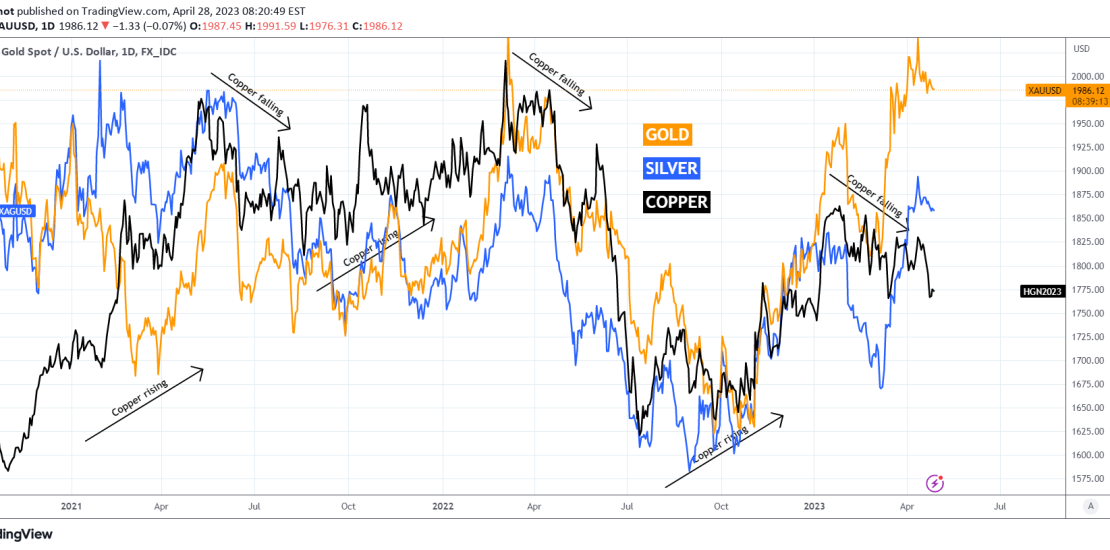

GOLD, SILVER, COPPER. Is the latter leading the way?

- April 28, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

On this 1D chart we see Gold (XAUUSD) against Silver (XAGUSD) and Copper (HG1!) displayed by the orange, blue and black trend-lines respectively. There is a lot of worrying lately with Gold’s pull-back since the mid-April High. Even though Gold and Silver have made Higher Highs, Copper has been declining since since its late January

-

COMCAST eyeing an end-of-quarter 44.00 target.

- April 28, 2023

- Posted by: Tradingshot Articles

- Category: Stocks

The Comcast Corporation (CMCSA) had a +10% jump yesterday, capitalizing on the higher than expected earnings and is approaching the February 02 High. The long-term pattern is a Channel Up (blue) but there might be a diverging Channel Up also emerging (dotted lines) that might decelerate this aggressive rise. So far we see a tendency

-

CHFJPY signaling a bullish extension

- April 28, 2023

- Posted by: Tradingshot Articles

- Category: Forex

The CHFJPY pair traded exactly as we expected more than 1 month ago, rebounding on the 2021 Higher Lows trend-line and hitting out 147.500 target: Today we see an impressive green 1D candle, indicating that the rally that started back then will have an extension. The 1D RSI indicates that we enter the final bullish

-

WTI OIL Channel Down extended selling to 72.50.

- April 28, 2023

- Posted by: Tradingshot Articles

- Category: Commodities

Perfect execution of our plan last Monday for WTI Oil (USOIL) as the price initially rebounded to the 4H MA50 (blue trend-line), got rejected and hit our 74.00 target: That is the top of the Pivot Zone that started back in mid-December. We are now expecting a (near) test of the 1D MA50 (red trend-line)