- January 13, 2023

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

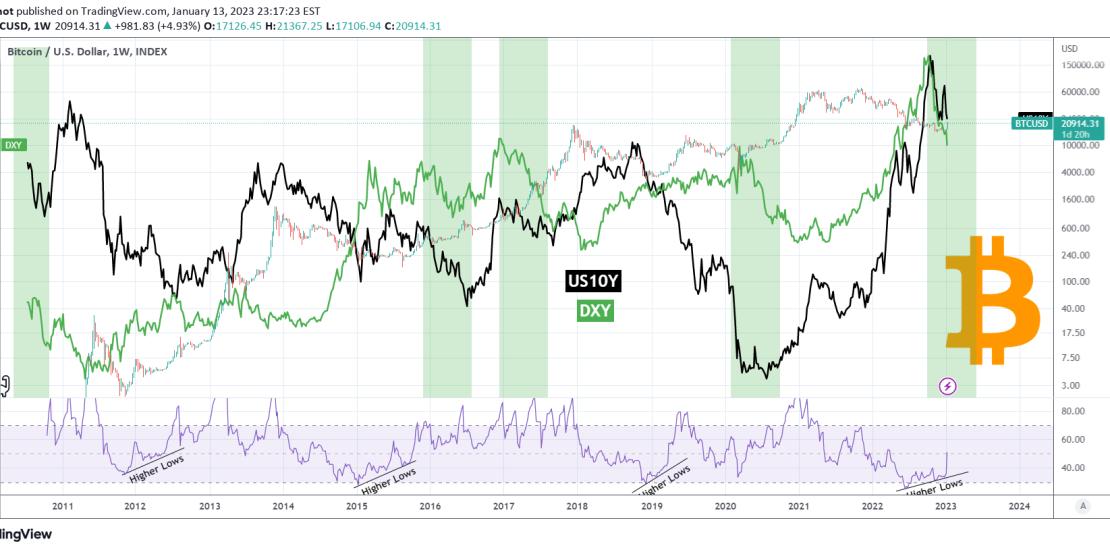

On this 1W time-frame analysis we make a case why Bitcoin (BTCUSD) is massively undervalued in relation to a technical factor as well as the effect that the U.S. 10 Year Government Bonds Yield (US10Y with the black trend-line) and the U.S. Dollar Index (DXY with the green trend-line) have.

Bitcoin’s rise this week may come as a surprise to most but it is no coincidence. The 1W RSI has been on Higher Lows since the mid-June 2022 Low, while BTC has been trading on Lower Lows. This is a technical Bullish Divergence and a lengthy one. The times the 1W RSI prints Higher Lows sequences that low, have always been Bear Cycle Bottoms.

At the same time, we see the US10Y and the DXY (aggressively) decline simultaneously. The previous four times this happened were on a Bitcoin (aggressive) rally phase.

The fact that we get those two occurrences taking place at the same time, simply shows the underlying strength on the market at a level that macro-economically is treated as a market Bottom. Possibly indicating that if it wasn’t for last year’s fundamental crashes of FTX and LUNA, the price potentially would have already been much higher, showing how deeply undervalued BTC is right now.

Feel free to let me know in the comments section below!

Tradingview link:

https://www.tradingview.com/chart/BTCUSD/eA97CKuA-BITCOIN-is-massively-undervalued-and-here-is-why