- November 2, 2022

- Posted by: Tradingshot Articles

- Category: Stock Indices

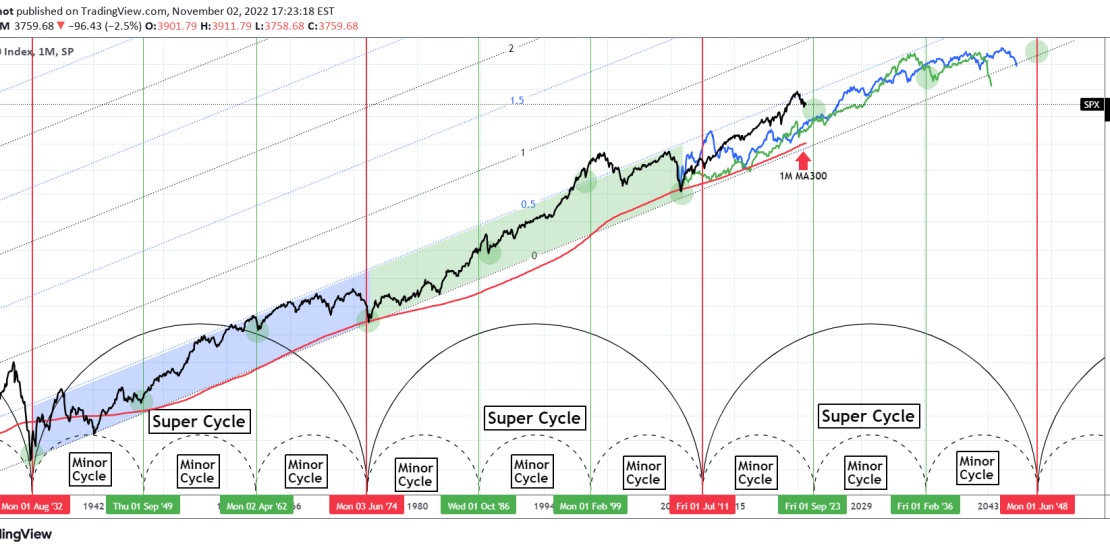

This is a complete roadmap of the S&P500 index (SPX) on the 1M time-frame, where we have taxonomized its historical trend on Super Cycles and Minor Cycles.

As you see, since the Great Depression, we can categorize a whole era (approximately 42 years) as a Super Cycle. Super Cycles tend to end with a massive Recession/ Bear Market.

Within the Super Cycle, we’ve fitted three Minor ones. The first two Minor Cycle within the Super one have ended with a minor corrections (relative to the long-term of course).

Based on S&P500’s current Super Cycle projection, it appears what we are only heading towards the end of the 1st Minor Cycle of the Super Cycle that started a few years after the 2008 Housing Crisis. As a result the current correction in 2022 due to the very high inflation, is simply viewed as another minor cyclical event at the start of a Super Cycle that is projected to end with a Recession around 2048!

For illustration purposes and to help make a better comparison, I have plotted the first two Super Cycles (blue and green trend-lines) on the current one. We can see how thee current one has diverged a bit more than the others, probably thanks to the massive QE since the Housing Crisis. Also notice that since January 1943, the 1M MA300 (red trend-line) has been the ultimate Support and a rebound level on both Super Cycle corrections/ Recessions.

This chart simply shows that long-term investors have nothing to be afraid of with this inflation crisis and soon incredible buy opportunities will emerge.

Tradingview link: