- October 15, 2022

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

Following the CPI release this week, the 3rd straight month of decreasing numbers with potentially high implications on the USD, I thought it would be relevant to look at the U.S. Dollar Index (DXY) and how it’s current state can affect Bitcoin (BTCUSD) relative to key turning points and correlations of the past.

** Bitcoin’s Bull and Bear against the Dollar **

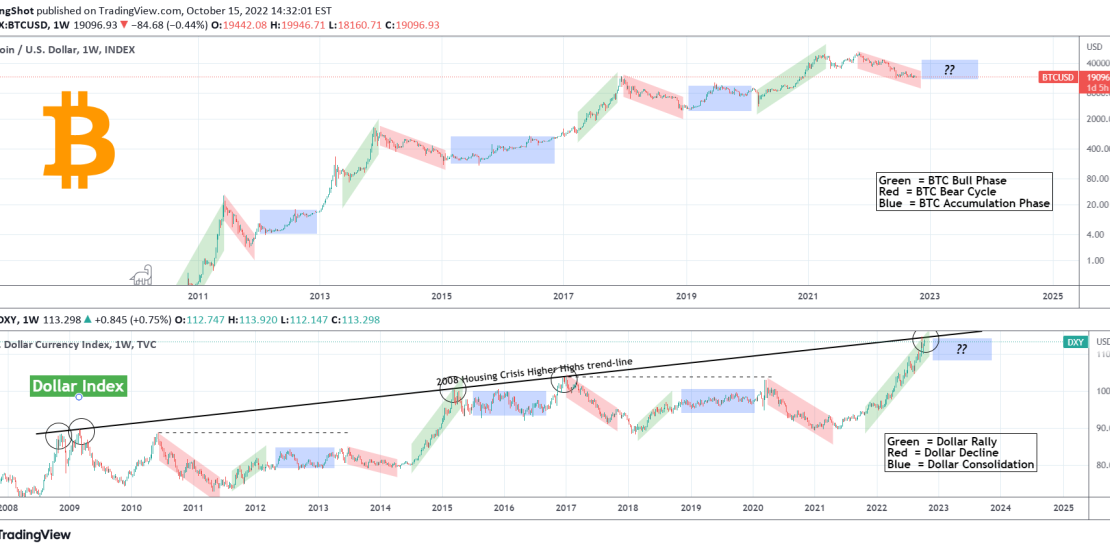

The chart on the top displays Bitcoin with the Green Channel being a Bull Phase, the Red Channel being a Bear Cycle and the Blue Rectangle predominantly an Accumulation Phase straight after the Bear Cycle where investors bought at a low price in preparation of the Bull Cycle.

The chart on the bottom displays the Dollar Index with the Green Channel being a Rally Phase, the Red Channel a Decline Phase and the Blue Rectangle sideways movement/ consolidation. What is perhaps more critical on this 14 year chart, is the Higher Highs trend-line that started during the 2008 Housing Crisis and where DXY has been so far rejected 4 times, including the most recent hit on the weekly (1W) candle of September 26 2022.

** The 2008 Housing Crisis trend-line **

This trend-line is where the Dollar Rallies historically ended. What followed was either a consolidation phase or a decline. And as you see (and I am sure you are well aware of), the Dollar is negatively correlated with Bitcoin, meaning that (typically) when the USD trends towards one direction, Bitcoin trends towards the opposite. This is quite evident on this comparison chart. Red phases on the DXY are typically the Final Parabolic Rallies on BTC’s Bull Cycles while Green phases on the DXY take place during BTC’s Bear Cycles.

** Are we at a turning point? **

This is exactly where we are at now. The DXY has been on its strongest multi-month rally of recent times (Green) while Bitcoin is having its traditional Bear Cycle. With the DXY hitting its 2008 Higher Highs trend-line, the probability of a reversal gets stronger. The last two times the 2008 trend-line got hit, Bitcoin ended a Bear Cycle (January 2015) and started a Final Parabolic Rally (January 2017). As a result the probability of Bitcoin making a Bear Cycle bottom here increases. It is more likely to see an Accumulation Phase (blue) next as the Dollar tends to consolidate after such Rallies end.

But what do you think? Will DXY stay below its 2008 Higher Highs trend-line and reverse, giving Bitcoin a bottom or it will break above it and invalidate this historic pattern, sending Bitcoin even lower and changing the narrative? Feel free to let me know in the comments section below!

P.S. Snapshot of the chart below, in case it doesn’t show up proportionally on your browser: