- June 2, 2022

- Posted by: Tradingshot Articles

- Category: Other, Stock Indices

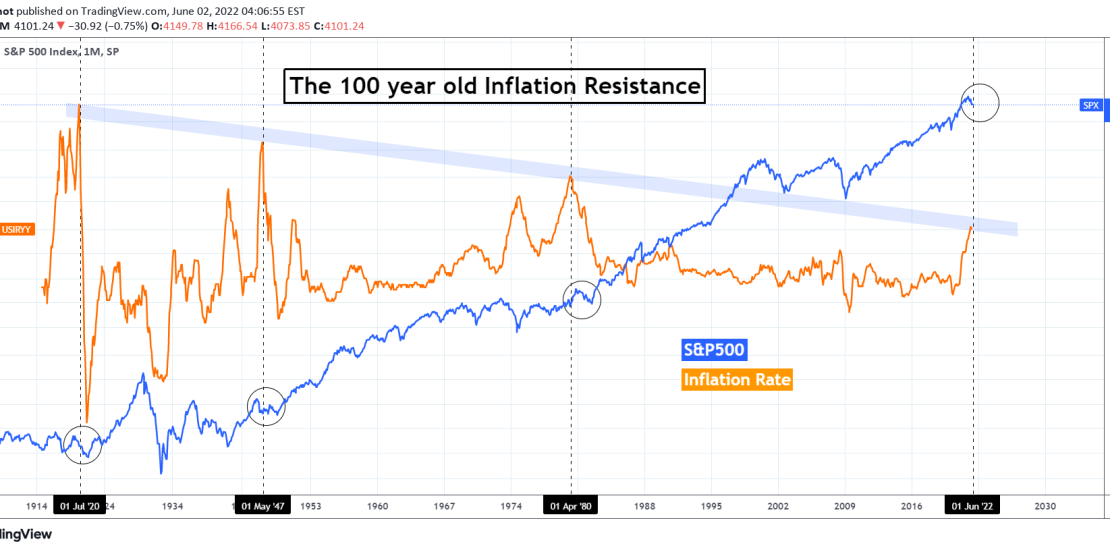

This is an interesting analysis as the U.S. Inflation Rate (orange trend-line) is testing for the first time since early 1980 a Lower Highs trend-line that started after the High of July 1920, exactly 100 years ago! This Lower Highs trend-line has made another 2 contacts after that and it is interesting to see how the S&P500 index (blue trend-line, SPX) has behaved upon such tests (and rejections).

As you see, every time the Inflation Rate hit that Lower Highs trend-line (Resistance), the S&P500 index went through a roughly 1.5 – 2 year period of correction. This was a high volatility phase, with the S&P500 correction on two out of the three occasions starting before the Inflation Rate hit the Lower Highs zone. Note that even though it was a correction, it was never in the magnitude of a Bear Cycle such as 2000/02, 2008/09 or even worse the 1929/32 Great Depression.

As a result, and since the correction has already started at the start of the year (2022), before the Inflation Rate reached the historic Lower Highs trend-line, we can say that it resembles more the cases of July 1920 and May 1947. Those bottomed on July 1921 and June 1949, so 1 and 2 years respectively after the Lower Highs rejection.

Can this mean that we still have another 1 – 2 years of volatility ahead of us before bottoming? What’s your view on this analysis?

Tradingview link: