- July 6, 2021

- Posted by: Tradingshot Articles

- Category: Commodities

No Comments

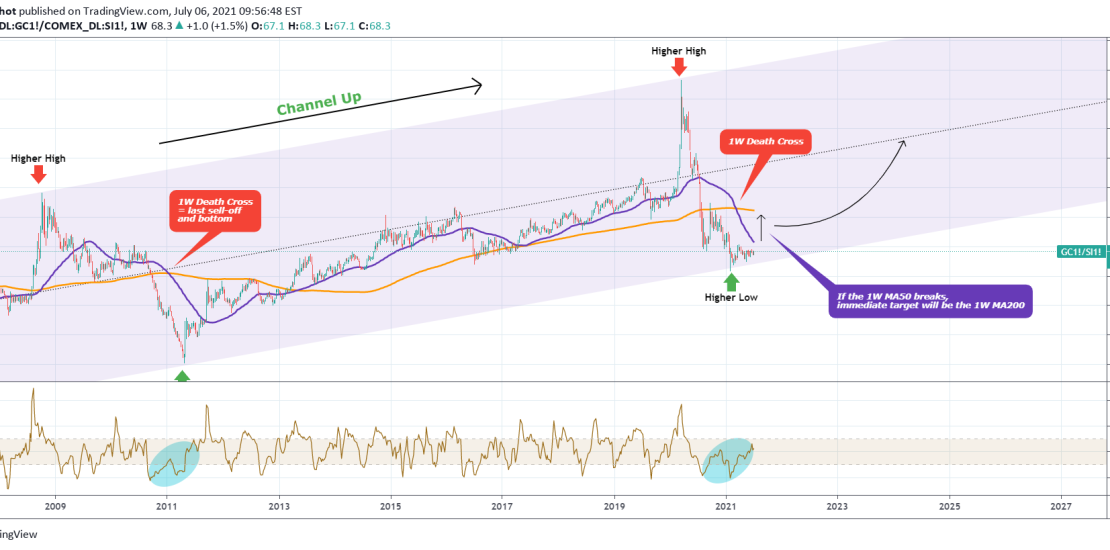

The Gold/ Silver ratio seems to be trading inside a Channel Up since the 2008/2009 subprime mortgage crisis. The recent COVID crisis and sell-off in March 2020 served as an excellent catalyst for the pair to make a Higher High within the Channel. In February it appears that the new Higher Low was priced and looking at the CCI, we have a similar bottom sequence as in early 2011.

On the short-term I see a quick jump if the 1W MA50 breaks (blue trend-line) towards the 1W MA200 (orange trend-line). On the (very) long-term I appears that the ratio will again enter a decade long steady rise to a new Higher High until the next crisis/ catalyst, so we can expect Gold (XAUUSD) to start outperforming Silver (XAGUSD).

Tradingview link: