- October 12, 2020

- Posted by: Tradingshot Articles

- Category: Cryptocurrency

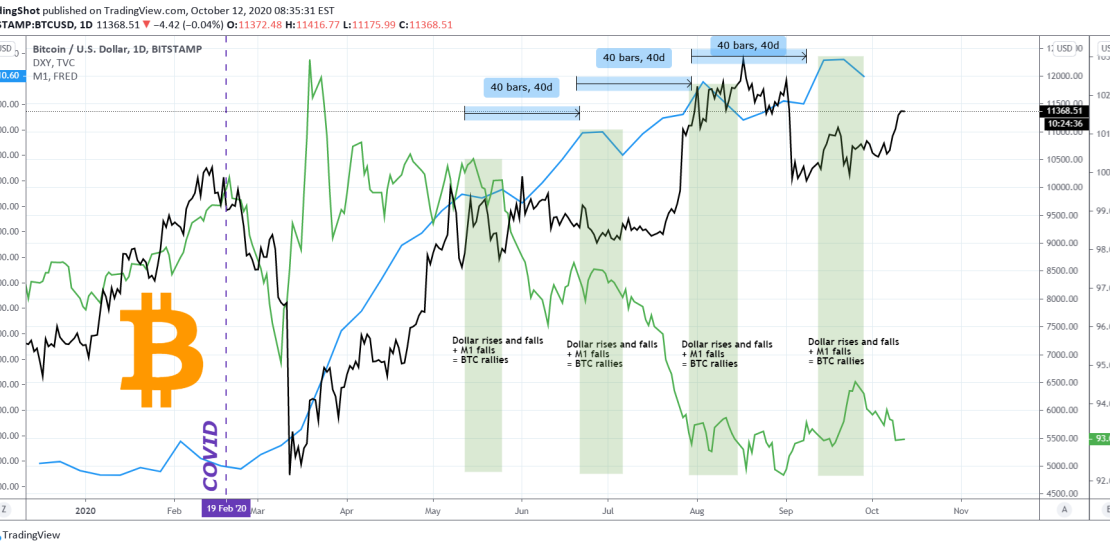

What does that have to do with BTC? Simple. As you see on the chart (marked with green), in the post COVID outbreak era, every time the USD initially rises and then starts to fall while the M1 (money supply representing the stimulus on this study) starts to fall but news have it that the printing machine will stay on to support the economic damage sustained by the COVID outbreak, BTC starts a rally (one time very aggressive, the other two not so much).

What does this show? That as long as new stimulus will be provided into the market (M1 rising), depreciating the USD already in circulation (USD falling), this fresh capital is used into risky investments such as Bitcoin, causing its price to rise. What’s surprising on this find, is that those readings seem to be systemic, as the appear on an average of 40 days. Can this be used to identify medium-term BTC accumulation levels? Seems like it.

What do think? Is the cheap dollar and renewed stimulus deal talks the reason for this rise on Bitcoin? Feel free to share your work and let me know in the comments section!

Please like, subscribe and share your ideas and charts with the community!

——————————————————————————————————–

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot’s 💰 top TradingView Coin donor 💰 this week ==> AxelShadah

——————————————————————————————————–

P.S. This is a continuation of a cross asset study that I published 2 weeks ago (September 27) but was deleted. I am posting it again below for future reference reasons: